U.S. electric vehicle (EV) manufacturer

Fisker Inc. NYSE: FSR stock went public through reverse merger with Spartan Energy Acquisition Corp. on Oct. 30, 2020. The fervor over special purpose acquisition companies (SPACs) and EVs reached a fever pitch on the rumor of luxury EV makers Lucid Motors potential reverse merging into

Churchill Capital Corp IV NYSE: CCIV. Lucid is widely considered a

Tesla NASDAQ: TSLA killer with its high-end EV models that range up to $160,000 with 500 mile range capabilities. However, investors overlook the original Tesla killer Fisker. Who better to take on Tesla than the man who helped design the iconic Tesla Model S? Unfortunately, Fisker is most well-known for his failed attempts to enter the hybrid EV market, notably the flop of the Fisker Karma. This was listed as one of Car and Driver’s biggest automobile flops in the past three decades as it drove the Company into bankruptcy with only 2,450 models produced in 2012. The bar has been set low and times have changed. The

momentum in EV stocks continues to surge as the market is infatuated to find the next Tesla killer. Fisker has transformed into a more focused EV company with plans to roll out its Ocean SUV by Q4 2022 with outsourced manufacturing and a combination of

clean energy utilizing both electric and a rooftop solar panel. Risk-tolerant investors looking for exposure into a high-end U.S. EV maker can watch for opportunistic pullbacks to scale into positions.

Henrik Fisker

As one of the most celebrated iconic designers in the automotive world, Henrik Fisker was credited for creating iconic models like the BMW Z8 roadster (James Bond), Aston Martin V8 (the best-selling Aston Marin of all-time), the Ford Shelby GR-1, the Tesla Model S, and the Artega GT. His brainchild Fisker Automotive was launched in 2007 to produce the Fisker Karma. The Karma was highly acclaimed for its design and celebrity list of customers including Leonardo DiCaprio, Justin Bieber, Colin Powell, and former U.S. vice president Al Gore. Fisker won a lawsuit with Tesla, claiming Fisker stole the Company’s EV technology. The Company was also awarded a $528.7 million conditional loan by the U.S. Dept. of Energy for the development of EVs. However, the loan was frozen when milestones weren’t reached in 2012. Hurricane Sandy destroyed 338 Karma vehicle shipment to Europe and 16 vehicles were burned during a flood that short-circuited on Karma leading to fire and bringing to question safety issues. Fisker Automotive ultimately went into bankruptcy in 2012. In 2016, Fisker reemerged as Fisker Inc. with a focus on all-electric vehicles. It reverse merged with SPAC Spartan Energy Acquisition resulting in $1 billion of funding to commence its EV production.

Fisker Ocean SUV

The first of four all-electric models is the Fisker Ocean SUV. Some of the features include a 300-mile range with an 80 kWh battery and a solar panel roof as a range extender with capacity to provide an extra 1,000 miles of range annually. The vehicle will be constructed out of recycled and sustainable materials. Deliveries are scheduled for 2022. Reservations are available with a $2,999 down payment and $250 reservation fee. The specialized Fisker Lease program enables customers to return the car any time and includes maintenance, service and 30,000 miles per year for $379 a month. The base vehicle cost is $37,499 before the $7,500 U.S. EV credit. The Ocean SUV was unveiled at the 2020 Consumer Electronics Show and was ranked “Best of CES 2020” receiving accolades from various publications including Newsweek, Time, Business Insider, CENT and PC Magazine. There will be a two and four-wheel drive with the quickest version able to reach 0-to-60 mpg speeds in 2.9 seconds. The Company also filed patents in 2017 for solid-state batteries which it will be developing with Caterpillar Venture Capital, a subsidiary of Caterpillar NYSE: CAT.

Magna International

Henrik Fisker is a brilliant designer, but the fallout of the past centered around operational issues. With a new team in place and a manufacturing deal with Magna International NYSE: MGI , the Company may finally be on its way. On Dec. 17, 2020, they signed a definitive platform and initial manufacturing agreement with Magna. The Fisker Ocean will be produced exclusively by Magna in Europe initially utilizing Magna’s EV platform as Fisker engineers continue to further develop FM29 to create a new IP unique to Fisker. Over 10,400 reservations for the Ocean have been registered. The Company plans to have the final Ocean prototype by summer 2021 and deliveries scheduled by Q4 2022. This obvious a longer-term hold play, but risk-tolerant investors can use the sell-offs to scale in at opportunistic pullback levels.

FSR Opportunistic Pullback Levels

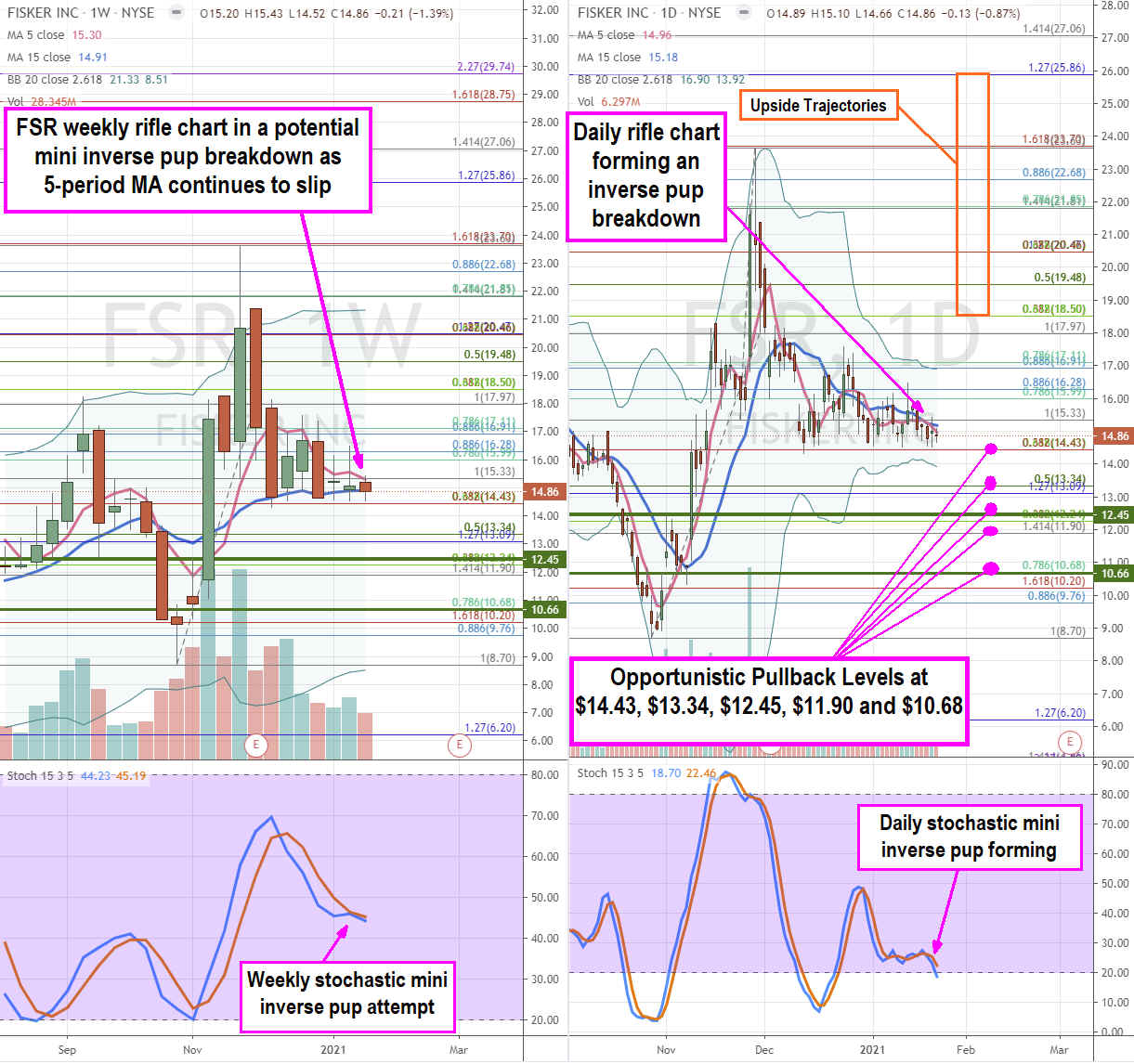

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the landscape for FSR stock. The weekly rifle chart has been coming down after peaking off the $23.70 Fibonacci (fib) level. The weekly stochastic has been oscillating down and stalling for a potential mini inverse pup on a breakdown through the $14.43 fib area. The weekly 5-period moving average (MA) has been sloping down at $15.30 as it nears the 15-period MA at $14.91 for potential crossover down. The weekly market structure low (MSL) triggered above $12.45 in November 2020. The daily rifle chart has been in a downtrend as the stochastic forms a mini inverse pup falling through the 20-band as the daily 5-period MA slopes down at $14.96. Having both the weekly and the daily rifle charts indicating downtrends can provide opportunistic pullback levels at the $14.43 fib, $13.34 fib, $12.45 weekly MSL trigger, $11.90 fib, and the $10.68 fib. Since the rollout of the Fisker Ocean is not scheduled to commence until Q4 2022, it’s important to get low priced shares. The upside trajectories range from the $18.50 fib up to the $25.86 fib.

Before you consider Fisker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fisker wasn't on the list.

While Fisker currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.