Communications and media giant

AT&T, Inc. NYSE: T stock is vastly underperforming the benchmark

S&P 500 index NYSEARCA: SPY. A recent Morgan Stanley downgrade took the wind out of the recently announced distribution deal with streaming platform

Roku, Inc. NASDAQ: ROKU the night before. The market is valuing streaming content networks at premium technology stock multiples as evidenced by the surge in

Walt Disney NYSE: DIS stock on the announcement of over 20 new Marvel Cinematic Universe (MCU) and Star Wars show being added to Disney+ which has reached over 80 million subscribers. This sent shares surging to all time highs with a forward price-earnings (P/E) multiple of 91. Meanwhile, AT&T with its WarnerMedia DC Entertainment Universe (DCEU) still trades around a 16 P/E even as they beef up the rollout of the DCEU with movies releasing simultaneously on HBO Max and

theatres in 2021. The untimely downgrade is a blessing in disguise as it provides opportunistic pullbacks for prudent investors seeking exposure in arguably the second most valuable superhero franchise on the eve of its rollout.

How Streaming Transformed Disney into a Momentum Stock

While the revenues from Disney+ is a drop in the bucket for Disney, the advent of building out a distribution network that bypasses the middleman has given the stock a halo effect that comes with lofty multiples. I noted the significance of the launch of the MCU on Disney+ in one of my first MarketBeat Original articles in November 2019. Wile the COVID-19 pandemic ravaged shares from the $140s to $$79 as parks closed and retail operations shuddered, the market focused on the streaming network to drive up shares as it identified Disney+ as a major player in the streaming content wars with Netflix NASDAQ: NFLX , Amazon NASDAQ: AMZN and Apple NASDAQ: AAPL. The market mostly ignored WarnerMedia and its HBO Max as another key player despite having the IP rights to the most widely known superheroes like Superman, Batman and Wonder Woman.

Dueling Universes: DC vs. Marvel

Credit has to be given to Marvel Studios and most notably Kevin Feige for reigniting the fervor over superhero live action films. His masterplan to introduce C-level Marvel characters like Ironman, Thor, Captain America, Black Widow and Guardians of the Galaxy in three Phases created a $23 billion franchise over 11 movies. The combination of great scripts, continuity, amazing GCI and connecting plots redefined the live action superhero genre. Meanwhile, WarnerMedia has also continued to build its key franchises like Superman, Batman and Wonder Woman. Surprisingly, D-level character Aquaman still did over $1 billion in worldwide box office. However, the DCEU franchise Justice League only did $658 million in worldwide box office, which was less than a quarter of what MCU Avengers: Endgame generated with worldwide gross receipts of $2.8 billion.

The flop of Justice League was a nail in the coffin for the DCEU early on. However, the unprecedented groundswell of support for the release of the Zack Snyder version of Justice League has resulted in the rerelease of the rumored four-hour original vision to be released on HBO Max. Additionally, WarnerMedia has decided to bolster the DCEU by introducing new franchises including Green Lantern, Justice League Dark, Strange Adventures as well as Batman, Aquaman and Suicide Squad spin-offs to be revealed.

The Transformation of AT&T WarnerMedia

In a bombshell announcement on Dec. 3, 2020, AT&T announced all if its 2021 theatrical releases would be available on HBO Max simultaneously with movie theaters for 30-days. This was an unexpected “shot heard around the world” to the delight of superhero fans and movie goers and the to the detriment of movie theaters chains like AMC Entertainment NYSE: AMC and Cinemark NYSE: CNK. AT&T has already invested $1.3 billion in building out HBO Max this year on track for a total of $2 billion investment in 2020. Keep in mind that Disney+ will be raising prices to $7.99 per month from $6.99 in 2021. However, HBO Max costs double at $14.99 per month so one paying subscriber brings in twice the revenues for a single Disney+ subscriber. To bolster sign ups, HBO Max will stream Wonder Woman 1984 on Dec. 25, 2020, the same day as the theatrical release.

Confusion Equals Opportunity

Upon last count at the end of September (Q3 2020), the Company had 28.7 million HBO Max customers and a combined 57 million worldwide subscribers between HBO and HBO Max. Part of the problem is the confusion between its legacy HBO and new HBO Max service as direct retail subscribers paying the $14.99 per month was closer to 3.625 million, up 625,000 for Q3. Nearly 8.6 million subscribers are HBO legacy customers that “qualify” to stream HBO Max but haven’t actually activated. Unlike Disney+ being one product, HBO Max is confusing to retail customers who may assume it’s an add-on product or the same product as HBO. They really need to bolster marketing to distinguish or just combine them completely. The final piece was the long awaited distribution deal with Roku to make HBO Max available to its 100 million users. AT&T has yet to announce the surge in new HBO Max subscribers since these two critical announcements in December along with the Wonder Woman 1984 streaming release, but the market will take notice when they do. Prudent investors looking to gain exposure on this underrated player in the streaming content wars can look for opportunistic pullback levels for entries.

T Opportunistic Pullback Levels

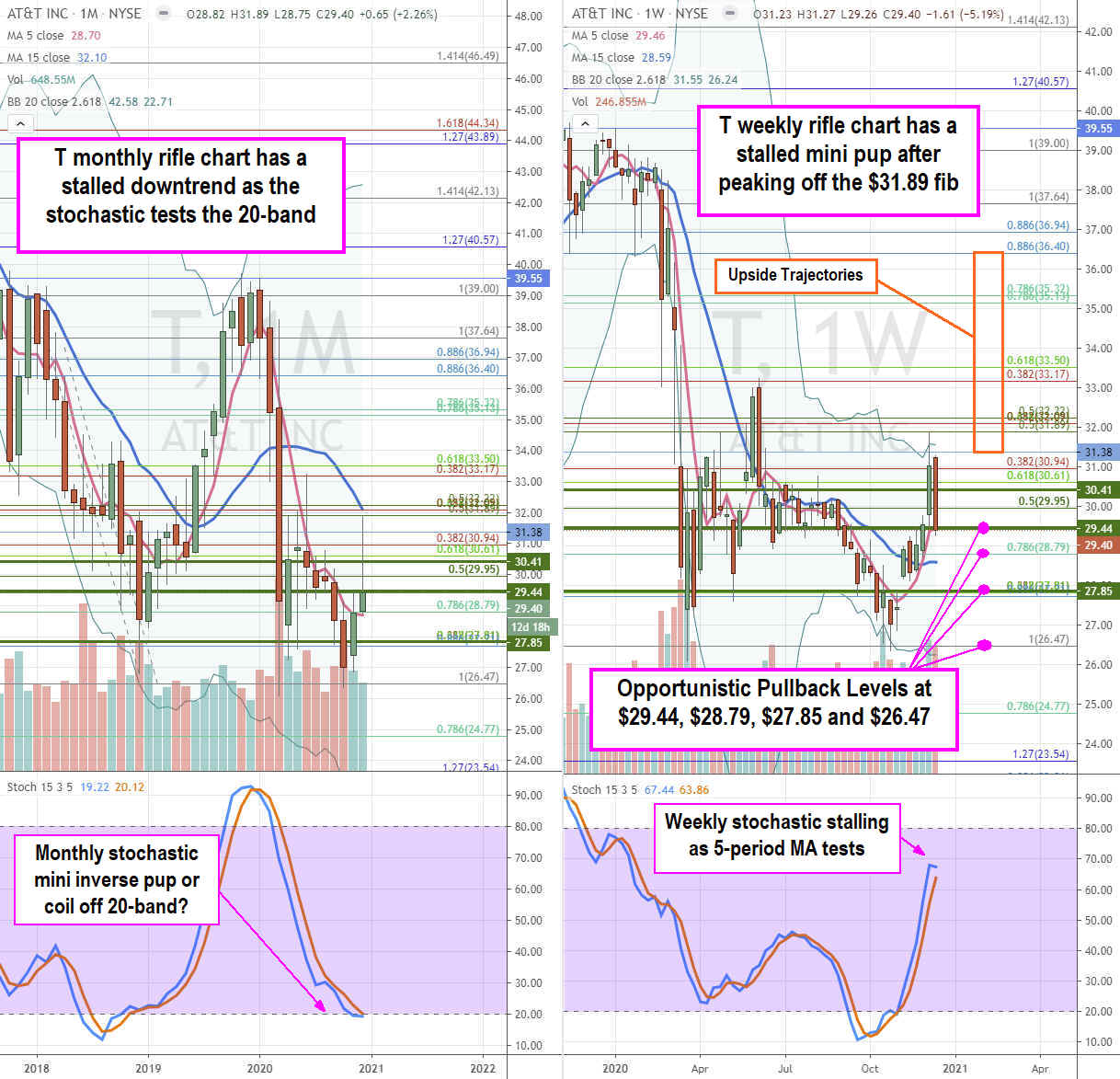

Using the rifle charts on the monthly and weekly time frames enables a broader view of the playing field for T stock. The monthly rifle chart is in a stalled downtrend as shares trade between its monthly 15-period moving average (MA) at the $32.10 Fibonacci (fib) level and the monthly 5-period MA at the $28.79 fib. The monthly stochastic has a bearish mini inverse pup near the 20-band that can trigger if it breaks the monthly 5-period MA, unless it can cross back up through the 15-period MA. The weekly rifle chart formed a mini pup to surge it to the weekly upper Bollinger Bands (BBs) to the $31.89 fib before selling back down to the weekly 5-period MA at the $29.44 market structure low (MSL) trigger on the Morgan Stanley downgrade. Prudent investors can take advantage of opportunistic pullback levels at the $29.44 weekly MSL, $28.79 monthly 5-period MA/fib, $27.85 lower weekly MSL/fib, and the $26.47 fib. The upside trajectories range from the $31.38 up to the $36.40 fib near-term and longer-term up to $39.55. Shares also pay a nice 7% dividend for long-term holders, which can be optimized with a covered call strategy.

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.