Consumer staples giant Kellogg Company NYSE: K stock is having a great year, trading up +12% versus the S&P 500 NYSEARCA: SPY , which is trading down (-20%) for 2022. The high inflation and an uncertain economic climate have benefited consumer staples companies. Kellogg is well known for its popular cereal and breakfast brands, including Special K, Raisin Bran, Froot Loops, Eggos, and Pop-Tarts, along with snacks like Pringles and Cheez-It.

It competes with other cereal makers like General Mills, Inc. NYSE: GIS and consumer staples producers like Conagra Brands, Inc. NYSE: CAG, The Hershey Company NYSE: HSY, and The Kraft Heinz Company NYSE: KHC. These food processors are all outperforming the S&P 500 in 2022, with year-to-date (YTD) gains ranging from +10% for Kraft Heinz, +11% for Conagra, +12% for Kellogg, +21% for Hershey to a whopping +29% gain for General Mills. In addition, Kellogg carries extra value for shareholders as it will split into three independent public companies in 2023.

Inflation Benefactors

Packaged food makers benefitted from the pandemic as consumers ate at home, especially during lockdowns. This trend became a lifestyle change for many post-pandemic. While rising inflation meant higher costs for ingredients and commodity prices, these manufacturers passed on the costs to consumers by raising prices.

This inevitably added to the bottom line resulting in continued growth during the post-pandemic period with little normalization. However, the recent CPI data shows inflation starting to ease as it fell to 7.1% for November, credited to the aggressive interest rate hikes from the U.S. Federal Reserve. This is good news for consumers but could mean a retracement for consumer staples stocks as investors migrate back into discretionary and technology stocks that have been hit the hardest by high inflation.

Q3 Fiscal 2022 Earnings Release

On November 3, 2022, Kellogg released its fiscal third-quarter 2022 results for September 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $1.01, excluding non-recurring items, meeting consensus analyst estimates of $0.98. In addition, revenues grew by 8.9% year-over-year (YOY) to $3.95 billion, beating analyst estimates of $3.78 billion.

Kellogg CEO Steve Cahillane commented, "We're pleased to report another quarter of better-than-expected financial performance and an increase to our outlook for the year. This required navigating effectively through global supply challenges and working to offset cost pressures with productivity and revenue growth management, sustaining momentum in snacks and emerging markets, and continuing to recover inventory and share in North America cereal."

Upside Guidance

Kellogg issued upside guidance for fiscal full-year 2022 for organic-basis net sales to grow 10%, up from earlier guidance of 7% to 8%. It raised its guidance for adjusted-basis operating profit growth to 6%, up from 4% to 5% earlier. It increased its guidance for adjusted-basis EPS growth to 3% on a currency-neutral basis, up from 2% prior guidance.

The Spin-Offs in 2023

Kellogg will spin off two divisions in 2023 to form three independent public companies. These will be tax-free distributions. Shareholders will receive shares in the two-spin off entities on a pro-rata basis relative to their Kellogg stock holdings at the record date for each spin-off.

The Global Snacking Co. will be the international producer of cereal and noodles, North American frozen breakfast, and global snacks with $11.4 billion in net sales. Its brands include Kellogg’s Frosted Flakes/Zucaritas, Cheez-It, Pop-Tarts, Special K, Coco-Pops, and Crunchy Nut. Nearly 60% of its net sales are derived from Pringles, Cheez-It, Pop-Tarts, Kellogg’s Rice Krispies Treats, Nutri-Grain, and RXBAR. Almost 10% of its net sales come from noodles sales in Africa. Another 10% comes from its Eggo brand and frozen breakfast products. North America represents half its sales, with emerging markets accounting for 30% and developed international markets for 20%.

The North America Cereal Co. will be a leading cereal company concentrating on the U.S., Canada, and the Caribbean, with $2.4 billion in net sales. The business will focus on ready-to-eat cereal distribution in the U.S., Canada, and the Caribbean. Its brands will include Kellogg’s, Frosted Flakes, Froot Loops, Mini-Wheats, Special K, Raisin Bran, Rice Krispies, Corn Flakes, Kashi, and Bear Naked.

Plant Co., with $340 million in net sales, is its pure plant-based foods company centered around its MorningStar Farms brand seeking to capitalize on solid long-term opportunities concentrating on North America and future expansion internationally.

Trading Range Break

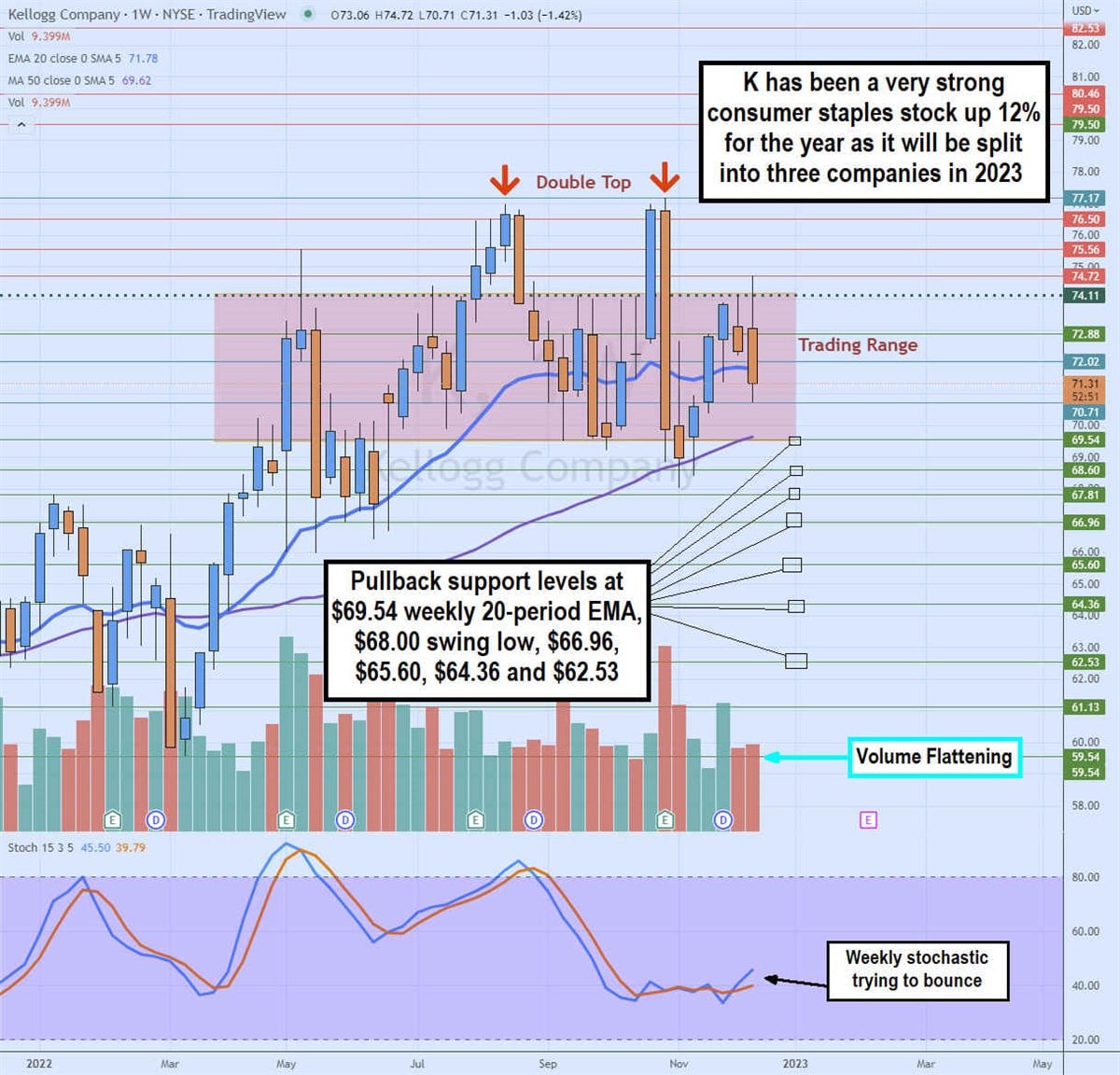

The weekly candlestick chart shows a double top around $77.00 and a trading range between $74.11 and $69.54. The weekly market structure low (MSL) breakout triggers above $74.11. The double top formed when shares collapsed on its earnings release down to a swing low near $68.00.

The weekly 20-period exponential moving average (EMA) sits at $71.78, and the weekly 50-period M.A. sits at $69.62. The weekly stochastic is attempting to bounce up through the 40-band as volume starts to flatten out. Pullback support levels sit at $69.54 weekly 50-period M.A., $68.60, $68.00 swing low, $66.96, $65.60, $64.36, and $62.53.

Before you consider Kellanova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kellanova wasn't on the list.

While Kellanova currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report