Everyone, at one point or another, has fallen into a bull trap. Falling into enough of them will convince you to expect a stock drop as soon as you get in. Bull traps can be painful financially and psychologically. In this article, we'll take a deep dive into what is a bull trap in stocks and how to trade them. By the end of this article, you should have a clearer understanding of bull traps and how to manage them moving forward.

What is a bull trap?

A bull trap is the equivalent of a hard rug pull after you've been convinced the surface has stabilized. A bull trap occurs when short-term positive sentiment sharply drives up a stock, often through key resistance levels. This buying activity causes new buyers to chase the stock as they jump in.

The stock climbs higher, usually on heavy volume, and then sharply reverses back down. This price action traps the new buyers, like deer in the headlights right before a collision. Bulls are baffled at the rug pull as bounce attempts get sold into cascading lower. New buyers start to panic when their losses quickly turn bright red. The stock continues to sell off lower, driving more panic selling as it breaks through more support levels.

Bull traps occur in all financial trading assets. In fact, cryptocurrency traders frequently experience bull traps. Knowing the bull trap pattern can help you understand what is a bull trap in crypto and crypto bull trap formations.

The opposite of a bull trap is a bear trap. Recognizing and understanding the price movement and psychology that distinguish a bull trap vs bear trap can help you sidestep the pitfalls and potentially use them for trading opportunities.

A bull trap, meaning a time when stocks in a downtrend quickly reverse higher, stirs up the fear of missing out (FOMO) emotion. A bull trap chart starts with a downtrend. After that, a sharp spike in a stock's price attracts more bulls and reverses with a sharp drop that continues to fall lower, shaking out more bulls along the way. Bulls don't want to or don't ask themselves, "Are we in a bull trap?" until the pain is too great.

The psychology behind bull traps

The psychology of bull traps is mainly driven by fear and greed. Fear can develop when losing money in a position. However, fear can also form when missing an opportunity. This is often described as fear of missing out or FOMO.

Greed can occur when you want more profits in an already profitable position. Bull traps commonly occur in down-trending stocks that attempt to reverse with a dead cat bounce which sucks in buyers only to fizzle and collapse again. Hope and wishing is what drives bulls. The hope of a reversal and wishing for a bounce causes bull traps to develop.

Some traders admit that it’s harder to take a loss on a stock that they were profitable in than in a stock in which they never had a profit. It can be hard to accept that you were wrong about a stock so quickly, especially when you were seemingly right initially. It's very tough to pivot quickly and accept the small loss and exit. This causes traders to stay committed to the initial pullback and panic when the pain is too great as the stock stumbles.

Bull traps can happen in any timeframe, from a one-minute chart to a monthly chart. They can also form in any market climate, whether a rising bull market or a falling bear market. However, since market context plays a role in investor sentiment, bull traps occur more often in falling markets.

Identifying bull traps

Bull traps share some common characteristics. These are the three parts that make up the bull trap meaning.

- Sharp price rises draw in the bulls. The sharp price rise can come at a short-term bottom in an existing downtrend. However, it can also form at the peak of an uptrend. The sharp spike often occurs after a short-term reversal pattern known as a market structure low (MSL) forms and creates a trigger candle and buy signal. This three-candle formation comes at the end of at least a four-candle downtrend. The final three candles comprise a low, lower, and higher low. The higher low candle is the trigger candle, and the high of the trigger candle is the buy signal that triggers if the stock rises through there.

- Sharp price reversal forms at the peak. As bulls rush into the stock, the bounce peaks and reverses sharply back down. Sometimes a bull trap flag can form preceding the drop.

- Bulls get trapped in the price drop. As the stock falls below the entry prices for the bull, the stock continues to fall lower. Bulls expect a bounce that doesn't materialize as the stock resumes its downtrend or forms a new downtrend. At this point, the bulls that aren't stopped are trapped and left to panic at lower prices.

Bull traps form with dead cat bounces. These patterns indicate a sharp bounce after a steep fall, inspiring hope that the stock is on its way toward reversing higher. Unfortunately for the bulls, the stock peaks quickly and reverses sharply to resume the downtrend. Much like bear traps, they can only be confirmed in the rearview mirror after the fact.

The Airbnb Inc. NASDAQ: ABNB daily candle stick chart illustrates two bull traps.

Historical bull traps

Bear markets tend to generate lots of bull traps since uptrends are possible within a larger time frame downtrend. No market or stock goes straight up or straight down. There are always reversions and counter trend wiggles. As markets fall, there are always moments when a short-term bottom triggers a bounce, which stumbles back into the downtrend as it sells off again. This happened during the 2000 to 2001 internet bubble and the 2008 to 2009 financial meltdown bear markets.

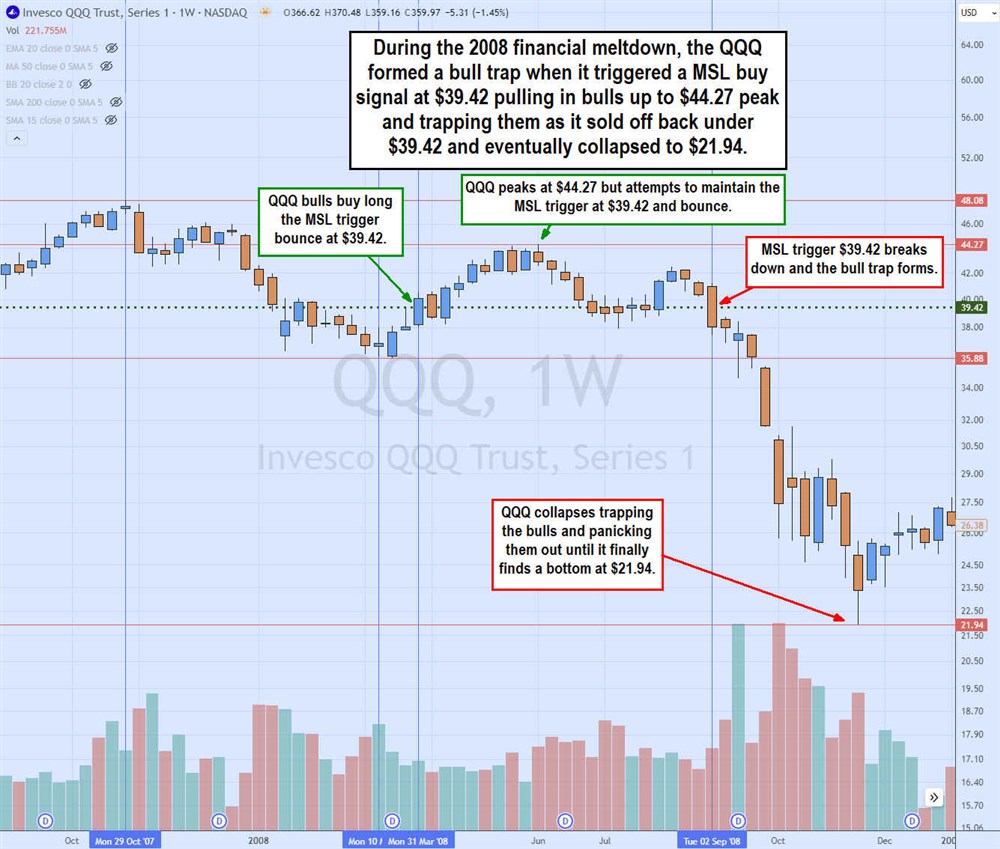

The Invesco QQQ NASDAQ: QQQ is an exchange-traded fund (ETF) representing the Nasdaq index. During the 2008 financial meltdown, the stock market entered a bear market, causing benchmark indexes to collapse more than 50% off their highs. The QQQ had peaked at $48.08 on October 29, 2007. It steadily sold off down to $35.88 on March 17, 2008. It formed a weekly MSL buy trigger on the bounce through $39.42, causing bulls to rush into the QQQ.

The QQQ rose to a high of $44.27 by June 2, 2008. Bulls were feeling like the market had finally bottomed. However, the QQQ eventually fell below the MSL trigger at $39.42 on September 2, 2008. The bear trap had formed as the QQQ selling had accelerated. This caused bulls to take stop losses and panic out as the QQQ continued to downtrend, eventually finding a bottom at $21.94 by November 17, 2008.

Recent bull traps

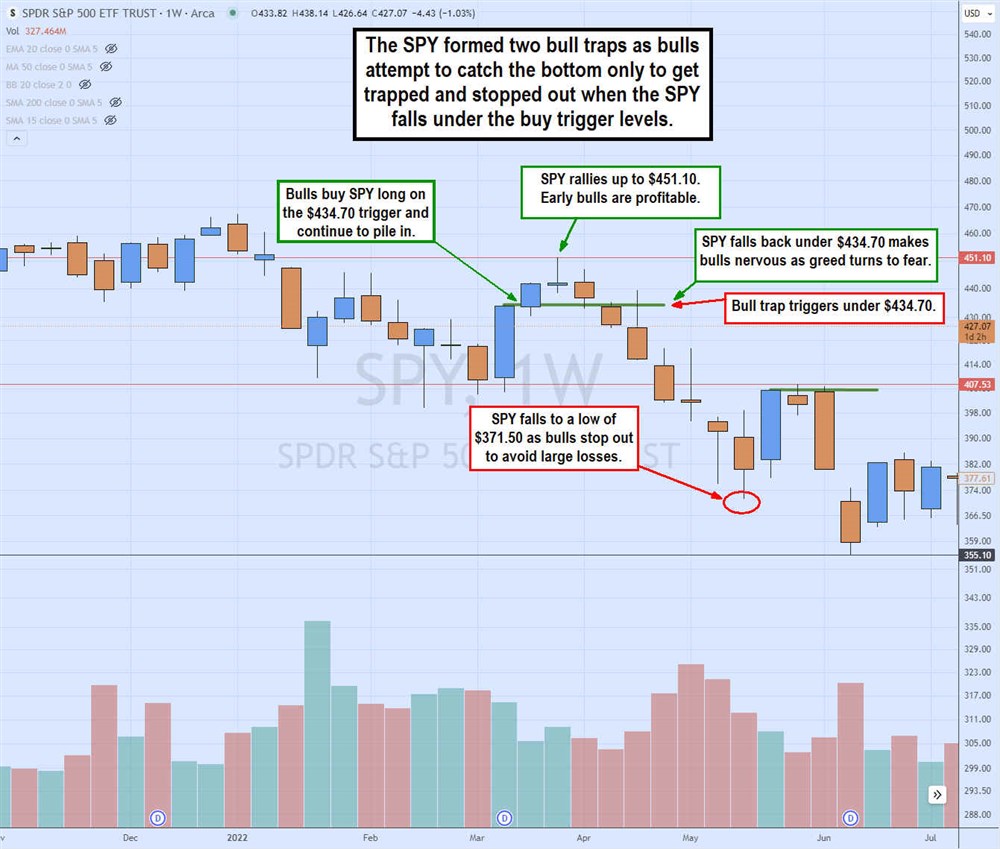

The SPDR S&P 500 ETF Trust NYSEARCA: SPY represents the S&P 500 index, the key benchmark index for the U.S. stock markets. The weekly candlestick chart on the SPY illustrates two occurrences of bull traps. The SPY peaked at $467.13 on January 3, 2022. The SPY proceeded to sell off to $404 by March 7, 2023. SPY bounced sharply to $434.30 on the next weekly candle. This caused bulls to have hope that the bottom was in after five weeks of selling. Bulls jumped in from $434.30 on the market structure low (MSL) buy trigger.

The buying action caused more bulls to step into the SPY. The SPY bounced to a high of $451.10 by March 28, 2023, and then started to fall. The selling action had bulls concerned but not overly panicked until the SPY fell under the $434.30 buy trigger. Everyone who bought SPY above the trigger loses money and is trapped, hoping for a bounce. However, the SPY continued to fall for six consecutive weeks as bulls exited their positions to avoid larger losses.

The SPY finally hits a bottom at $371.50. A sharp bounce forms the weekly MSL buy trigger at $405.52. This triggers bulls to jump back in, but peaks early at $407.53 and reverses through $371.50, falling to a new low of $355.10.

Distinguishing bull traps from real bull markets

The key distinction between a bullish reversal, an uptrend, and a bull trap lies in the follow-through. They all start with a sharp rise, but the bull trap reverses sharply while the breakout rises as traders and investors buy the dips and pullbacks. In essence, the lack of dip buying or pullback buying separates a bull trap from a bullish reversal and uptrend.

When attempting to distinguish between a bull trap and a bullish trend, the tricky part is that they can only be confirmed in hindsight after they have formed. In other words, they are rearview mirror formations.

The best way to manage a reversal is to maintain trailing stops just in case the bounce, breakout or uptrend reverses into a breakdown. While bull trap implies that the bulls are trapped in their long positions, no one is trapped since it's up to the trader to swallow their pride and take the stop loss. Hope and wishes keep bulls "stuck" in a losing position. Applying disciplined trailing stops can enable you to ride bull trends higher while quickly stopping out of bull traps.

Strategies for avoiding bull traps

While bull traps are hindsight formations, there are strategies to help avoid them altogether. Having the discipline to maintain trailing stops is paramount. Having a game plan going into any trade is important, and your stop-loss price levels are paramount. Here are some technical and fundamental analysis techniques to avoid bull traps.

To spot bull traps, it's imperative to have chart tools available. For example, candlestick charts are frequently used. Most charting services and platforms have the basic price and momentum indicators required to detect and act upon bull traps. Price indicators can include moving averages, market structure signals and Bollinger Bands. Momentum indicators can include the relative strength index (RSI), accumulate distribution indicator (ADI) or the moving average convergence divergence (MACD) indicator.

Here are the six steps for the formation of a bull trap:

- Bull traps tend to start with a downtrend.

- A sharp reversal forms on a MSL trigger.

- The stock bounces sharply.

- The stock peaks and tends to form a rounding top.

- The stock sells off again back towards the MSL trigger price.

- The stock breaks down under the MSL trigger, forming the bull trap.

The daily candlestick chart on Nike Inc. NYSE: NKE illustrates the six steps that form a bull trap. Step 1 shows the downtrend in NKE as it falls from $111.58 on August 10, 2023, to a low of $96.22 by August 23, 2023. The falling blue line is the 5-period moving average, illustrating the downtrend. Each bounce attempt gets rejected at the 5-period moving average as it falls lower. The RSI oscillator is also falling under the oversold 30-band. Step 2 is the bullish reversal attempt as a daily MSL trigger forms at $98.86, and the oversold RSI starts to bounce back up through the 30-band. The MSL trigger breaks as NKE finally thrusts up through the 5-period moving average and rises.

Step 3 is the bounce, which lifts NKE as bulls buy into the stock, driving shares higher. Step 4 occurs when NKE peaks at $103.52 and forms a rounding top as shares fall back down. Step 5 is the price drop as it falls back towards the MSL buy trigger price at $98.86. Bulls are getting nervous as latecomers have losses, and the MSL buyers give back all profits. Step 6 is the bull trap formation as NKE falls below the MSL trigger price at $98.86, putting all buyers above in the red. The bull trap continues on a downtrend as NKE again falls under the 5-period moving average and stays below it as prices plunge to $89.42. Short selling during step five or six can benefit seasoned traders. Short selling is a much riskier form of trading than playing longs, and it is crucial to maintain stop-losses to avoid short squeezes.

Utilizing fundamental analysis to avoid bull traps

Fundamental analysis can help you avoid bull traps. If a company's earnings report and conference call are negative and they lower guidance, then it's best to stay away from the stock. Weak earnings reports usually trigger analyst downgrades in the following days. These actions can add more selling pressure and also form bull traps as the downgrades dampen the bounce attempts.

Bull traps occur when traders and investors attempt to pick a bottom on stocks. By being selective with your entries and buying pullbacks on existing uptrends on stocks with positive sentiment and earnings guidance, you can improve your odds of sidestepping bull traps. The market climate is also going to impact bull traps. They tend to occur more often during falling markets; therefore, being frugal with your long trades is essential.

As mentioned many times, the market climate is significant. Trades are influenced by the market context, whether a rising or falling market, bull or bear market. A rising market can help foster bullish reversals that may not turn into a bull trap. A falling market can cause a promising rebound to reverse into a bull trap.

It's best to stay aligned with the markets by using indicators with index ETFs or futures. Keeping the SPY or the QQQ up on a candlestick chart can help you understand which direction the market is trending. This further enables you to trade with the direction and decide if a bullish reversal is suitable based on the market climate.

Real-time monitoring and automated solutions

You can use various trading platforms for real-time tracking and trade automation. Some platforms provide algorithmic trading, enabling you to automate your trades upon specific triggered parameters. Real-time data analysis can also allow you to spot bull traps as they occur utilizing pattern recognition like dead cat bounces or head and shoulders patterns on multiple time frames.

For better monitoring, you can also consider subscribing to various trading services, screeners, pattern recognition software, algorithm providers, and trading bots. However, be aware that many of these services may be too good to be true. Be sure to read reviews and consider only reputable providers that offer a no-obligation trial period.

Discipline is key

In this article, we covered how to spot bull trap stocks and avoid them. We detailed the six stages of a bull trap to understand better why and how they occur. We also detailed the many indicator tools you can use to manage them and several examples of real-life bull traps. Administering discipline is easier said than done whether stopping out of bull traps vs bear traps.

Identifying bull traps is easier to do on a simulator than with real cash. So start with a simulator and gradually ease into trading with real cash. Always plan your trade or investment with a stop-loss in mind and the discipline to administer them if they trigger. Always be cautious and be informed with your decision-making in the markets.

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.