What Are the Warren Buffett Stocks?

Warren Buffett's stock portfolio, often referred to as the Warren Buffett investment portfolio or Berkshire Hathaway portfolio, comprises a carefully curated selection of stocks. These stocks testify to Buffett's investment principles, emphasizing stability, competitive advantage and long-term growth potential.

Here is a comprehensive explanation of some of the key elements and characteristics of the Warren Buffett stocks:

- Value investing philosophy: Warren Buffett is a champion of value investing. This approach involves identifying stocks undervalued by the market but have strong fundamentals. His investment philosophy is rooted in the belief that, over time, the market will recognize the true value of these stocks.

- Diverse holdings: The Buffett portfolio spans various industries and sectors, reflecting his diversification strategy. This diversification helps mitigate risks associated with market fluctuations in any particular sector.

- Stable and established companies: When examining the companies in Warren Buffett's stock portfolio, you can observe a preference for well-established and mature businesses. Many of these companies have stood the test of time and have decades of history.

- Competitive advantage: Buffett's stock picks often include companies with strong competitive advantages or economic moats. These are businesses with barriers to entry that protect them from competition and allow them to maintain profitability.

- Long-term holding: Buffett is known for his buy-and-hold strategy. He invests in stocks for the long term, sometimes even for decades. This approach aligns with his belief in the compounding power of investments over time.

- Focus on fundamentals: Rather than being swayed by short-term market trends or speculative bets, Buffett's investment decisions are grounded in a thorough analysis of a company's financial health, management quality and potential for sustained growth.

- Transparency: Under Buffett's leadership, Berkshire Hathaway regularly discloses its holdings through required regulatory filings and earnings calls. Investors and the public can gain insights into the portfolio's composition.

- Influence on stock prices: Warren Buffett's reputation and track record can significantly impact the stock prices of the companies he invests in. His endorsement often boosts investor confidence and can lead to increased stock valuations.

- Educational value: For aspiring investors, studying Warren Buffett's stock portfolio provides valuable lessons in investment strategy, risk management and the importance of patience in wealth creation.

The Warren Buffett stock portfolio, managed through Berkshire Hathaway, reflects Buffett's enduring investment principles. It consists of stocks carefully chosen for their intrinsic value, stability and long-term growth potential. Buffett's approach to investing has made him a legendary figure in finance. His portfolio serves as a blueprint for those seeking to navigate the complexities of the stock market with a focus on value and sustainability.

Warren Buffett’s Investment Philosophy

Warren Buffett's investment philosophy, characterized by value investing and a long-term perspective, forms the cornerstone of his remarkable success in building a substantial portfolio. Let’s take a detailed exploration of the key elements that define Buffett's investment philosophy:

- Value investing: At the core of Buffett's philosophy lies the concept of value investing. He seeks out stocks that are trading at prices below their intrinsic value. This approach involves a meticulous analysis of a company's financials, including its balance sheet, income statement and cash flow statement, to determine whether the market undervalues it.

- Economic moats: Buffett often invests in companies with economic moats, a term he coined to describe businesses with enduring competitive advantages. These moats can take various forms, such as brand recognition, cost advantages, network effects or regulatory advantages. Companies with economic moats are better equipped to maintain profitability and withstand competition.

- Long-term horizon: One of Buffett's most renowned principles is his long-term perspective. He views stocks as ownership stakes in businesses and can hold onto them for an extended period, sometimes decades. This patient approach aligns with his belief in the power of compound interest and the potential for investments to grow substantially over time.

- Management quality: Buffett places significant importance on the quality of a company's management team. He seeks out businesses led by competent, honest and shareholder-oriented executives. A capable management team is crucial for a company's success and ability to create long-term value.

- Margin of safety: Buffett is cautious and emphasizes the importance of a margin of safety in his investments. This means buying stocks at prices significantly lower than their intrinsic value, reducing the risk of capital loss if the market undergoes corrections or downturns.

- Diversification: While Buffett's portfolio doesn't have significant diversification, he prefers to focus on a relatively small number of investments he thoroughly understands. This concentrated approach allows for more effective monitoring and decision-making.

- Continuous learning: Buffett is known for his voracious appetite for reading and learning. He continually expands his knowledge about businesses, industries and the global economy. His intellectual curiosity plays a vital role in his investment decision-making process.

- Transparency: Under Buffett's leadership, Berkshire Hathaway maintains transparency by disclosing its holdings through regulatory filings. This transparency provides valuable insights for investors and the public into the composition of the Warren Buffett portfolio.

Warren Buffett's investment philosophy is a blend of disciplined value investing, focusing on companies with competitive advantages and a long-term perspective. His approach to investing has yielded substantial returns and set a benchmark for investors worldwide. By adhering to these principles, Buffett established a portfolio reflecting his unwavering commitment to intelligent and informed investing.

Warren Buffett Top Stock Holdings by Size

Warren Buffett, often regarded as one of the greatest investors ever, has built a remarkable investment portfolio. His investment philosophy, characterized by a focus on long-term value, enduring competitive advantages and sound management, makes him one of the world's most successful investors.

What does Warren Buffett own? These investments offer a unique insight into Warren Buffett holdings and the mind of the Oracle of Omaha. Shedding light on how Warren Buffett chooses companies and how they fit into his broader investment strategy. Let's explore the companies that make up the core of Warren Buffett's portfolio and the rationale behind each investment.

Apple Inc. (NASDAQ: AAPL)

Apple Inc. (NASDAQ: AAPL), a titan in the technology industry, has been a key player in shaping the digital age. With a portfolio that includes the iPhone, iPad and Mac computers, Apple has consistently pushed the boundaries of innovation, creating products that have become integral to our daily lives.

Buffett’s investment philosophy centers around companies with strong brands, loyal customer bases and a track record of consistent innovation. Apple checks all these boxes. Its brand is one of the most recognized worldwide, its customers are famously loyal, and it has a history of groundbreaking products.

Now, let's dig into Apple’s financials, a company that has caught the discerning eye of Warren Buffett due to its extensive product range and global influence. As Buffett would likely agree, the fiscal well-being of a company can often serve as a reliable barometer for its stock's potential.

Bank of America Corporation (NYSE: BAC)

Bank of America Corporation (NYSE: BAC) is a multinational investment bank and financial services holding company headquartered in Charlotte, North Carolina. It is one of the largest banking institutions in the United States, serving approximately 10% of all American bank deposits. The company provides a broad range of banking, investing, asset management and other financial and risk management products and services.

Warren Buffett’s Berkshire Hathaway has a significant stake in Bank of America, making it one of the most significant positions in its portfolio. Buffett is known for his value investing philosophy, which involves buying shares of undervalued companies based on their intrinsic value. He likely sees Bank of America as a solid investment due to its strong fundamentals, consistent profitability and position as a leading bank in the U.S.

One of the key aspects of Buffett’s investment philosophy is the importance of company earnings. Bank of America’s earnings have consistently had strong reports. This consistent profitability likely plays a significant role in Buffett's decision to include Bank of America in his portfolio.

American Express Company (NYSE: AXP)

The American Express Company (NYSE: AXP) is a globally recognized financial services corporation. Its credit card, charge card and other businesses have carved a niche in the financial world. The company’s reputation for quality service and customer satisfaction has made it a household name.

Warren Buffett, the Oracle of Omaha, is known for his value investing philosophy. He seeks out companies that exhibit strong brand loyalty, high returns on equity and extensive global reach, all of which are characteristics of American Express.

Now, look at American Express Company’s dividends, returning to Buffett’s investing philosophy. Buffett is a proponent of companies that provide consistent and growing dividends, viewing them as a sign of a company’s financial health and commitment to returning capital to shareholders. American Express has a history of paying dividends, further solidifying its position in Buffett’s portfolio.

The Coca-Cola Company (NYSE: KO)

The Coca-Cola Company (NYSE: KO) is a global juggernaut in the beverage sector, celebrated for its wide-ranging portfolio of soft drinks, including the legendary Coca-Cola brand that has satisfied global thirst for over a hundred years.

Warren Buffet has been a steadfast investor in Coca-Cola. His investment principles align seamlessly with the company's characteristics. The potent brand, worldwide reach, and steady profit generation of Coca-Cola harmonize with Buffett's investment approach. He values straightforward, predictable, cash-generative businesses, and Coca-Cola ticks all these boxes.

When you examine Coca-Cola’s financials, you will find that it aligns with one of Buffett’s favored investing philosophies. Buffet likes to invest in companies with strong and stable financial health. Coca-Cola has consistently demonstrated robust financial performance with steady revenue growth and strong cash flows.

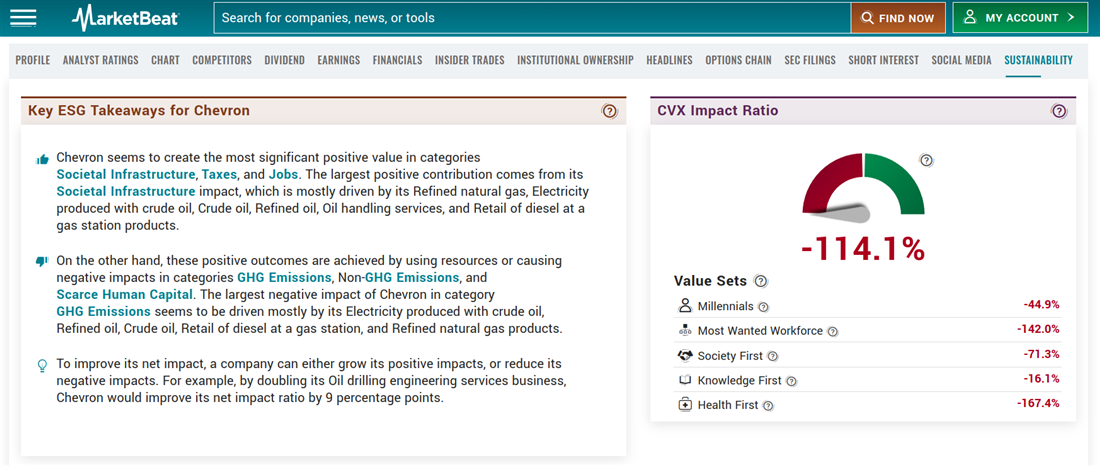

Chevron Corporation (NYSE: CVX)

Chevron Corporation (NYSE: CVX) is a titan in the energy sector. The company is deeply involved in exploring, producing, refining and marketing oil and gas. This extensive involvement allows Chevron to impact the global energy landscape significantly.

There are multiple reasons why Berkshire Hathaway Holdings includes Chevron in its portfolio:

- Chevron’s robust balance sheet is a testament to its financial health, a quality Buffett highly values.

- Chevron’s exposure to oil and gas prices allows it to benefit from market fluctuations, providing potential for substantial returns.

- The company’s ability to consistently generate profits, even in challenging market conditions, aligns with Buffett’s preference for companies with a strong track record of profitability.

Chevron Corporation’s sustainability efforts are a key reason Buffett invested in the company. The company invests in technologies and initiatives to reduce its environmental footprint, demonstrating a commitment to sustainable operations.

Analyzing Warren Buffett's Stock Selection Criteria

Warren Buffett has developed a set of criteria that guide his investment decisions. These criteria result from decades of experience and a deep understanding of what makes a company a worthwhile investment. By understanding these principles, you can gain valuable insights into the art of value investing and learn from the Oracle of Omaha himself.

Financial Health

Financial health is a critical aspect of Warren Buffett's stock selection criteria, representing the cornerstone of his investment philosophy. This criterion assesses a company's fiscal stability and solvency by looking at its balance sheet, cash flow and debt levels.

Buffett's emphasis on financial health is rooted in a simple yet profound principle: a company's ability to weather economic storms and continue operating profitably, even in challenging times, significantly reduces the risk for investors.

A company's financial health is a barometer of its overall resilience, reflecting its capacity to endure economic downturns, invest in growth opportunities and consistently generate shareholder returns. It matters because financially robust companies are better positioned to navigate uncertainties, seize market opportunities and avoid the perils of excessive debt, which can lead to financial distress.

Buffett's remarkable investment success can be attributed, in part, to his unwavering commitment to investing in companies with strong financial health. He minimizes the risk of permanent capital loss by carefully scrutinizing a company's financial statements and favoring those with substantial cash reserves, manageable debt levels and steady cash flows. This approach aligns with his long-term investment horizon and preserving shareholder value, a hallmark of his investment strategy for decades. Ultimately, Buffett's focus on financial health underscores his dedication to safeguarding the interests of Berkshire Hathaway's shareholders and achieving sustainable, long-term wealth creation.

Competitive Advantage (Moat)

Competitive advantage, often termed a "moat," is a critical element of Warren Buffett's stock selection. It signifies a company's enduring edge over competitors, like a castle's protective moat. This enduring advantage can stem from a strong brand, cost efficiency, customer loyalty or proprietary technology.

The importance of a moat lies in its ability to safeguard a company's profitability. It matters because a company with a wide and enduring moat is better equipped to generate consistent profits, which is vital for shareholders. Buffett's success partially stems from his skill in identifying businesses with substantial moats, reducing the risk of investing in vulnerable companies.

In essence, competitive advantage is a foundation of Buffett's strategy. It leads him to long-term investments in resilient, high-quality businesses that can withstand economic shifts, making it integral to his investment success.

Quality Management

Quality Management is a pivotal element of Warren Buffett's stock selection criteria. It encompasses a company's leadership team's competency, honesty and integrity. Buffett places immense importance on the people responsible for running a business because he believes that exceptional management is integral to long-term success.

Buffett's rationale behind this criterion is straightforward: capable and honest managers make prudent decisions that benefit shareholders. They guide the company through challenges and capitalize on opportunities. Moreover, trustworthy management reduces the risk of corporate scandals and ethical breaches that can negatively impact a company's stock value.

The significance of quality management is evident in Buffett's investment philosophy. He seeks businesses led by leaders who prioritize the company's long-term health over short-term gains, aligning with his strategy of holding stocks for the long haul. This emphasis on management quality has contributed significantly to his remarkable investment success by minimizing governance-related risks and ensuring that the companies he invests in are well-led and well-positioned for sustained growth.

Consistent Earnings

Consistent earnings are a fundamental aspect of Warren Buffett's stock selection criteria. This criterion emphasizes a company's ability to generate stable and predictable profits over time. Buffett values businesses with a history of reliable earnings because they indicate a well-established and resilient operation.

Buffett prefers to invest in companies where he can reasonably forecast future earnings with a degree of certainty. Such predictability reduces investment risk, aligning with his strategy of holding stocks for the long term. Companies with erratic or unpredictable earnings are more susceptible to market volatility and economic downturns, which can lead to significant stock price fluctuations.

Buffett's focus on consistent earnings contributes to his remarkable investment success by allowing him to make informed and prudent investment decisions. By choosing companies with a track record of steady profits, he minimizes the uncertainty and risk associated with investments, increasing the probability of positive returns over time. This criterion aligns with his value investing philosophy, emphasizing the importance of buying stocks in well-established, financially stable companies that can weather economic fluctuations.

Return on Equity (ROE)

Return on equity (ROE) is vital to Warren Buffett's stock selection criteria. ROE measures a company's profitability by evaluating how efficiently it utilizes shareholders' equity to generate profits. Buffett values businesses with a consistently high ROE because it reflects the company's ability to generate solid returns for its investors.

Return on equity matters because it indicates the effectiveness of a company's management in deploying shareholder capital. A high ROE suggests that the company uses shareholders' funds efficiently to generate profits, while a low ROE may indicate inefficiency or poor financial management. Buffett seeks companies with a competitive advantage or economic moat, and a high ROE often accompanies such advantages.

ROE contributes significantly to Buffett's investment success by guiding him toward businesses with robust fundamentals. Companies with a history of high ROE often possess durable competitive advantages, which aligns with his preference for businesses with strong economic moats. Investing in companies with a high ROE can lead to consistent and attractive returns over the long term, an essential element of his value investing philosophy. This criterion helps him identify companies capable of sustaining their profitability and competitive positions, contributing to his remarkable investment track record.

Simple Business

Warren Buffett's preference for businesses with a simple and understandable model is a cornerstone of his stock selection criteria. A "simple business" means a company whose operations, products and financials can be easily grasped and analyzed by an average investor. This criterion matters because it reduces the risk of misunderstanding or misjudging the company's prospects.

Buffett's investment philosophy revolves around investing in what he understands. He often says investors should stay within their "circle of competence," focusing on industries and businesses they comprehend thoroughly, a long-term investment success.

Simplicity contributes to Buffett's remarkable investment success by allowing him to make informed decisions based on a clear understanding of a company's competitive position, risks and growth potential. When he invests in simple businesses, he can predict their future performance more confidently, which aligns with his preference for low-risk, high-reward investments. By adhering to this criterion, he minimizes the chances of costly mistakes and maximizes the likelihood of long-term profitability.

Profitable Use of Earnings

Warren Buffett's emphasis on the profitable use of earnings is a crucial component of his stock selection criteria. It refers to his preference for companies that effectively reinvest their profits to generate further growth and shareholder value. This criterion matters because it ensures that a company doesn't just accumulate earnings but uses them wisely to expand its business, develop new products, enter new markets or improve existing operations.

Buffett's investment philosophy recognizes that a company's ability to generate profits is valuable only if those profits are utilized productively. Buffett maximizes the compounding effect of earnings over time by seeking out businesses that reinvest in areas where they have a competitive advantage. This approach aligns with his long-term investment horizon, as he aims to benefit from the snowballing growth of companies that consistently deploy their profits in ways that create additional wealth.

The profitable use of earnings contributes to Buffett's remarkable investment success by allowing him to identify companies with sustainable growth potential. Such companies are more likely to provide substantial returns to shareholders over the years, fitting well within their strategy of holding onto stocks for the long haul. It's another example of how Buffett's disciplined approach to stock selection has been a key driver of his impressive track record in investing.

Stocks Recently Bought or Sold

Warren Buffett's investment decisions have always commanded considerable attention within the financial community. In recent years, Berkshire Hathaway has engaged in several notable stock transactions. These maneuvers not only shed light on Buffett's distinctive investment philosophy but also provide glimpses into his perspectives on various sectors of the economy.

Among the stocks Warren Buffett's Berkshire Hathaway acquired are D.R. Horton, Lennar Corporation, NVR Inc. and Occidental Petroleum Corporation. On July 20, 2023, Berkshire Hathaway purchased approximately 5.97 million shares of D.R. Horton, amounting to a valuation of roughly $726.5 million.

This strategic move underscores Buffett's unwavering confidence in the housing market's resilience. The ongoing trend favors suburban living and lower-density housing positions companies like D.R. Horton as beneficiaries, bolstered by the housing sector's stability compared to other industries.

Similarly, Berkshire Hathaway acquired 152,572 shares of Lennar Corporation on March 14, 2023, with an approximate value of $17.2 million. This purchase reaffirms the firm's trust in the housing market's continued vigor, driven by the expanding trend toward suburbanization and the persistent demand for new homes. In line with this theme, Berkshire Hathaway added 11,112 shares of NVR Inc. to its portfolio on July 28, 2023, amounting to approximately $70.6 million. This decision signals Buffett's recognition of the value inherent in companies contributing to constructing new homes.

Going beyond the housing sector, Berkshire Hathaway's substantial investment in Occidental Petroleum Corporation in April 2019 is noteworthy. The acquisition of 12.4 million shares, valued at around $13.2 billion, reflects Buffett's evaluation of the oil and gas industry's potential. This investment likely hinges on the company's assets, capable management and strong financial performance, in harmony with Buffett's belief in the enduring value of oil and gas.

Conversely, among the stocks sold by Berkshire Hathaway were Activision Blizzard Inc. and General Motors Corporation. On January 18, 2022, the company divested its entire stake of 35.3 million Activision Blizzard shares, totaling approximately $3.8 billion partly due to concerns surrounding the company's workplace culture and its handling of sexual harassment allegations. Furthermore, the impending Microsoft acquisition presented an enticing arbitrage opportunity.

In a separate move, on September 27, 2023, Berkshire Hathaway sold 18 million shares of General Motors Corporation, amounting to around $730 million. While the precise rationale for this sale remains undisclosed, it is plausible that Buffett perceived the stock as overvalued or identified more attractive investment prospects. This divestiture may also reflect his views on the cyclicality inherent in the automotive industry.

Case Studies: Warren Buffett's Successful Stock Picks

Over the years, Warren Buffett’s investment decisions have captivated the financial world. Some of his most remarkable picks have become legendary case studies in value investing. So, let’s review three compelling case studies illuminating Buffett's investment strategy and shed light on the enduring qualities he seeks in the companies he invests in.

These case studies will provide valuable insights into the rationale behind Buffett's selections and how his approach to investing has translated into exceptional returns over the long term. From iconic brands like Coca-Cola to innovative tech giants like Apple, let's explore the reasons behind these investments and how they have contributed to Warren Buffett's illustrious investment career. Through these case studies, we gain a deeper appreciation for the wisdom and discipline that have made Warren Buffett a true master of the investment world.

Case Study 1: See’s Candy

- Company overview: See’s Candy is a premium chocolate and candy retailer distributing its products through company-owned stores and select retailers.

- Investment thesis: Warren Buffett's Berkshire Hathaway acquired See’s Candy in 1972, recognizing the strength of its brand, loyal customer base and efficient operations. See’s Candy had a consistent track record of profitability and a reputation for quality.

- Performance: Since its purchase, See’s Candy has generated over $2 billion in pre-tax earnings for Berkshire Hathaway. The company's strong brand allowed it to increase prices over time, helping it withstand the impact of inflation.

Case Study 2: Coca-Cola

- Company overview: Coca-Cola (NYSE: KO) is a global beverage company with products distributed in over 200 countries.

- Investment thesis: Berkshire Hathaway started buying Coca-Cola's stock in 1988, driven by Buffett's belief in the company's enduring competitive advantage in the global beverage market. Coca-Cola possessed a unique brand and a dedicated customer base that spanned generations.

- Performance: Coca-Cola has been one of Buffett's longest-held and most successful investments. The company consistently grew its earnings and dividends over time. Reviewing Coca-Cola’s price graph shows how lucrative this decision was for Buffett.

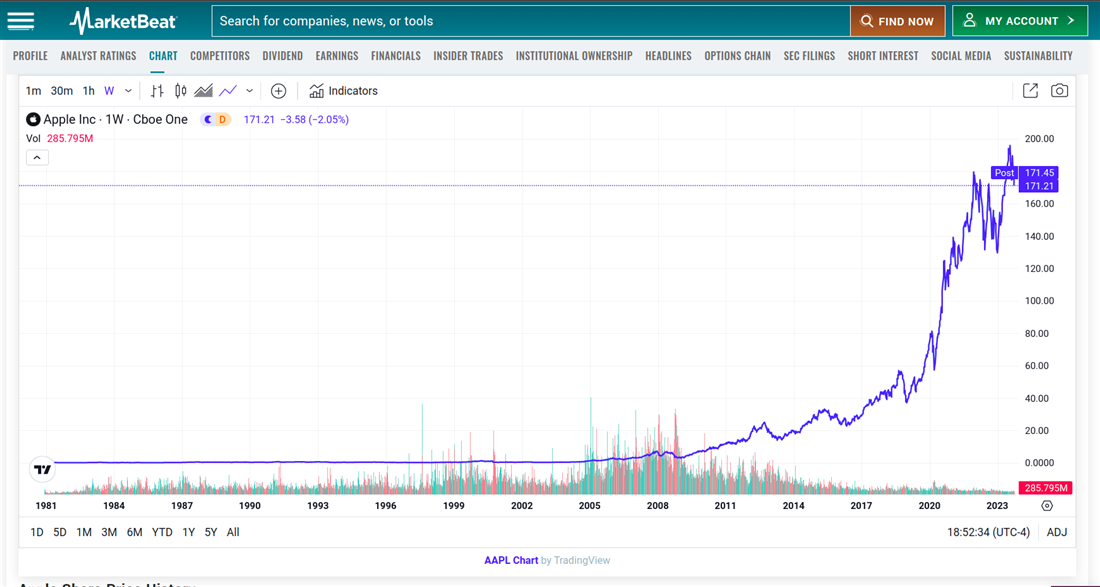

Case Study 3: Apple Inc.

- Company overview: Apple (NASDAQ: AAPL) is a technology company renowned for designing, developing and selling consumer electronics, software and online services.

- Investment thesis: Berkshire Hathaway began acquiring Apple stock in 2016, drawn to the company's robust brand, innovative products and dedicated customer base. Apple dominated the smartphone and tablet markets and enjoyed global consumer adoption.

- Performance: Apple emerged as one of Buffett's top-performing investments in recent years, with its stock price more than doubling since Berkshire Hathaway's initial purchases. Check out Apple’s stock chart to see what a win this investment was for Berkshire.

These case studies underscore Warren Buffett's investment strategy of purchasing and holding onto high-quality companies for the long term. Buffett emphasizes a deep understanding of a business, seeks a margin of safety in every investment, maintains a concentrated portfolio and remains resilient against the speculative and emotional aspects of the market. His investment philosophy has yielded remarkable success, with Berkshire Hathaway delivering average annual returns of over 20% since Buffett assumed control in 1965.

While even the most accomplished investors make occasional mistakes, Buffett's overall investment track record is highly impressive. Despite a few notable missteps, such as the Dexter Shoes and American Express investments during the 2008 financial crisis, Buffett consistently outperforms the market over extended periods.

Following his investment strategy requires patience, discipline and a willingness to endure market volatility. However, Buffett's approach offers a proven path to wealth creation for those who can commit to the long term and tolerate risk.

Lessons from Warren Buffett's Investment Success

Warren Buffett's unparalleled success as an investor is a testament to the enduring principles and lessons guiding his investment journey. Over decades of prolific investing, Buffett has imparted invaluable wisdom that continues to resonate with both seasoned professionals and aspiring investors.

From the importance of investing in businesses you understand to the value of patience and discipline, each lesson is a building block in Buffett's time-tested strategy. Beyond the fundamental principles, Buffet’s strategy has strong defensive characteristics, such as the significance of risk management, the power of stock repurchases and the notion that a systematic approach often outperforms individual brilliance. These lessons serve as a tribute to Warren Buffett's remarkable achievements and guide investors on their journey toward financial prosperity.

While Buffett's wisdom offers valuable guidance, it's crucial to remember that even the most accomplished investors make mistakes. Ultimately, these lessons provide a foundation for informed decision-making and emphasize the importance of continuous learning and adaptability in the ever-evolving landscape of finance.

How to Invest Like Warren Buffett

Investing like Warren Buffett is a goal shared by many seeking to navigate the complexities of the stock market and achieve long-term financial success. While replicating his extraordinary wealth may be ambitious, adopting his timeless investment principles can undoubtedly guide your path to becoming a more astute and prosperous investor. Here's a comprehensive overview of how to invest like the legendary "Oracle of Omaha."

Understand the Business

Warren Buffett's investment philosophy begins with a deep understanding of the companies he invests in. To follow in his footsteps, dedicate yourself to comprehending the businesses you consider for your portfolio. This involves thorough research, including reading annual reports, attending shareholder meetings and gaining insights into the company's operations and industry dynamics. Informed decisions are the cornerstone of Buffett-style investing.

Seek Competitive Advantages

One of Buffett's key tenets is investing in companies boasting sustainable competitive advantages, often called economic moats. These advantages give a company a lasting edge over its rivals. Economic moats can take various forms, such as a strong brand, network effects, or cost leadership. Identify and invest in companies with these inherent strengths when building your portfolio.

Embrace Value Investing

Warren Buffett is synonymous with value investing, which centers on purchasing stocks below their intrinsic values. To emulate this strategy:

- Conduct rigorous financial analysis to estimate a stock's intrinsic value.

- Compare the stock's current market price to your calculated intrinsic value.

- Invest when the market price is significantly lower, creating a safety buffer against potential downturns.

Adopt a Long-Term Perspective

Buffett's unwavering patience and long-term perspective are renowned. He advocates holding investments for extended periods, often for a lifetime. To align with this approach:

- Avoid frequent buying and selling, which can incur high transaction costs and taxes.

- Be prepared to weather market fluctuations and believe in the long-term potential of your investments.

- Embrace compounding as a means of wealth generation over time.

Be a Contrarian When Warranted

Warren Buffett is unafraid to go against the market's prevailing sentiment. He often finds value in companies overlooked or undervalued by others. As an investor, consider opportunities in companies temporarily out of favor with the market, provided they possess strong fundamentals and growth potential.

Steer Clear of Market Timing

Buffett advises against attempting to time the market, a challenging pursuit. Instead, concentrate on acquiring exceptional companies at reasonable prices and holding them for the long haul.

Diversify Thoughtfully

While Buffett maintains a relatively concentrated portfolio, he recognizes the importance of diversification for risk management. Diversify your investments across various industries and asset classes, but avoid over-diversification that might dilute your ability to make informed decisions.

Never Stop Learning

Buffett is a voracious reader who champions continuous learning. Expand your knowledge by reading extensively about different industries, businesses and investment strategies. This ongoing education can enhance your capacity to identify opportunities and make well-informed investment choices.

Invest with an Owner's Mindset

One of Buffett's most valuable lessons is approaching investments as if purchasing the entire business. This mindset promotes thorough due diligence and a focus on long-term value creation.

Investing like Warren Buffett involves:

- Embracing his principles of understanding businesses.

- Seeking competitive advantages.

- Practicing value investing.

- Adopting a long-term perspective.

- Being a contrarian when necessary.

- Avoiding market timing.

- Diversifying thoughtfully.

- Continuously learning and investing with an owner's mindset.

Although achieving Buffett's success may take time, these principles serve as a valuable compass on your journey toward becoming a more proficient and prosperous investor.

Tips for Tracking Warren Buffett's Stock Moves

Keeping tabs on Warren Buffett's stock moves is a goal shared by many investors who admire his successful investment strategies. Here are some valuable tips to help you stay informed about Buffett's investment decisions:

- Follow Berkshire Hathaway's SEC filings: Berkshire Hathaway must disclose its holdings quarterly in a 13F filing with the Securities and Exchange Commission (SEC). This filing provides a comprehensive list of all the stocks held by Berkshire Hathaway, along with the number of shares held. It's a fundamental resource for tracking Buffett's portfolio.

- Dive into Berkshire Hathaway's annual report: Berkshire Hathaway's annual report is a treasure trove of information for investors looking to understand Buffett's investments better. In addition to listing the company's holdings, the report includes Buffett's letter to shareholders. These letters often contain valuable insights into his investment philosophy and outlook.

- Subscribe to a financial news service: Numerous financial news services like MarketBeat track Warren Buffett's investments. Subscribing to such a service can provide real-time updates on Buffett's holdings and offer in-depth analyses of his investment strategy. Staying informed through these services can be a strategic advantage.

- Attend Berkshire Hathaway's annual shareholder meeting: The annual shareholder meeting of Berkshire Hathaway, often referred to as the "Woodstock for Capitalists," is a unique opportunity to hear Warren Buffett himself speak about his investment strategy and provide insights into his current holdings. Attending this event can be a valuable experience for any investor.

Tracking Warren Buffett's stock moves requires diligence and patience. Investments are typically disclosed quarterly, so you must stay consistent in your efforts. Research and invest in companies aligned with your financial goals and beliefs. Focus on identifying high-quality companies trading at reasonable prices and maintaining a long-term perspective.

While Buffett's approach is revered, it's not a guaranteed path to success. Combining knowledge of his strategies with your own research and financial objectives is the key to becoming a more astute and prosperous investor.

The Impact of Warren Buffett on the Stock Market

Warren Buffett is not just a renowned investor but a figure whose actions and words substantially influence finance and the stock market. Buffett's impact on the stock market can be observed from several angles, ranging from his investment decisions to his broader contributions to investment philosophy and market behavior.

Investment Decisions as Market Signals

One of the most immediate and tangible ways Warren Buffett influences the stock market is through his investment decisions. When Berkshire Hathaway, under Buffett's guidance, buys or sells shares in a company, it often sends a strong signal to other investors. The "Buffett effect" is a phenomenon where a company's stock price can experience significant fluctuations following news of Berkshire Hathaway's investment. Investors often view Buffett's choices as indicators of a company's fundamental strength and prospects.

Long-Term Investing

Warren Buffett's investment philosophy centers on long-term value and patience. He frequently emphasizes the importance of holding investments for extended periods, sometimes decades, to benefit from the power of compounding. This perspective has had a subtle yet profound influence on investors' behavior. By advocating for a patient, buy-and-hold approach, Buffett encourages investors to resist the temptation of short-term trading and market timing, promoting more stable and rational markets.

Shaping Investment Philosophy

Buffett's writings and annual letters to Berkshire Hathaway shareholders have become revered sources of wisdom for investors worldwide. His emphasis on understanding the businesses in which one invests, seeking companies with competitive advantages and demanding a margin of safety when purchasing stocks has profoundly shaped the modern investment philosophy. Many novice and seasoned investors turn to Buffett's principles as guiding lights in navigating the complex and ever-changing landscape of the stock market.

The Berkshire Hathaway Annual Meeting

The annual shareholder meeting of Berkshire Hathaway, often dubbed the "Woodstock for Capitalists," is a testament to Warren Buffett's influence. Thousands of investors and enthusiasts flock to this event to hear Buffett and his business partner, Charlie Munger, share their insights and wisdom.

The meeting has evolved into a forum where financial professionals, academics and individuals discuss investment strategies and market trends, reflecting Buffett's ability to bring together a diverse community of stakeholders.

Philanthropic Initiatives

Warren Buffett's commitment to philanthropy, as demonstrated through his partnership with the Bill and Melinda Gates Foundation and the "Giving Pledge" he initiated, has also indirectly impacted the stock market. By directing substantial portions of his wealth toward charitable causes, Buffett sets an example of responsible wealth management and encourages other affluent individuals to consider their investments' social and ethical dimensions.

The impact of Warren Buffett on the stock market extends beyond his investment decisions. His actions, principles and teachings influence market behavior, investor sentiment and the broader investment philosophy. The Oracle of Omaha's enduring legacy continues to shape the world of finance and inspire individuals to approach the stock market with a focus on long-term value and prudent decision-making.

Buffett's Stock Market Symphony: The Oracle's Final Note

In the world of finance, Warren Buffett is a legendary figure, often referred to as the Oracle of Omaha. His journey from a young investor to one of the world's wealthiest individuals is a testament to timeless investment principles.

Now that we have explored Buffett's investment philosophy, his renowned portfolio and the lessons we can learn from his success. The key takeaway is that investing, as Buffett exemplifies, should be rooted in a deep understanding of businesses, patience and a focus on long-term value.

Warren Buffett's impact on the stock market extends far beyond his portfolio. His insights move markets, and his commitment to ethical investing sets a standard for all.