We all love high yields—but every now and then we run across one here at Contrarian Outlook that’s so high it’s a blaring warning sign.

Case in point: the 60.4% yield (no, I didn’t misplace a decimal there!) on a tech-focused fund called the YieldMax TSLA Option Income Strategy ETF (TSLY).

That’s right: buy this one and, going by the headline yield, you could recover your upfront investment in less than two years through dividend payouts!

But, well, not so fast: because in this case (as in pretty well all cases when dividend yields strain the bounds of reality), some income-hungry investors are being drawn to a high yield that not only can’t last, but masks poor long-term performance, too.

In fact, despite that outsized yield, another tech fund we’ll cover in a bit—a closed-end fund (CEF)—clobbers TSLY while offering a dividend that’s only about one-tenth the size.

Before I continue, let me be clear that I’m not criticizing Tesla (TSLA) here. Despite the name, this fund has little to do with Tesla. As YieldMax admits, “The Fund does not invest directly in TSLA.” Instead, it invests in a variety of call and put options on Tesla shares that aim to generate a profit from the volatility of Tesla stock.

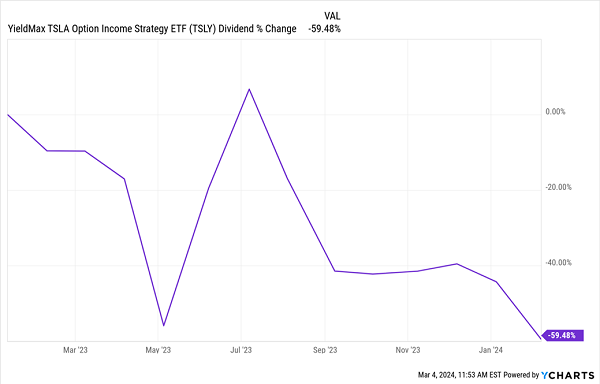

These options fund the dividend, but the problem is that this is a very unsustainable way to fund a payout, as history shows:

TSLY’s YieldMax Goes “YieldMin”

This kind of dividend cut is not normal, but it does demonstrate the power of high yields to attract investors, despite a non-existent dividend-growth record. And TSLY has attracted investors, to the tune of $778 million in net assets.

Now, for comparison’s sake, let’s roll in that CEF I mentioned a second ago, the Columbia Seligman Premium Technology Growth Fund (STK), a 5.5%-yielder that, as the name suggests, sports a portfolio that mainly consists of large-cap tech names. Its top-10 holdings lean toward semiconductor firms like Lam Research (LRCX), Broadcom (AVGO) and Teradyne (TER).

Like TSLY, STK sells options to help fund its dividend, but it simply sells call options. These give the buyer of the option the right to buy the fund’s stocks at a fixed date and price in the future—STK keeps the premium it charges for this right no matter how these trades play out.

That helps fund the dividend with little risk to the fund (save for its top performers being sold, or “called away.”) And of course, STK actually holds the stocks on which it sells options—and is far more diversified than TSLY, with its sole reliance on Tesla.

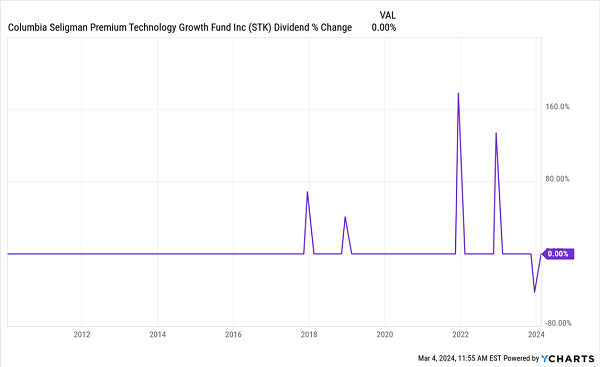

The result has been a payout that has held firm for over a decade, with a few big special payouts issued here and there, as well (that dip on the right side of the chart is not a cut—just a special dividend that came in below the value of the regular payout).

STK’s Stable Income

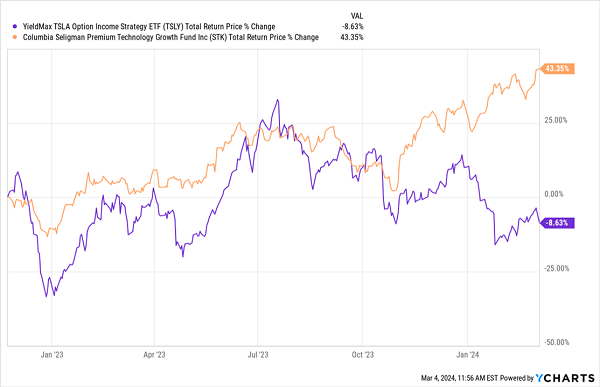

Clearly, STK is more preferable for income investors, even with its smaller headline yield. But it’s also more preferable for investors of all stripes who don’t like to lose money, as we can see when we compare the total returns of these two funds since TSLY’s IPO a little over a year ago:

TSLY Books Losses in a Banner Year for Tech

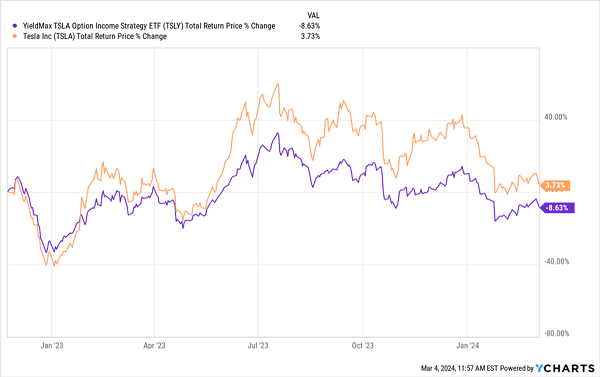

As you can see, TSLY has lost investor money since its IPO a bit over a year ago (even with that massive dividend), while STK is up over 40%. And while shares of Tesla have also underperformed STK in that time period, they’ve run ahead of TSLY, showing that despite the dividend, you’d have been better off simply owning the stock itself!

TSLA Beats TSLY

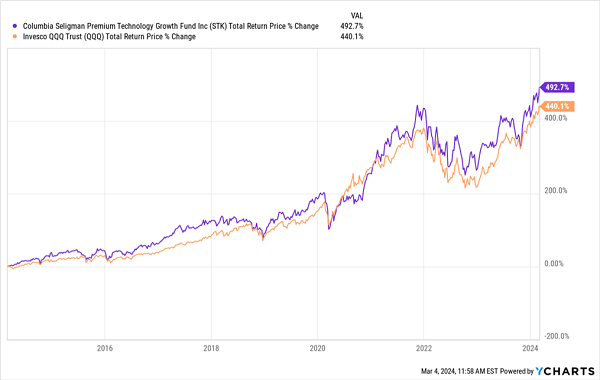

There’s more reason to prefer STK over TSLY, too, beyond the more sustainable payouts and the outperformance. STK has also beaten the NASDAQ—shown below by the performance of the benchmark Invesco QQQ Trust (QQQ)—over the last decade, which I chalk up to management’s ability to identify better performers and ignore the laggards.

STK Beats the Index

I think this means STK is long overdue for a dividend hike, especially since the fund yielded more like 8.6% back when I was first bullish on it back in 2017. It’s been on a tremendous run since then.

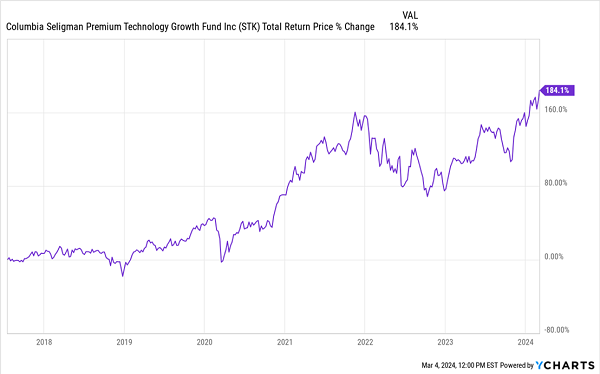

STK Shows Its Chops as a Prime Long-Term Holding

This means that investors who bought around then have kept their 8.6% yield and are sitting on capital gains that they can cash in whenever they want. So far, at least, TSLY has provided the exact opposite: capital losses.

Will TSLY turn around? Anything’s possible, but there’s no indication of such a shift, since the market isn’t meeting the fund’s need for more TSLA volatility.

Lower Volatility = Bigger TSLY Losses

While the stock’s volatility has ticked up in recent weeks, largely on concerns that other electric-car companies are moving in on its turf. If the stock steadily falls and TSLY fails to capture that movement, investors won’t see their dividends go up.

None of this should surprise anyone. A 60% yield is not sustainable, no matter what kind of stock or fund you’re talking about.

Admittedly, that doesn’t mean a 5.5% yield with STK—while solid and likely to grow—is the best game in town, either. For one, the fund trades at a 9% premium to net asset value, or NAV, as I write this. That a rich valuation reflects investor enthusiasm about tech stocks right now (part of the reason why TSLY has attracted the inflows it has, as well).

But even with that premium, STK is a solid bet to keep outperforming unsustainable high-yielders like TSLY. And your yield on cost will rise if the fund raises payouts, as I expect it will.

4 Higher-Paying (and Cheaper!) Funds Than STK—With an “AI Powered” Boost

Of course, we don’t just want to beat dumpster fires like TSLY—we want to run laps around them, with smartly run tech funds that are deeply discounted now.

We also want to make sure we have exposure to the fast-growing AI trend, too. Because that shift is only now starting to supercharge the US economy.

Take it from Microsoft CEO Satya Nadella, who captured the essence of this moment perfectly in a recent earnings call:

“We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.”

In other words, AI is no longer an internet party trick—it’s generating real profits for market leaders like Microsoft.

STK is a decent way to play this shift, but its focus on semiconductor firms mean it isn’t the best way. We want a more direct route, with funds that hold both AI stalwarts, like Microsoft, and lesser-known AI firms that will lead as this technology enters its next evolution.

To that end, I’ve assembled my top 4 AI funds into a special “mini-portfolio” designed to help you take full advantage of—and reap the biggest dividends from—this economy-changing megatrend.

These 4 funds yield 7.8% between them and trade at such deep discounts they essentially “rewind the clock,” letting us buy top AI stocks at prices unseen in months.

No way these discounts will last as income-hungry investors discover this back-door way to tap AI for big payouts (and upside). Click here and I’ll tell you all the secrets of these unique AI-Powered dividends and give you the opportunity to download a FREE Special Report naming each one.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report