TimesSquare Capital Management LLC raised its holdings in Interactive Brokers Group, Inc. (NASDAQ:IBKR - Free Report) by 6.6% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 808,806 shares of the financial services provider's stock after purchasing an additional 50,035 shares during the quarter. TimesSquare Capital Management LLC owned 0.19% of Interactive Brokers Group worth $67,050,000 as of its most recent SEC filing.

TimesSquare Capital Management LLC raised its holdings in Interactive Brokers Group, Inc. (NASDAQ:IBKR - Free Report) by 6.6% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 808,806 shares of the financial services provider's stock after purchasing an additional 50,035 shares during the quarter. TimesSquare Capital Management LLC owned 0.19% of Interactive Brokers Group worth $67,050,000 as of its most recent SEC filing.

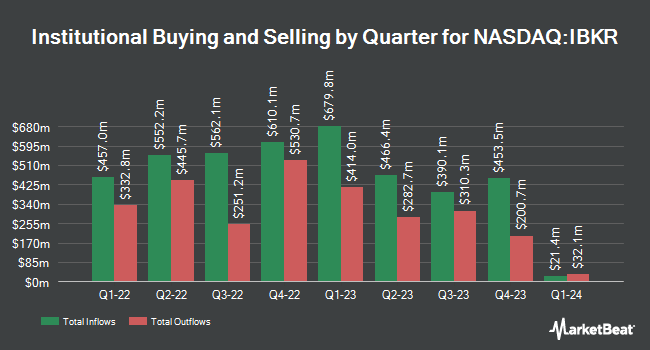

Other hedge funds and other institutional investors have also recently modified their holdings of the company. AIA Group Ltd acquired a new stake in shares of Interactive Brokers Group in the fourth quarter valued at $1,840,000. International Assets Investment Management LLC acquired a new stake in shares of Interactive Brokers Group during the fourth quarter worth about $7,841,000. Darwin Wealth Management LLC purchased a new position in shares of Interactive Brokers Group in the third quarter valued at approximately $1,775,000. Lecap Asset Management Ltd. acquired a new position in shares of Interactive Brokers Group in the fourth quarter valued at approximately $1,910,000. Finally, Teachers Retirement System of The State of Kentucky increased its stake in Interactive Brokers Group by 93.5% during the 3rd quarter. Teachers Retirement System of The State of Kentucky now owns 35,170 shares of the financial services provider's stock worth $3,044,000 after buying an additional 16,996 shares during the period. 23.80% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of research firms have recently weighed in on IBKR. Piper Sandler upped their price objective on Interactive Brokers Group from $105.00 to $125.00 and gave the stock an "overweight" rating in a research report on Friday, April 12th. Jefferies Financial Group increased their price target on Interactive Brokers Group from $133.00 to $138.00 and gave the company a "buy" rating in a research report on Wednesday, April 17th. Bank of America boosted their price objective on Interactive Brokers Group from $147.00 to $152.00 and gave the stock a "buy" rating in a research report on Wednesday, April 17th. Citigroup raised their target price on shares of Interactive Brokers Group from $105.00 to $135.00 and gave the company a "buy" rating in a report on Thursday, April 11th. Finally, Barclays boosted their price target on shares of Interactive Brokers Group from $132.00 to $136.00 and gave the stock an "overweight" rating in a report on Wednesday, April 17th. One equities research analyst has rated the stock with a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $124.00.

View Our Latest Analysis on IBKR

Insider Buying and Selling at Interactive Brokers Group

In related news, Vice Chairman Earl H. Nemser sold 50,000 shares of the stock in a transaction on Tuesday, February 13th. The stock was sold at an average price of $101.07, for a total transaction of $5,053,500.00. Following the completion of the sale, the insider now directly owns 158,770 shares of the company's stock, valued at $16,046,883.90. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other news, Vice Chairman Earl H. Nemser sold 5,000 shares of the firm's stock in a transaction that occurred on Wednesday, February 21st. The stock was sold at an average price of $104.86, for a total value of $524,300.00. Following the completion of the sale, the insider now directly owns 113,770 shares of the company's stock, valued at approximately $11,929,922.20. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Vice Chairman Earl H. Nemser sold 50,000 shares of the company's stock in a transaction on Tuesday, February 13th. The stock was sold at an average price of $101.07, for a total value of $5,053,500.00. Following the transaction, the insider now directly owns 158,770 shares in the company, valued at approximately $16,046,883.90. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 65,000 shares of company stock worth $6,613,100. 3.21% of the stock is currently owned by insiders.

Interactive Brokers Group Price Performance

Shares of IBKR stock traded down $0.59 during trading hours on Thursday, hitting $119.13. The stock had a trading volume of 840,262 shares, compared to its average volume of 1,152,529. The stock's 50 day moving average is $112.13 and its 200 day moving average is $95.78. The firm has a market capitalization of $50.16 billion, a PE ratio of 20.46, a PEG ratio of 1.22 and a beta of 0.81. Interactive Brokers Group, Inc. has a twelve month low of $72.60 and a twelve month high of $122.88.

Interactive Brokers Group (NASDAQ:IBKR - Get Free Report) last issued its quarterly earnings data on Tuesday, April 16th. The financial services provider reported $1.64 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.63 by $0.01. Interactive Brokers Group had a net margin of 7.62% and a return on equity of 4.72%. The company had revenue of $1.20 billion for the quarter, compared to the consensus estimate of $1.19 billion. As a group, equities analysts predict that Interactive Brokers Group, Inc. will post 6.46 earnings per share for the current year.

Interactive Brokers Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 14th. Shareholders of record on Friday, May 31st will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 0.84%. This is a boost from Interactive Brokers Group's previous quarterly dividend of $0.10. The ex-dividend date is Friday, May 31st. Interactive Brokers Group's dividend payout ratio (DPR) is presently 17.09%.

About Interactive Brokers Group

(

Free Report)

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Interactive Brokers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interactive Brokers Group wasn't on the list.

While Interactive Brokers Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report