Howard Capital Management Inc. bought a new stake in PACCAR Inc (NASDAQ:PCAR - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 21,843 shares of the company's stock, valued at approximately $2,192,000. PACCAR makes up about 0.3% of Howard Capital Management Inc.'s investment portfolio, making the stock its 27th biggest holding.

Howard Capital Management Inc. bought a new stake in PACCAR Inc (NASDAQ:PCAR - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 21,843 shares of the company's stock, valued at approximately $2,192,000. PACCAR makes up about 0.3% of Howard Capital Management Inc.'s investment portfolio, making the stock its 27th biggest holding.

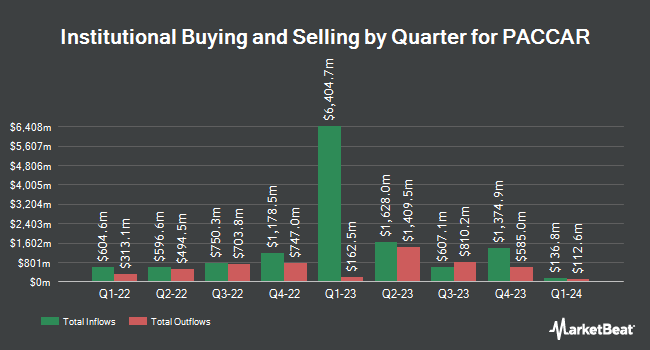

Other institutional investors and hedge funds have also recently modified their holdings of the company. State Street Corp boosted its stake in PACCAR by 49.0% during the first quarter. State Street Corp now owns 21,345,321 shares of the company's stock worth $1,562,477,000 after buying an additional 7,020,923 shares during the period. Geode Capital Management LLC boosted its stake in PACCAR by 53.3% during the first quarter. Geode Capital Management LLC now owns 11,742,555 shares of the company's stock worth $858,948,000 after buying an additional 4,082,677 shares during the period. Norges Bank purchased a new position in PACCAR during the fourth quarter worth $323,885,000. Wellington Management Group LLP boosted its stake in PACCAR by 249.2% during the first quarter. Wellington Management Group LLP now owns 3,845,387 shares of the company's stock worth $338,663,000 after buying an additional 2,744,040 shares during the period. Finally, Mercer Global Advisors Inc. ADV boosted its stake in PACCAR by 2,578.2% during the first quarter. Mercer Global Advisors Inc. ADV now owns 2,292,972 shares of the company's stock worth $167,846,000 after buying an additional 2,207,357 shares during the period. 64.90% of the stock is owned by hedge funds and other institutional investors.

PACCAR Stock Down 0.6 %

PACCAR stock traded down $0.72 during trading hours on Friday, reaching $118.16. The stock had a trading volume of 1,976,024 shares, compared to its average volume of 2,238,831. The company has a market cap of $61.92 billion, a price-to-earnings ratio of 13.47, a PEG ratio of 1.79 and a beta of 0.92. The company has a debt-to-equity ratio of 0.54, a current ratio of 2.40 and a quick ratio of 2.21. The business's 50 day moving average price is $114.94 and its 200-day moving average price is $100.01. PACCAR Inc has a 52 week low of $68.40 and a 52 week high of $125.50.

PACCAR (NASDAQ:PCAR - Get Free Report) last announced its earnings results on Tuesday, January 23rd. The company reported $2.70 EPS for the quarter, topping analysts' consensus estimates of $2.25 by $0.45. The business had revenue of $8.59 billion during the quarter, compared to the consensus estimate of $8.48 billion. PACCAR had a net margin of 13.10% and a return on equity of 33.17%. The firm's revenue was up 11.1% on a year-over-year basis. During the same period in the previous year, the company posted $1.76 earnings per share. Sell-side analysts anticipate that PACCAR Inc will post 8.16 EPS for the current year.

PACCAR Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, March 6th. Stockholders of record on Thursday, February 15th were issued a dividend of $0.27 per share. The ex-dividend date was Wednesday, February 14th. This represents a $1.08 annualized dividend and a dividend yield of 0.91%. PACCAR's dividend payout ratio (DPR) is currently 12.31%.

Insider Activity

In other news, VP Todd R. Hubbard sold 4,829 shares of the company's stock in a transaction dated Thursday, February 1st. The shares were sold at an average price of $102.12, for a total transaction of $493,137.48. Following the transaction, the vice president now owns 5,726 shares in the company, valued at $584,739.12. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. In related news, VP Todd R. Hubbard sold 4,829 shares of the company's stock in a transaction that occurred on Thursday, February 1st. The stock was sold at an average price of $102.12, for a total value of $493,137.48. Following the sale, the vice president now owns 5,726 shares in the company, valued at $584,739.12. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, CFO Harrie Schippers sold 5,000 shares of the company's stock in a transaction that occurred on Friday, January 26th. The shares were sold at an average price of $102.27, for a total value of $511,350.00. Following the completion of the sale, the chief financial officer now owns 103,547 shares in the company, valued at approximately $10,589,751.69. The disclosure for this sale can be found here. Insiders have sold a total of 153,496 shares of company stock worth $15,834,812 over the last 90 days. 2.02% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Several research firms have commented on PCAR. Morgan Stanley began coverage on shares of PACCAR in a research note on Monday, January 8th. They set an "overweight" rating and a $125.00 price objective for the company. UBS Group raised shares of PACCAR from a "neutral" rating to a "buy" rating and boosted their target price for the company from $104.00 to $136.00 in a research note on Friday, March 15th. Truist Financial assumed coverage on shares of PACCAR in a research note on Thursday, March 14th. They set a "hold" rating and a $117.00 target price for the company. The Goldman Sachs Group boosted their target price on shares of PACCAR from $93.00 to $106.00 and gave the company a "neutral" rating in a research note on Wednesday, January 24th. Finally, JPMorgan Chase & Co. boosted their target price on shares of PACCAR from $116.00 to $135.00 and gave the company an "overweight" rating in a research note on Tuesday, March 5th. Eight research analysts have rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $109.39.

Check Out Our Latest Analysis on PACCAR

PACCAR Company Profile

(

Free Report)

PACCAR Inc designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally. It operates through three segments: Truck, Parts, and Financial Services. The Truck segment designs, manufactures, and distributes trucks for the over-the-road and off-highway hauling of commercial and consumer goods.

Read More

Before you consider PACCAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PACCAR wasn't on the list.

While PACCAR currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report