Great Valley Advisor Group Inc. reduced its holdings in Vanguard Russell 1000 Growth ETF (NASDAQ:VONG - Free Report) by 12.7% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 150,881 shares of the company's stock after selling 21,910 shares during the period. Great Valley Advisor Group Inc. owned approximately 0.07% of Vanguard Russell 1000 Growth ETF worth $11,772,000 as of its most recent filing with the Securities & Exchange Commission.

Great Valley Advisor Group Inc. reduced its holdings in Vanguard Russell 1000 Growth ETF (NASDAQ:VONG - Free Report) by 12.7% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 150,881 shares of the company's stock after selling 21,910 shares during the period. Great Valley Advisor Group Inc. owned approximately 0.07% of Vanguard Russell 1000 Growth ETF worth $11,772,000 as of its most recent filing with the Securities & Exchange Commission.

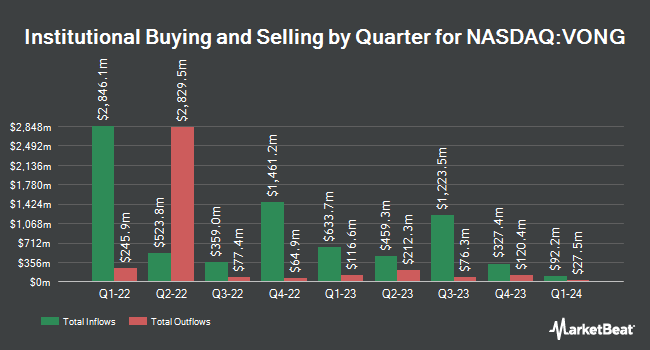

A number of other institutional investors and hedge funds have also made changes to their positions in VONG. Hexagon Capital Partners LLC purchased a new position in shares of Vanguard Russell 1000 Growth ETF during the 3rd quarter worth about $79,000. Mission Wealth Management LP boosted its stake in shares of Vanguard Russell 1000 Growth ETF by 6.3% during the 3rd quarter. Mission Wealth Management LP now owns 5,838 shares of the company's stock worth $400,000 after purchasing an additional 345 shares during the period. Raymond James & Associates boosted its stake in shares of Vanguard Russell 1000 Growth ETF by 8.4% during the 3rd quarter. Raymond James & Associates now owns 570,009 shares of the company's stock worth $39,011,000 after purchasing an additional 44,291 shares during the period. Raymond James Financial Services Advisors Inc. boosted its stake in shares of Vanguard Russell 1000 Growth ETF by 1.8% during the 3rd quarter. Raymond James Financial Services Advisors Inc. now owns 1,449,568 shares of the company's stock worth $99,208,000 after purchasing an additional 25,268 shares during the period. Finally, Grey Fox Wealth Advisors LLC purchased a new position in shares of Vanguard Russell 1000 Growth ETF during the 3rd quarter worth about $439,000.

Vanguard Russell 1000 Growth ETF Trading Down 0.4 %

Shares of VONG stock traded down $0.33 during trading hours on Wednesday, reaching $82.71. 669,785 shares of the stock were exchanged, compared to its average volume of 861,875. Vanguard Russell 1000 Growth ETF has a 12-month low of $62.10 and a 12-month high of $87.75. The company's 50-day moving average price is $85.23 and its 200-day moving average price is $79.50. The firm has a market capitalization of $18.38 billion, a price-to-earnings ratio of 36.74 and a beta of 1.08.

Vanguard Russell 1000 Growth ETF Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, March 26th. Shareholders of record on Friday, March 22nd were given a $0.155 dividend. The ex-dividend date was Thursday, March 21st. This represents a $0.62 annualized dividend and a yield of 0.75%.

Vanguard Russell 1000 Growth ETF Company Profile

(

Free Report)

The Vanguard Russell 1000 Growth ETF (VONG) is an exchange-traded fund that is based on the Russell 1000 Growth index. The fund tracks an index of US large- and mid-cap stocks selected from the Russell 1000 Index with high growth characteristics, based on Russell's style methodology. VONG was launched on Sep 20, 2010 and is managed by Vanguard.

Recommended Stories

Want to see what other hedge funds are holding VONG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Vanguard Russell 1000 Growth ETF (NASDAQ:VONG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vanguard Russell 1000 Growth ETF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vanguard Russell 1000 Growth ETF wasn't on the list.

While Vanguard Russell 1000 Growth ETF currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report