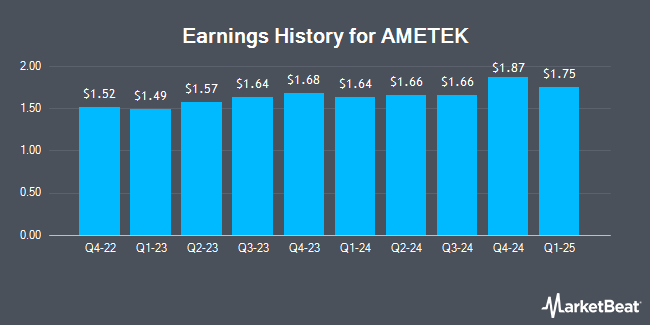

AMETEK (NYSE:AME - Get Free Report) released its earnings results on Thursday. The technology company reported $1.64 EPS for the quarter, beating the consensus estimate of $1.59 by $0.05, Briefing.com reports. AMETEK had a return on equity of 17.96% and a net margin of 19.91%. The company had revenue of $1.74 billion during the quarter, compared to analysts' expectations of $1.78 billion. During the same period in the prior year, the business posted $1.49 EPS. The business's revenue was up 9.0% on a year-over-year basis. AMETEK updated its Q2 guidance to $1.63-$1.65 EPS and its FY24 guidance to $6.74-$6.86 EPS.

AMETEK (NYSE:AME - Get Free Report) released its earnings results on Thursday. The technology company reported $1.64 EPS for the quarter, beating the consensus estimate of $1.59 by $0.05, Briefing.com reports. AMETEK had a return on equity of 17.96% and a net margin of 19.91%. The company had revenue of $1.74 billion during the quarter, compared to analysts' expectations of $1.78 billion. During the same period in the prior year, the business posted $1.49 EPS. The business's revenue was up 9.0% on a year-over-year basis. AMETEK updated its Q2 guidance to $1.63-$1.65 EPS and its FY24 guidance to $6.74-$6.86 EPS.

AMETEK Stock Performance

Shares of NYSE AME traded up $3.15 during midday trading on Friday, reaching $166.49. 2,065,096 shares of the company traded hands, compared to its average volume of 972,476. The company has a market cap of $38.49 billion, a price-to-earnings ratio of 29.36, a PEG ratio of 2.78 and a beta of 1.21. The stock has a 50-day moving average price of $179.88 and a 200 day moving average price of $165.94. AMETEK has a 52 week low of $136.89 and a 52 week high of $186.32. The company has a debt-to-equity ratio of 0.22, a current ratio of 0.98 and a quick ratio of 0.59.

AMETEK Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, March 28th. Shareholders of record on Friday, March 8th were given a dividend of $0.28 per share. This represents a $1.12 dividend on an annualized basis and a yield of 0.67%. The ex-dividend date of this dividend was Thursday, March 7th. This is a positive change from AMETEK's previous quarterly dividend of $0.25. AMETEK's payout ratio is 19.75%.

Insider Activity at AMETEK

In related news, CFO William Joseph Burke sold 17,437 shares of the business's stock in a transaction that occurred on Wednesday, February 14th. The stock was sold at an average price of $168.51, for a total transaction of $2,938,308.87. Following the sale, the chief financial officer now owns 101,709 shares of the company's stock, valued at $17,138,983.59. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other news, CFO William Joseph Burke sold 17,437 shares of AMETEK stock in a transaction that occurred on Wednesday, February 14th. The shares were sold at an average price of $168.51, for a total value of $2,938,308.87. Following the transaction, the chief financial officer now owns 101,709 shares of the company's stock, valued at approximately $17,138,983.59. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Thomas A. Amato sold 780 shares of the stock in a transaction that occurred on Tuesday, March 26th. The shares were sold at an average price of $182.00, for a total transaction of $141,960.00. Following the sale, the director now directly owns 10,240 shares of the company's stock, valued at $1,863,680. The disclosure for this sale can be found here. Insiders sold 59,881 shares of company stock worth $10,689,758 in the last 90 days. Corporate insiders own 0.61% of the company's stock.

Analyst Ratings Changes

A number of research analysts have commented on the company. Royal Bank of Canada reduced their target price on AMETEK from $192.00 to $188.00 and set an "outperform" rating on the stock in a report on Wednesday, February 7th. Truist Financial assumed coverage on shares of AMETEK in a report on Thursday, March 14th. They set a "buy" rating and a $210.00 target price on the stock. KeyCorp lifted their price target on shares of AMETEK from $182.00 to $205.00 and gave the company an "overweight" rating in a report on Tuesday, February 27th. Finally, StockNews.com lowered shares of AMETEK from a "buy" rating to a "hold" rating in a research note on Saturday, March 2nd. Three analysts have rated the stock with a hold rating and seven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $180.78.

Check Out Our Latest Report on AMETEK

About AMETEK

(

Get Free Report)

AMETEK, Inc manufactures and sells electronic instruments and electromechanical devices in the North America, Europe, Asia, and South America, and internationally. The company's EIG segment offers advanced instruments for the process, aerospace, power, and industrial markets; process and analytical instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries; instruments to the laboratory equipment, ultra-precision manufacturing, medical, and test and measurement markets; power quality monitoring and c devices, uninterruptible power supplies, programmable power and electromagnetic compatibility test equipment, and sensors for gas turbines and dashboard instruments; heavy trucks, instrumentation, and controls for the food and beverage industries; and aircraft and engine sensors, power supplies, embedded computing, monitoring, fuel and fluid measurement, and data acquisition systems for aerospace and defense industry.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AMETEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMETEK wasn't on the list.

While AMETEK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report