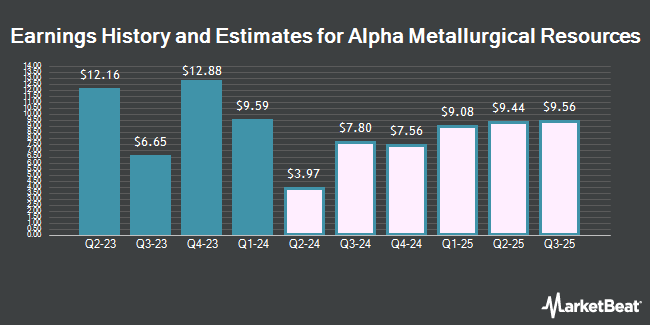

Alpha Metallurgical Resources, Inc. (NYSE:AMR - Free Report) - Stock analysts at B. Riley lowered their FY2024 earnings per share (EPS) estimates for Alpha Metallurgical Resources in a research note issued to investors on Tuesday, May 7th. B. Riley analyst L. Pipes now anticipates that the energy company will post earnings per share of $28.91 for the year, down from their previous estimate of $29.82. B. Riley currently has a "Buy" rating and a $375.00 target price on the stock. The consensus estimate for Alpha Metallurgical Resources' current full-year earnings is $29.82 per share. B. Riley also issued estimates for Alpha Metallurgical Resources' FY2025 earnings at $37.51 EPS and FY2026 earnings at $39.73 EPS.

Separately, Benchmark reissued a "hold" rating on shares of Alpha Metallurgical Resources in a report on Tuesday.

Check Out Our Latest Analysis on Alpha Metallurgical Resources

Alpha Metallurgical Resources Price Performance

Shares of NYSE AMR traded down $4.08 during mid-day trading on Wednesday, hitting $300.49. The company had a trading volume of 237,878 shares, compared to its average volume of 240,771. The company has a market capitalization of $3.91 billion, a PE ratio of 6.17 and a beta of 1.38. Alpha Metallurgical Resources has a 1-year low of $132.72 and a 1-year high of $452.00. The business's 50-day simple moving average is $330.80 and its 200 day simple moving average is $325.23.

Alpha Metallurgical Resources (NYSE:AMR - Get Free Report) last announced its quarterly earnings data on Monday, May 6th. The energy company reported $9.59 earnings per share (EPS) for the quarter, missing the consensus estimate of $9.61 by ($0.02). The company had revenue of $864.07 million during the quarter, compared to analyst estimates of $845.35 million. Alpha Metallurgical Resources had a net margin of 20.80% and a return on equity of 46.22%. The firm's revenue was down 5.2% on a year-over-year basis. During the same quarter in the previous year, the business posted $17.01 earnings per share.

Insider Activity at Alpha Metallurgical Resources

In related news, Director David J. Stetson sold 30,694 shares of the stock in a transaction on Wednesday, February 28th. The stock was sold at an average price of $392.30, for a total value of $12,041,256.20. Following the transaction, the director now owns 26,054 shares of the company's stock, valued at $10,220,984.20. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In other Alpha Metallurgical Resources news, Director Kenneth S. Courtis sold 22,802 shares of the firm's stock in a transaction dated Thursday, March 14th. The stock was sold at an average price of $302.81, for a total transaction of $6,904,673.62. Following the transaction, the director now owns 638,234 shares of the company's stock, valued at $193,263,637.54. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director David J. Stetson sold 30,694 shares of the firm's stock in a transaction dated Wednesday, February 28th. The stock was sold at an average price of $392.30, for a total value of $12,041,256.20. Following the transaction, the director now directly owns 26,054 shares in the company, valued at approximately $10,220,984.20. The disclosure for this sale can be found here. Insiders have sold 153,971 shares of company stock valued at $55,479,986 over the last quarter. 16.40% of the stock is owned by insiders.

Hedge Funds Weigh In On Alpha Metallurgical Resources

Hedge funds and other institutional investors have recently made changes to their positions in the stock. GAMMA Investing LLC purchased a new position in shares of Alpha Metallurgical Resources during the fourth quarter worth about $33,000. Wetzel Investment Advisors Inc. acquired a new stake in Alpha Metallurgical Resources in the fourth quarter valued at about $34,000. Quadrant Capital Group LLC acquired a new stake in Alpha Metallurgical Resources in the fourth quarter valued at about $35,000. Creekmur Asset Management LLC acquired a new stake in Alpha Metallurgical Resources in the fourth quarter valued at about $36,000. Finally, PNC Financial Services Group Inc. lifted its position in Alpha Metallurgical Resources by 947.1% in the fourth quarter. PNC Financial Services Group Inc. now owns 178 shares of the energy company's stock valued at $60,000 after purchasing an additional 161 shares during the period. Hedge funds and other institutional investors own 84.29% of the company's stock.

About Alpha Metallurgical Resources

(

Get Free Report)

Alpha Metallurgical Resources, Inc, a mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia. The company offers metallurgical coal products. It operates twenty-two active mines and nine coal preparation and load-out facilities. The company was formerly known as Contura Energy, Inc and changed its name to Alpha Metallurgical Resources, Inc in February 2021.

Further Reading

Before you consider Alpha Metallurgical Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alpha Metallurgical Resources wasn't on the list.

While Alpha Metallurgical Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report