Calix (NYSE:CALX - Get Free Report) was downgraded by analysts at StockNews.com from a "hold" rating to a "sell" rating in a report issued on Wednesday.

Calix (NYSE:CALX - Get Free Report) was downgraded by analysts at StockNews.com from a "hold" rating to a "sell" rating in a report issued on Wednesday.

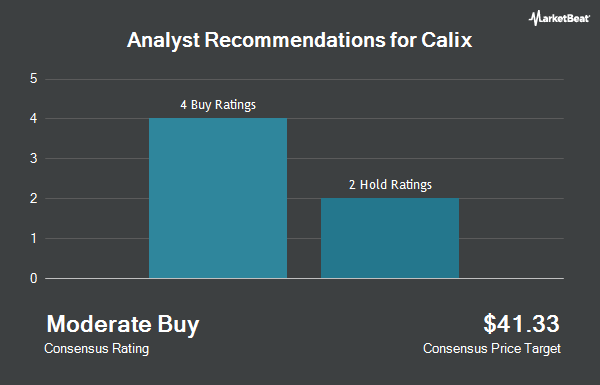

A number of other equities research analysts also recently issued reports on the stock. Rosenblatt Securities reduced their price objective on shares of Calix from $45.00 to $35.00 and set a "buy" rating on the stock in a research note on Tuesday. Roth Mkm reiterated a "buy" rating and set a $50.00 price objective on shares of Calix in a research note on Monday. Craig Hallum reduced their price objective on shares of Calix from $48.00 to $41.00 and set a "buy" rating on the stock in a research note on Wednesday. Finally, Needham & Company LLC reiterated a "buy" rating and set a $50.00 price objective on shares of Calix in a research note on Tuesday. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, Calix has a consensus rating of "Moderate Buy" and a consensus price target of $43.60.

Get Our Latest Analysis on Calix

Calix Stock Up 0.8 %

Shares of CALX traded up $0.22 during trading hours on Wednesday, hitting $28.25. The company had a trading volume of 1,189,297 shares, compared to its average volume of 1,010,304. The firm has a market cap of $1.85 billion, a price-to-earnings ratio of 91.13 and a beta of 1.65. The business has a fifty day moving average of $33.04 and a 200-day moving average of $37.45. Calix has a 12 month low of $26.76 and a 12 month high of $53.90.

Calix (NYSE:CALX - Get Free Report) last released its quarterly earnings results on Tuesday, January 30th. The communications equipment provider reported $0.43 EPS for the quarter, beating the consensus estimate of $0.36 by $0.07. Calix had a net margin of 2.19% and a return on equity of 6.65%. The business had revenue of $264.73 million for the quarter, compared to the consensus estimate of $264.41 million. During the same period in the prior year, the company posted $0.18 earnings per share. Calix's revenue was up 8.3% compared to the same quarter last year. On average, equities analysts expect that Calix will post 0.45 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently modified their holdings of the company. Assenagon Asset Management S.A. lifted its position in shares of Calix by 175.1% in the 1st quarter. Assenagon Asset Management S.A. now owns 607,001 shares of the communications equipment provider's stock worth $20,128,000 after purchasing an additional 386,318 shares during the period. Louisiana State Employees Retirement System lifted its position in shares of Calix by 75.8% during the 1st quarter. Louisiana State Employees Retirement System now owns 29,000 shares of the communications equipment provider's stock valued at $962,000 after acquiring an additional 12,500 shares during the period. Maryland State Retirement & Pension System acquired a new position in shares of Calix during the 1st quarter valued at $700,000. Norden Group LLC lifted its position in shares of Calix by 1,634.9% during the 1st quarter. Norden Group LLC now owns 143,299 shares of the communications equipment provider's stock valued at $4,752,000 after acquiring an additional 135,039 shares during the period. Finally, State of Alaska Department of Revenue lifted its position in shares of Calix by 463.7% during the 1st quarter. State of Alaska Department of Revenue now owns 35,711 shares of the communications equipment provider's stock valued at $1,184,000 after acquiring an additional 29,376 shares during the period. Institutional investors and hedge funds own 98.14% of the company's stock.

Calix Company Profile

(

Get Free Report)

Calix, Inc, together with its subsidiaries, engages in the provision of cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific. Its cloud and software platforms, and systems and services enable broadband service providers (BSPs) to provide a range of services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Calix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calix wasn't on the list.

While Calix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report