Amalgamated Bank decreased its position in Illinois Tool Works Inc. (NYSE:ITW - Free Report) by 6.4% in the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 70,774 shares of the industrial products company's stock after selling 4,861 shares during the period. Amalgamated Bank's holdings in Illinois Tool Works were worth $18,539,000 at the end of the most recent reporting period.

Amalgamated Bank decreased its position in Illinois Tool Works Inc. (NYSE:ITW - Free Report) by 6.4% in the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 70,774 shares of the industrial products company's stock after selling 4,861 shares during the period. Amalgamated Bank's holdings in Illinois Tool Works were worth $18,539,000 at the end of the most recent reporting period.

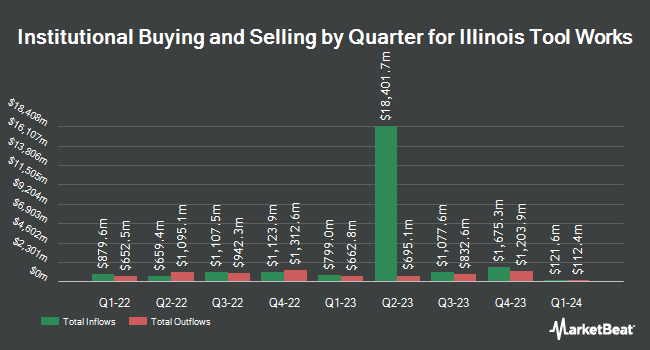

Several other large investors have also recently bought and sold shares of the business. Vanguard Group Inc. increased its holdings in shares of Illinois Tool Works by 5.0% in the 3rd quarter. Vanguard Group Inc. now owns 26,205,082 shares of the industrial products company's stock valued at $6,035,292,000 after purchasing an additional 1,238,239 shares during the period. Northern Trust Corp lifted its position in Illinois Tool Works by 1.9% in the 3rd quarter. Northern Trust Corp now owns 12,829,189 shares of the industrial products company's stock worth $2,954,691,000 after buying an additional 244,145 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its stake in shares of Illinois Tool Works by 1.4% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 6,899,522 shares of the industrial products company's stock valued at $1,578,299,000 after buying an additional 97,568 shares during the period. Fisher Asset Management LLC boosted its stake in shares of Illinois Tool Works by 4.3% during the 4th quarter. Fisher Asset Management LLC now owns 2,951,948 shares of the industrial products company's stock valued at $773,234,000 after buying an additional 122,840 shares during the period. Finally, Stifel Financial Corp grew its holdings in shares of Illinois Tool Works by 1.3% during the 3rd quarter. Stifel Financial Corp now owns 1,742,605 shares of the industrial products company's stock valued at $401,352,000 after acquiring an additional 22,238 shares in the last quarter. 79.77% of the stock is owned by institutional investors and hedge funds.

Illinois Tool Works Stock Performance

ITW traded up $1.88 during trading on Friday, hitting $243.92. The stock had a trading volume of 909,430 shares, compared to its average volume of 1,258,057. The firm has a market cap of $72.87 billion, a PE ratio of 24.06, a P/E/G ratio of 3.48 and a beta of 1.14. The company has a current ratio of 1.32, a quick ratio of 0.97 and a debt-to-equity ratio of 2.07. Illinois Tool Works Inc. has a 12 month low of $217.06 and a 12 month high of $271.15. The company has a 50 day simple moving average of $259.07 and a 200-day simple moving average of $251.66.

Illinois Tool Works (NYSE:ITW - Get Free Report) last posted its quarterly earnings data on Tuesday, April 30th. The industrial products company reported $2.44 EPS for the quarter, topping analysts' consensus estimates of $2.35 by $0.09. Illinois Tool Works had a return on equity of 97.82% and a net margin of 19.07%. The business had revenue of $3.97 billion for the quarter, compared to analyst estimates of $4.03 billion. During the same period in the previous year, the company posted $2.33 earnings per share. The firm's revenue for the quarter was down 1.1% on a year-over-year basis. Analysts expect that Illinois Tool Works Inc. will post 10.35 EPS for the current year.

Illinois Tool Works Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, April 11th. Stockholders of record on Friday, March 29th were given a $1.40 dividend. The ex-dividend date was Wednesday, March 27th. This represents a $5.60 annualized dividend and a dividend yield of 2.30%. Illinois Tool Works's dividend payout ratio is 55.23%.

Wall Street Analysts Forecast Growth

A number of analysts recently issued reports on the company. StockNews.com raised Illinois Tool Works from a "hold" rating to a "buy" rating in a research report on Wednesday. Bank of America downgraded Illinois Tool Works from a "neutral" rating to an "underperform" rating and dropped their price objective for the stock from $260.00 to $235.00 in a report on Wednesday, January 10th. Stifel Nicolaus raised their price objective on shares of Illinois Tool Works from $258.00 to $259.00 and gave the company a "hold" rating in a research report on Wednesday, April 17th. Wells Fargo & Company decreased their target price on shares of Illinois Tool Works from $255.00 to $244.00 and set an "underweight" rating for the company in a research report on Wednesday. Finally, Truist Financial raised their price target on shares of Illinois Tool Works from $303.00 to $305.00 and gave the company a "buy" rating in a report on Wednesday. Four equities research analysts have rated the stock with a sell rating, two have issued a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $257.78.

Get Our Latest Stock Report on Illinois Tool Works

Insider Transactions at Illinois Tool Works

In related news, EVP Sharon Szafranski sold 801 shares of the company's stock in a transaction on Monday, February 12th. The shares were sold at an average price of $256.42, for a total transaction of $205,392.42. Following the completion of the transaction, the executive vice president now directly owns 5,870 shares in the company, valued at approximately $1,505,185.40. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. In other news, EVP Sharon Szafranski sold 801 shares of the business's stock in a transaction dated Monday, February 12th. The shares were sold at an average price of $256.42, for a total transaction of $205,392.42. Following the transaction, the executive vice president now owns 5,870 shares in the company, valued at approximately $1,505,185.40. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, Chairman Ernest Scott Santi sold 50,000 shares of the stock in a transaction dated Tuesday, February 6th. The shares were sold at an average price of $254.44, for a total transaction of $12,722,000.00. Following the completion of the sale, the chairman now owns 221,015 shares of the company's stock, valued at approximately $56,235,056.60. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 139,471 shares of company stock worth $35,970,816. Insiders own 0.88% of the company's stock.

Illinois Tool Works Company Profile

(

Free Report)

Illinois Tool Works Inc manufactures and sells industrial products and equipment in the United States and internationally. It operates through seven segments: Automotive OEM; Food Equipment; Test & Measurement and Electronics; Welding; Polymers & Fluids; Construction Products; and Specialty Products.

Further Reading

Want to see what other hedge funds are holding ITW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Illinois Tool Works Inc. (NYSE:ITW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Illinois Tool Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illinois Tool Works wasn't on the list.

While Illinois Tool Works currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report