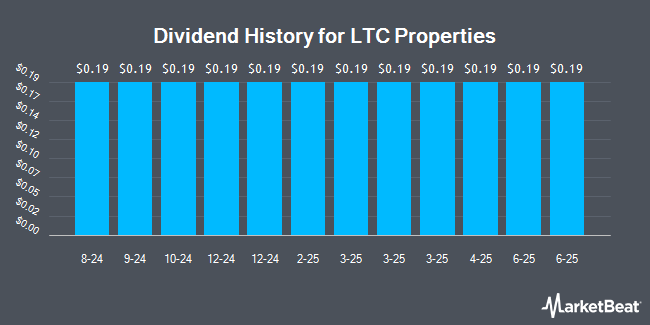

LTC Properties, Inc. (NYSE:LTC - Get Free Report) declared a monthly dividend on Wednesday, April 3rd, Wall Street Journal reports. Stockholders of record on Thursday, June 20th will be paid a dividend of 0.19 per share by the real estate investment trust on Friday, June 28th. This represents a $2.28 dividend on an annualized basis and a dividend yield of 7.21%. The ex-dividend date is Thursday, June 20th.

LTC Properties, Inc. (NYSE:LTC - Get Free Report) declared a monthly dividend on Wednesday, April 3rd, Wall Street Journal reports. Stockholders of record on Thursday, June 20th will be paid a dividend of 0.19 per share by the real estate investment trust on Friday, June 28th. This represents a $2.28 dividend on an annualized basis and a dividend yield of 7.21%. The ex-dividend date is Thursday, June 20th.

LTC Properties has a payout ratio of 121.9% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities analysts expect LTC Properties to earn $2.73 per share next year, which means the company should continue to be able to cover its $2.28 annual dividend with an expected future payout ratio of 83.5%.

LTC Properties Stock Performance

Shares of NYSE:LTC traded down $0.10 during midday trading on Wednesday, reaching $31.61. 240,837 shares of the company's stock traded hands, compared to its average volume of 296,650. The company has a market cap of $1.36 billion, a price-to-earnings ratio of 14.63 and a beta of 0.87. The company has a debt-to-equity ratio of 0.97, a quick ratio of 13.29 and a current ratio of 13.29. LTC Properties has a one year low of $30.30 and a one year high of $35.72. The stock has a 50 day moving average of $31.78 and a 200 day moving average of $32.08.

Institutional Trading of LTC Properties

Hedge funds have recently bought and sold shares of the company. Money Concepts Capital Corp increased its position in LTC Properties by 3,395.0% in the fourth quarter. Money Concepts Capital Corp now owns 699 shares of the real estate investment trust's stock worth $25,000 after buying an additional 679 shares in the last quarter. Lazard Asset Management LLC purchased a new stake in LTC Properties in the fourth quarter worth about $26,000. FMR LLC increased its position in LTC Properties by 73.3% in the third quarter. FMR LLC now owns 1,168 shares of the real estate investment trust's stock worth $38,000 after buying an additional 494 shares in the last quarter. Point72 Hong Kong Ltd purchased a new stake in LTC Properties in the second quarter worth about $41,000. Finally, Tower Research Capital LLC TRC increased its position in LTC Properties by 59.1% in the third quarter. Tower Research Capital LLC TRC now owns 2,340 shares of the real estate investment trust's stock worth $87,000 after buying an additional 869 shares in the last quarter. Hedge funds and other institutional investors own 69.25% of the company's stock.

Wall Street Analyst Weigh In

Separately, Deutsche Bank Aktiengesellschaft initiated coverage on LTC Properties in a report on Tuesday, January 30th. They set a "hold" rating and a $34.00 price target on the stock. Six equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $34.33.

Read Our Latest Stock Analysis on LTC Properties

LTC Properties Company Profile

(

Get Free Report)

LTC is a real estate investment trust (REIT) investing in seniors housing and health care properties primarily through sale-leasebacks, mortgage financing, joint-ventures and structured finance solutions including preferred equity and mezzanine lending. LTC's investment portfolio includes 201 properties in 26 states with 29 operating partners.

Featured Stories

Before you consider LTC Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LTC Properties wasn't on the list.

While LTC Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report