Channing Capital Management LLC lowered its stake in shares of MSA Safety Incorporated (NYSE:MSA - Free Report) by 16.3% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 363,612 shares of the industrial products company's stock after selling 70,605 shares during the quarter. Channing Capital Management LLC owned approximately 0.92% of MSA Safety worth $61,389,000 as of its most recent filing with the Securities and Exchange Commission.

Channing Capital Management LLC lowered its stake in shares of MSA Safety Incorporated (NYSE:MSA - Free Report) by 16.3% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 363,612 shares of the industrial products company's stock after selling 70,605 shares during the quarter. Channing Capital Management LLC owned approximately 0.92% of MSA Safety worth $61,389,000 as of its most recent filing with the Securities and Exchange Commission.

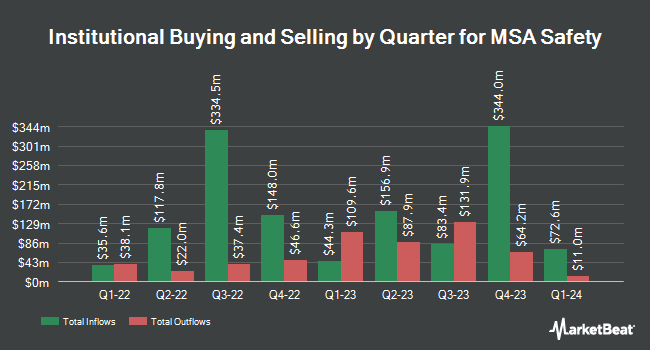

Several other institutional investors have also modified their holdings of the stock. Contravisory Investment Management Inc. acquired a new stake in MSA Safety during the 4th quarter worth $25,000. Exchange Traded Concepts LLC purchased a new position in shares of MSA Safety during the fourth quarter worth about $26,000. Global Retirement Partners LLC acquired a new stake in shares of MSA Safety during the fourth quarter worth about $46,000. Fifth Third Bancorp lifted its holdings in shares of MSA Safety by 28.2% in the 4th quarter. Fifth Third Bancorp now owns 336 shares of the industrial products company's stock valued at $57,000 after purchasing an additional 74 shares during the last quarter. Finally, McGlone Suttner Wealth Management Inc. acquired a new stake in shares of MSA Safety in the 4th quarter valued at about $61,000. Hedge funds and other institutional investors own 92.51% of the company's stock.

MSA Safety Stock Performance

NYSE MSA traded down $1.39 during trading on Friday, reaching $183.93. The company's stock had a trading volume of 134,828 shares, compared to its average volume of 130,942. The business's fifty day moving average price is $187.56 and its 200-day moving average price is $174.02. MSA Safety Incorporated has a twelve month low of $126.75 and a twelve month high of $196.02. The company has a debt-to-equity ratio of 0.57, a quick ratio of 1.48 and a current ratio of 2.51. The firm has a market cap of $7.24 billion, a price-to-earnings ratio of 27.25 and a beta of 1.01.

MSA Safety (NYSE:MSA - Get Free Report) last issued its quarterly earnings results on Monday, April 29th. The industrial products company reported $1.61 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.47 by $0.14. MSA Safety had a return on equity of 31.51% and a net margin of 14.81%. The firm had revenue of $413.00 million for the quarter, compared to analysts' expectations of $428.38 million. During the same quarter in the previous year, the firm posted $1.36 EPS. The firm's revenue for the quarter was up 3.7% on a year-over-year basis. As a group, analysts anticipate that MSA Safety Incorporated will post 7.75 EPS for the current fiscal year.

MSA Safety Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, June 10th. Investors of record on Wednesday, May 15th will be issued a dividend of $0.51 per share. The ex-dividend date of this dividend is Tuesday, May 14th. This is an increase from MSA Safety's previous quarterly dividend of $0.47. This represents a $2.04 annualized dividend and a dividend yield of 1.11%. MSA Safety's dividend payout ratio (DPR) is currently 27.85%.

Insider Activity at MSA Safety

In other MSA Safety news, Director Rebecca B. Roberts sold 1,100 shares of the company's stock in a transaction on Tuesday, February 27th. The shares were sold at an average price of $181.84, for a total transaction of $200,024.00. Following the completion of the transaction, the director now owns 8,474 shares in the company, valued at approximately $1,540,912.16. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In other news, CEO Nishan J. Vartanian sold 4,099 shares of the firm's stock in a transaction that occurred on Tuesday, March 12th. The stock was sold at an average price of $185.75, for a total value of $761,389.25. Following the completion of the sale, the chief executive officer now directly owns 67,800 shares of the company's stock, valued at approximately $12,593,850. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Rebecca B. Roberts sold 1,100 shares of the company's stock in a transaction on Tuesday, February 27th. The stock was sold at an average price of $181.84, for a total value of $200,024.00. Following the transaction, the director now directly owns 8,474 shares in the company, valued at approximately $1,540,912.16. The disclosure for this sale can be found here. Insiders have sold a total of 16,504 shares of company stock worth $3,056,181 in the last three months. Insiders own 6.20% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com upgraded MSA Safety from a "hold" rating to a "buy" rating in a research note on Friday, February 23rd. One research analyst has rated the stock with a hold rating and three have issued a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $189.50.

Get Our Latest Stock Report on MSA Safety

About MSA Safety

(

Free Report)

MSA Safety Incorporated develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures in the fire service, energy, utility, construction, and industrial manufacturing applications, as well as heating, ventilation, air conditioning, and refrigeration industries worldwide.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MSA Safety, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSA Safety wasn't on the list.

While MSA Safety currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report