Welch & Forbes LLC trimmed its position in NextEra Energy, Inc. (NYSE:NEE - Free Report) by 11.9% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 430,528 shares of the utilities provider's stock after selling 58,060 shares during the period. Welch & Forbes LLC's holdings in NextEra Energy were worth $26,150,000 at the end of the most recent quarter.

Welch & Forbes LLC trimmed its position in NextEra Energy, Inc. (NYSE:NEE - Free Report) by 11.9% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 430,528 shares of the utilities provider's stock after selling 58,060 shares during the period. Welch & Forbes LLC's holdings in NextEra Energy were worth $26,150,000 at the end of the most recent quarter.

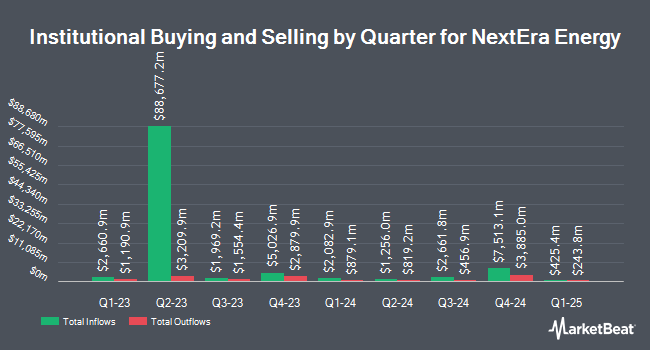

Several other hedge funds and other institutional investors have also bought and sold shares of NEE. Vanguard Group Inc. grew its holdings in shares of NextEra Energy by 1.0% in the 3rd quarter. Vanguard Group Inc. now owns 198,430,172 shares of the utilities provider's stock valued at $11,368,065,000 after buying an additional 1,956,153 shares during the period. Northern Trust Corp increased its holdings in shares of NextEra Energy by 2.0% in the third quarter. Northern Trust Corp now owns 22,982,250 shares of the utilities provider's stock worth $1,316,653,000 after acquiring an additional 455,271 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in shares of NextEra Energy by 1.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 10,352,695 shares of the utilities provider's stock valued at $593,106,000 after purchasing an additional 148,674 shares in the last quarter. California Public Employees Retirement System boosted its holdings in shares of NextEra Energy by 2.4% in the third quarter. California Public Employees Retirement System now owns 9,026,464 shares of the utilities provider's stock valued at $517,126,000 after buying an additional 209,584 shares during the period. Finally, Nordea Investment Management AB raised its holdings in shares of NextEra Energy by 59.1% during the third quarter. Nordea Investment Management AB now owns 5,784,080 shares of the utilities provider's stock worth $337,096,000 after acquiring an additional 2,148,205 shares during the period. Institutional investors own 78.72% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on NEE. Barclays started coverage on NextEra Energy in a report on Wednesday, April 10th. They set an "equal weight" rating and a $66.00 target price for the company. StockNews.com raised NextEra Energy from a "sell" rating to a "hold" rating in a research report on Thursday. Royal Bank of Canada reaffirmed an "outperform" rating and set a $74.00 price target on shares of NextEra Energy in a research report on Tuesday, January 30th. Guggenheim lifted their price objective on shares of NextEra Energy from $70.00 to $80.00 and gave the company a "buy" rating in a report on Monday, January 22nd. Finally, Scotiabank raised their target price on shares of NextEra Energy from $69.00 to $73.00 and gave the company a "sector outperform" rating in a research report on Monday, April 22nd. One analyst has rated the stock with a sell rating, four have given a hold rating and eleven have given a buy rating to the company's stock. According to data from MarketBeat.com, NextEra Energy currently has a consensus rating of "Moderate Buy" and a consensus target price of $71.50.

View Our Latest Analysis on NextEra Energy

NextEra Energy Stock Performance

NEE traded up $1.12 during trading hours on Monday, reaching $71.26. The company's stock had a trading volume of 14,040,262 shares, compared to its average volume of 11,912,485. The company has a debt-to-equity ratio of 1.12, a quick ratio of 0.43 and a current ratio of 0.51. The company's 50-day moving average is $62.33 and its 200-day moving average is $59.80. NextEra Energy, Inc. has a 52 week low of $47.15 and a 52 week high of $78.53. The firm has a market cap of $146.41 billion, a PE ratio of 19.42, a price-to-earnings-growth ratio of 2.58 and a beta of 0.50.

NextEra Energy (NYSE:NEE - Get Free Report) last issued its quarterly earnings data on Tuesday, April 23rd. The utilities provider reported $0.91 earnings per share for the quarter, beating the consensus estimate of $0.80 by $0.11. The company had revenue of $5.73 billion for the quarter, compared to analyst estimates of $6.28 billion. NextEra Energy had a net margin of 27.62% and a return on equity of 11.72%. The company's revenue was down 14.7% on a year-over-year basis. During the same period in the prior year, the firm earned $0.84 earnings per share. On average, equities analysts forecast that NextEra Energy, Inc. will post 3.4 EPS for the current year.

NextEra Energy Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 15th. Stockholders of record on Tuesday, February 27th were given a $0.515 dividend. This is an increase from NextEra Energy's previous quarterly dividend of $0.47. The ex-dividend date was Monday, February 26th. This represents a $2.06 annualized dividend and a dividend yield of 2.89%. NextEra Energy's dividend payout ratio is presently 56.13%.

About NextEra Energy

(

Free Report)

NextEra Energy, Inc, through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear,natural gas, and other clean energy. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

Read More

Want to see what other hedge funds are holding NEE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for NextEra Energy, Inc. (NYSE:NEE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NextEra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy wasn't on the list.

While NextEra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report