Paramount Resources (TSE:POU - Get Free Report) had its price objective increased by stock analysts at CIBC from C$35.00 to C$37.00 in a research note issued to investors on Friday, BayStreet.CA reports. The brokerage presently has a "neutral" rating on the stock. CIBC's target price indicates a potential upside of 15.44% from the company's current price.

Paramount Resources (TSE:POU - Get Free Report) had its price objective increased by stock analysts at CIBC from C$35.00 to C$37.00 in a research note issued to investors on Friday, BayStreet.CA reports. The brokerage presently has a "neutral" rating on the stock. CIBC's target price indicates a potential upside of 15.44% from the company's current price.

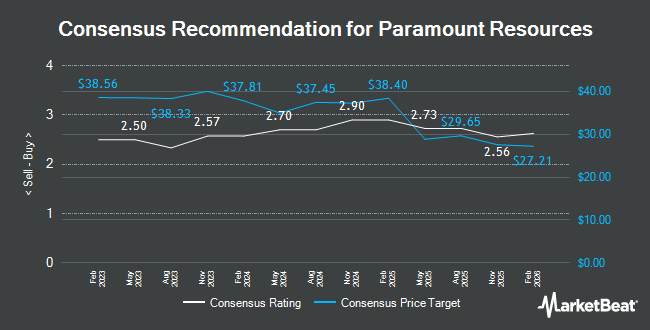

Other research analysts also recently issued reports about the stock. Scotiabank lowered their price objective on shares of Paramount Resources from C$30.00 to C$29.00 and set an "outperform" rating for the company in a research report on Thursday, March 7th. Jefferies Financial Group decreased their price target on shares of Paramount Resources from C$33.00 to C$31.00 in a research report on Thursday, March 7th. ATB Capital decreased their price target on shares of Paramount Resources from C$37.00 to C$36.00 and set an "outperform" rating for the company in a research note on Thursday, March 7th. Royal Bank of Canada boosted their price objective on Paramount Resources from C$34.00 to C$36.00 and gave the company a "sector perform" rating in a report on Friday. Finally, BMO Capital Markets increased their price objective on Paramount Resources from C$37.00 to C$38.50 and gave the stock an "outperform" rating in a research note on Friday. Three analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of C$35.80.

View Our Latest Stock Report on Paramount Resources

Paramount Resources Price Performance

TSE POU traded up C$0.07 during trading hours on Friday, reaching C$32.05. 289,838 shares of the company's stock were exchanged, compared to its average volume of 265,621. Paramount Resources has a one year low of C$24.59 and a one year high of C$33.80. The stock has a market cap of C$4.63 billion, a PE ratio of 10.11, a price-to-earnings-growth ratio of 0.14 and a beta of 3.23. The company has a current ratio of 0.71, a quick ratio of 0.68 and a debt-to-equity ratio of 0.83. The firm has a fifty day moving average of C$28.80 and a 200-day moving average of C$27.95.

Paramount Resources (TSE:POU - Get Free Report) last posted its quarterly earnings data on Wednesday, March 6th. The company reported C$0.75 EPS for the quarter, missing analysts' consensus estimates of C$0.95 by C($0.20). The company had revenue of C$470.50 million for the quarter, compared to the consensus estimate of C$436.00 million. Paramount Resources had a return on equity of 13.67% and a net margin of 26.13%. On average, equities research analysts predict that Paramount Resources will post 2.3708207 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, Senior Officer Bernard K. Lee sold 20,000 shares of the stock in a transaction on Friday, April 12th. The shares were sold at an average price of C$30.50, for a total transaction of C$610,000.00. In other Paramount Resources news, Senior Officer Michael S. Han sold 30,040 shares of the stock in a transaction on Thursday, March 7th. The shares were sold at an average price of C$28.00, for a total transaction of C$841,120.00. Also, Senior Officer Bernard K. Lee sold 20,000 shares of the company's stock in a transaction that occurred on Friday, April 12th. The shares were sold at an average price of C$30.50, for a total value of C$610,000.00. Insiders sold a total of 69,655 shares of company stock worth $2,021,257 over the last ninety days. 45.75% of the stock is owned by corporate insiders.

Paramount Resources Company Profile

(

Get Free Report)

Paramount Resources Ltd. explores for and develops conventional and unconventional petroleum and natural gas reserves and resources in Canada. The company holds interests in the Karr and Wapiti Montney properties covering an area of 109,000 net acres located south of the city of Grande Prairie, Alberta; Kaybob North Duvernay development and natural gas producing properties covering an area of 124,000 net acres located in west-central Alberta; and Willesden Green Duvernay development in central Alberta and shale gas producing properties in the Horn River Basin in northeast British Columbia covering an area of 249,000 net acres.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Paramount Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Resources wasn't on the list.

While Paramount Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report