Key Points

- AppLovin's shares have surged over 263% year-to-date, outperforming its sector and the overall market.

- Insider selling by key figures, including the CEO and CTO, has totaled $1.68 billion over the past year.

- Analysts remain bullish despite recent shifts in stock momentum and insider selling.

- 5 stocks we like better than AppLovin

Shares of the software technology company AppLovin NASDAQ: APP have been on fire this year, surging by over 263% year-to-date. The company, now categorized as a large cap, with a $12.84 billion market capitalization, has dramatically outperformed its sector and overall market.

The company, which debuted on the exchange in April 2021, has experienced sharp growth this year stemming from diverse game offerings. Offerings that span various genres, platforms, and markets, owning over 200 games like Matchington Mansion and Wordscapes. Its success is also attributed to an advanced technology platform enabling effective user acquisition, monetization, and analytics.

However, despite remarkable share appreciation and solid quarterly results this year, shareholders might need to act defensively as the stock appears to be shifting momentum. Additionally, insiders have consistently sold stock throughout the year, including sales recently made by the company's CEO and CTO.

Insiders are selling stock

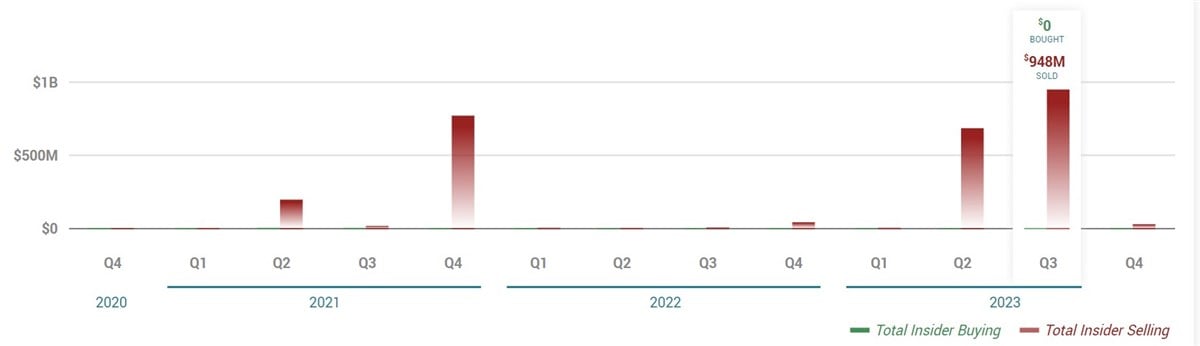

Currently, insider ownership stands at 12.43%. However, that figure has steadily declined as insiders have actively and consistently sold stock.

Over the previous twelve months, no insiders have purchased stock. Conversely, eight insiders have sold stock in the same period, totaling $1.68 billion. It's not just this year either. And shareholders won't be thrilled to know this trend extends back to when the company went public.

Most recently, during the final week of November, the company's CTO, CEO, and CMO all sold stock. Company CTO Vasily Shikin sold 300,000 shares. CEO Arash Adam Foroughi sold 325,000 shares, and CMO Katie Jansen sold 52,193 shares.

Naturally, consistent Insider selling could be viewed as a negative as it can signal a lack of confidence in the company's prospects from those who know it best. It may also create concerns among investors about the company's performance or potential upcoming challenges.

But so far, that has not been the case, as shares of AppLovin have continued to soar higher this year. However, with a recent shift in momentum and trend break, is that all about to change?

Shares of AppLovin may be running out of steam

In 2023, shareholders and participants have not had much to worry about as it relates to APP's share performance. For the most part, the stock has steadily trended higher, hugging its uptrend, since the beginning of the year.

However, the stock failed to hold above its September high when it tested it in November and put in a double top. Since then, shares of APP have looked vulnerable and traded below its 50-day Simple Moving Average.

A short-term trend and momentum shift will be confirmed if the stock fails to reclaim its uptrend and holds underneath the 50-day SMA. Shall that confirmation present itself, a move toward the 200-day SMA could be likely.

Analysts remain bullish

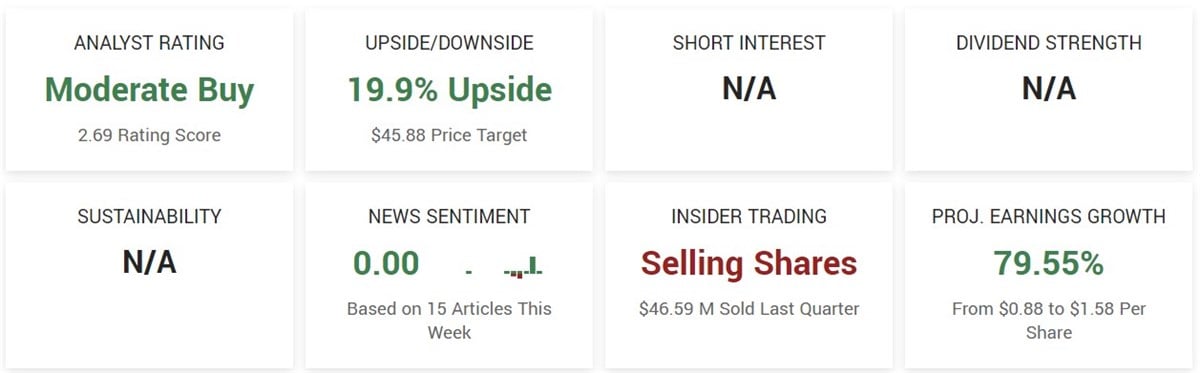

Notably, analysts remain bullish despite the apparent early stage of a momentum shift for the stock and consistent selling by insiders.

APP maintains a Moderate Buy rating from sixteen analysts, with a consensus price target forecasting nearly 20% upside. Analysts' ongoing bullish sentiment has persisted throughout the year, consistently raising the price target each quarter, reinforcing its Moderate Buy status.

Before you consider AppLovin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppLovin wasn't on the list.

While AppLovin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report