Key Points

- PDD Holdings saw a breakout in its shares alongside a surge in trading volume on Friday.

- Over the previous three months, shares of PDD have surged almost 55%.

- Analysts are bullish, with a Buy rating and a consensus price target of $117.75, predicting nearly a 12% upside.

- 5 stocks we like better than PDD

Shares of PDD Holdings NASDAQ: PDD, a multinational commerce group, broke out to the upside on Friday, along with a surge in trading volume.

The stock, which has been on an impressive three-month run since reporting earnings, up over 55%, now boasts a $139 billion market capitalization and an RSI of 68.19, indicating that the stock may not be in overbought territory.

For many, PDD might have flown under the radar, but should you be focused on this company and stock going forward now that a surge in volume and price has been confirmed?

Well, let’s take a closer look at what the company does and several other important factors to paint a better picture.

What is PDD Holdings?

PDD, previously known as Pinduoduo Inc., is a multinational commerce group operating an e-commerce platform called Pinduoduo, offering a wide range of products. They also run Temu, an online marketplace focusing on digital economy integration. Established in 2015, the company is headquartered in Dublin, Ireland.

PDD’s Impressive Growth Has Fueled Share Performance

The company most recently reported earnings on August 29. PDD reported impressive earnings that exceeded expectations. As a result, PDD's U.S.-listed shares surged by over 15% on that day.

They announced a remarkable 66% increase in revenue to $7.21 billion for the quarter ending on June 30, surpassing the anticipated $5.95 billion in sales. The company also earned an adjusted $1.44 per U.S. share, exceeding analyst predictions of $1.

This positive outcome was attributed to a rise in consumer demand across various product categories, according to Jiazhen Zhao, co-chief executive of PDD Holdings. PDD is expected to report its subsequent quarter earnings on November 27.

With that impressive beat and growth, it may be no surprise that shares have rocketed higher since reporting earnings. And with the breakout on Friday, it appears they will continue to do so.

On Friday, shares of PDD broke out of the wedge pattern that had formed since the beginning of September. Notably, the range contracted significantly over the prior week as the stock consolidated near the wedge's resistance, signaling a likely breakout. The extreme contraction in the range indicated that the momentum would be there once the price broke out. That’s precisely what happened on Friday, with a surge in volume to back it up.

Going forward, investors or those looking to invest would need to see the stock continue to hold above the breakout level and, more importantly, establish a higher level of support. For example, a pullback into $103 and a higher low indicates buyers have stepped up to support the stock and a fresh uptrend has developed.

Analysts are Bullish on PDD

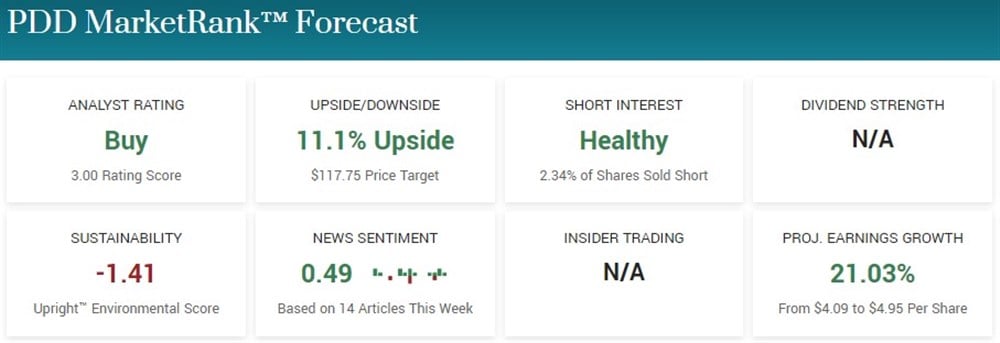

PDD is a Top-Rated stock with a Buy rating based on the twelve analyst ratings. Impressively, PDD’s Buy rating is above the consensus rating of Hold for retail/wholesale companies and the consensus rating of S&P 500 companies, which is also a Hold.

The company currently has a consensus analysis price target of $117.75, predicting an almost 12% upside for the multinational commerce group.

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report