Fitness beverage maker

Celsius Holdings, Inc. (NASDAQ: CELH) stock had an explosive rise followed by a death defying drop into the end of 2021. Shares skyrocketed as a direct result of the

reopening trend as

fitness clubs and

gyms reopened as well as

commuters hitting the roads again. While gross sales grew triple digits, margins shrunk due to rising costs of materials,

supply chain, transportation, and general

inflation. Worker costs also grew as travel and business expenses increased with the reopening. The Company’s beverages can be found in most convenience stores as its distribution continues to expand. Prudent investors seeking to gain exposure in the energy beverage market with a fallen yet growing player can watch for opportunistic pullback levels in shares of Celsius Holdings.

Q3 FY 2021 Earnings Release

On Aug. 6, 2020, OraSure released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $0.03 excluding non-recurring items versus consensus analyst estimates for a profit of $0.07, missing estimates by (-$0.04). Revenues grew by 157.9% year-over-year (YoY) to $94.9 million beating analyst estimates for $74.96 million. Domestic revenues grew 214% to $84.5 million and international revenues rose 5% YoY to $10.4 million.

Conference Call Takeaways

CEO of Celsius Holdings John Fieldly set the tone, “We continue to see 2 of our hardest hit channels from COVID, our Fitness channel and our vending channel, not only rebound by the drive of new sales records with again, reaching triple-digit growth rates and contributing approximately $5.2 million in incremental revenue when compared to the prior year, international sales grew 5% to 10.4 million for the quarter and 18% through the first nine months of this year. We're still dealing with the impacts of COVID-19 most pronounced in the European markets, with all markets facing increased costs and raw materials, transportation. Our EU, Middle East, Southeast Asia, and Australia operations remain adversely affected by COVID-19 with varying restrictions and lockdowns in the markets. Overall, we continue to see quarterly improvements over -- or quarter over quarter with capacity restrictions as well as reopening and the hardest hit channels. But there still remains uncertainty as there could be potential reclosing due to new variance during the winter months, and case increases in the regions of operations which could force closures in some states and countries. Turning to some additional financial highlights for the quarter, our domestic revenue reached at $85.4 million, was driven by accelerated triple growth in our channels of trade, expansion with world-class retailers, further activation, and growth from our distribution partners. Direct store delivery network grew over 429% in revenues when compared to the prior year. Also, our club channel continues to accelerate following the expansion roll out of over 550 plus Costco Stores. In Q -- late Q2 to Q3, Costco growth now has been listed as just over a 10% revenue customer. We are also now rolling out onto their platform costco.com. In addition to Sam's Club, we're launching in several test markets during the fourth quarter, driven by the strong growth in Walmart. On the convenience channel side in North America, the latest spins data shows a growth of 205.5% year-over-year increase for the Celsius product portfolio and the convenience channel, compared to a 13.6% overall growth in the energy drink category as of October 3rd of 2021, last 12 weeks, while during the same period, our ACV increased 118% versus the prior year to 34.7% total ACV average.”

He concluded, “We're not only driving growth in the energy category, we're also expanding the demographics while bringing an industry-leading percentage of consumers from outside the category who are new. We have also reached another inflection point in our operations and growth, one which positioned Celsius for exponential growth and market share gains. We have committed the resources, both in personnel and operational infrastructure, to maximize this opportunity and support the incremental growth drivers on national DSD distribution platform has opened in the convenience store channel in the U.S. We're also not only seeing significant expansion in ACV across all channels but doing so while increasing our velocities at retail. We are in a unique position to see material concurrent growth in both due to we're just materially entering the most productive convenience channel in the U.S., while transitioning our existing accounts to DSD network, where we have seen incremental growth post-transition. Our team is ready, our infrastructure is in place to support the sales growth we expect on an expedited basis.”

CELH Opportunistic Pullback Levels

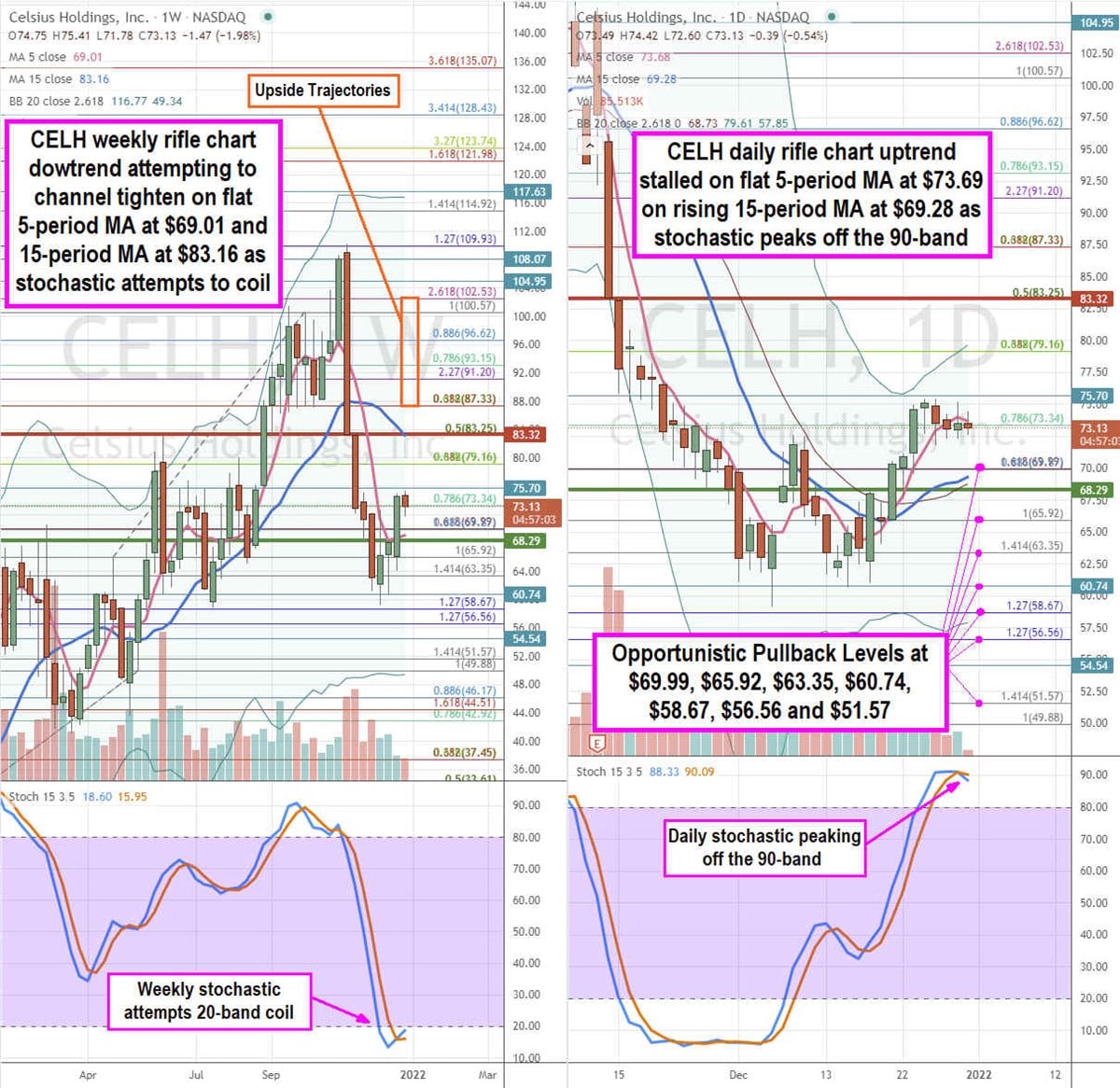

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for CELH stock. The weekly rifle chart peaked at the $109.93 Fibonacci (fib) level before losing almost half its value. The weekly rifle chart downtrend is stalling with a flat 5-period moving average (MA) at $69.01. The weekly stochastic is crossing back up attempting to bounce through the 20-band. The weekly market structure low (MSL) buy triggered on the breakout above $68.29. The weekly 15-period MA sits at the $83.32 weekly market structure high (MSH) trigger. The daily rifle chart uptrend is stalling with a flat 5-period MA at $73.68 with a rising 15-period MA at $69.28. The daily stochastic peaked at the 90-band crossing down but still above the 80-band. Prudent investors can watch for opportunistic pullback levels at the $69.99 fib level, $65.92 fib level, $63.35 fib level, $60.74 fib level, $58.67 fib level, $56.56 fib level, and the $51.57 fib level. Upside trajectories range from the $87.33 fib level up towards the $102.53 fib level.

Before you consider Celsius, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celsius wasn't on the list.

While Celsius currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report