- Home Depot is slated to report its second quarter on August 16

- Lowe’s reports its second quarter on August 17

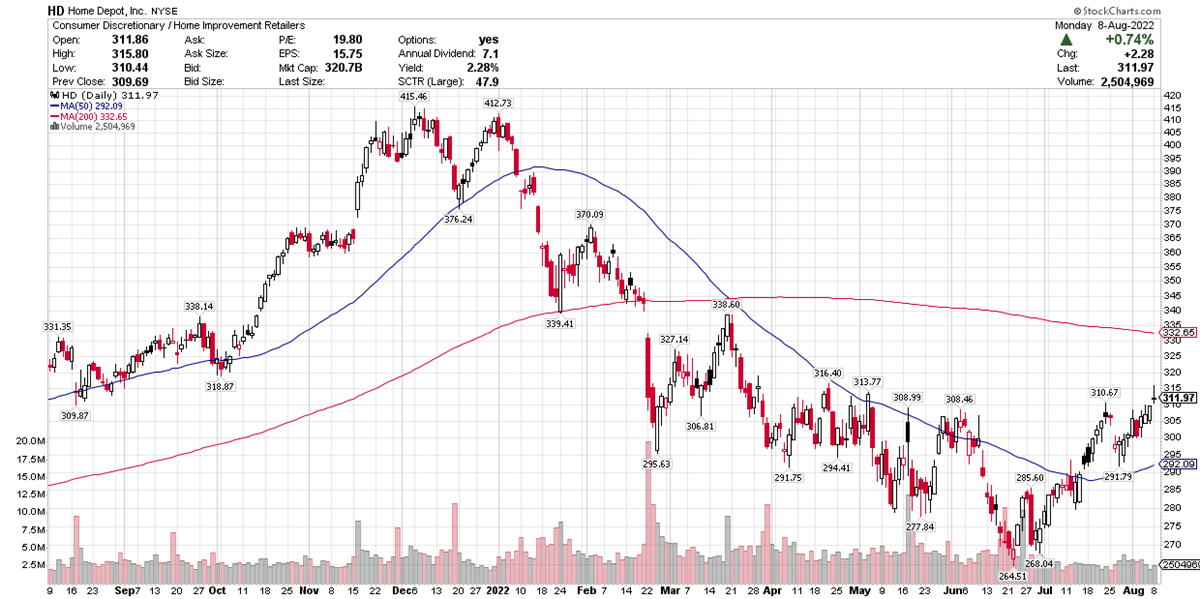

- Both stocks are trading above their 50-day moving averages

Home Depot NYSE: HD and

Lowe's NYSE: LOW have become ubiquitous sightings throughout American cities and towns, large and small. Both home-improvement giants operate north of 2,200 stores each.

Both are on deck to report earnings next week.

Perhaps I’m unique among home-repair consumers, but I’ll often go to both interchangeably. The only reason Lowe’s often wins out is because it’s about five minutes closer to my home.

But in reality, the two companies operate their businesses differently, relying on different suppliers and emphasizing different products in the mix.

For example, in 2020, Home Depot said it would invest $1.2 billion to build about 150 new facilities designed to reach 90% of U.S. customers with same-day or next-day delivery. These centers are dubbed Flatbed Distribution Centers.

Meanwhile, Lowe’s last month launched Into the Blue: Lowe’s Product Pitch Event, which invites small businesses to pitch their products, which Lowe’s could eventually offer for sale.

In an interview with the Charlotte Business Journal, Lowe’s senior vice president of global merchandising, Sarah Dodd, said, “It's hard for smaller businesses or entrepreneurs or folks to get in front of Lowe's buyers, and this is a huge opportunity to do that in a live pitch environment. This is a way for them to have their voices and ideas heard.”

Beating Analysts’ Views

Home Depot is slated to report its second quarter on August 16, with analysts eyeing earnings per share of $4.95 per share on revenue of $43.38 billion. Those would mark increases over the year-ago quarter.

MarketBeat earnings data show that Home Depot topped analysts’ earnings views in the past eight quarters. It beat revenue expectations in the past nine quarters.

Of course, the Covid-era boom in housing purchases and home remodeling spurred massive growth. Home Depot grew earnings at double digit-rates between July 2020 and January of this year. Revenue was also up to the tune of double digits in six of the past eight quarters.

Analysts expect Home Depot to bring in revenue of $156 billion for the full year. Earnings are seen coming in at $16.48 per share this year, up 6% over 2021. That consensus estimate was revised higher recently.

Next year, that’s seen growing another 5% to $17.33 per share.

Growth From Construction Boom

According to MarketBeat analyst ratings, the Wall Street consensus on Home Depot is a “moderate buy” with a price target of $368.45, an 18.11% upside.

Lowe’s also enjoyed growth from the construction boom. Earnings increased at double-digit rates in six of the past eight quarters. Lowe’s revenue growth has slowed to the single digits in the past four quarters, after booming during late 2020 and early 2020.

Lowe's has carved out a name for itself as the low-cost provider. It also works with suppliers to cut costs, which it then passes on to customers.

Analysts expect Lowe’s to bring in $97 billion in sales for the year. Their rating on the stock is also “moderate buy,” with a price target of $238.58, representing an 18.20% upside.

Lowe’s reports its second quarter on August 17, the day after Home Depot reports. It’s seen delivering earnings per share of $4.65 on revenue of $28.26 billion.

This year, which is fiscal 2023, earnings are expected to come in at $13.44 per share, up 11%. For fiscal 2024, that’s seen growing another 9% to $14.59 per share.

So is either of these a buy right now?

Home Depot has corrected 24.46% year-to-date. It’s staged a rally recently, advancing 9.15% in the month and 4.17% in the past three months. It’s holding above its June 22 low of $264.51.

Meanwhile, Lowe’s is down 21.96% so far this year, and has rallied 11.26% in the past month and 2.15% in the past three months. It, too has rallied since its June low of $170.12.

Both stocks are trading above their 50-day moving averages, but below their 200-day lines. While the shorter-term line remains below the longer line, it’s often an indicator that the stock does not yet have enough momentum to stage a rally, despite strong fundamentals.

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report