Key Points

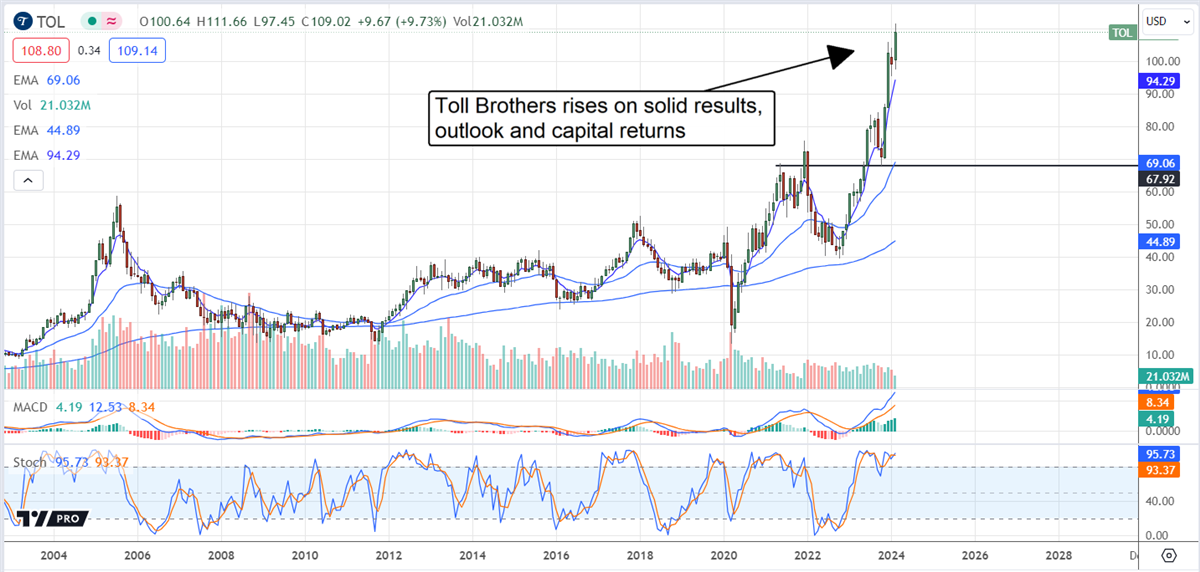

- Despite weakening housing data, Toll Brothers outpaces consensus and provides solid guidance for the year.

- The takeaway is robust cash flow and capital returns.

- Analysts are driving the market higher and should continue to do so as the year progresses.

- 5 stocks we like better than Toll Brothers

The latest mortgage data is tepid, to say the least, but Toll Brothers NYSE: TOL stock is still a buy. Whether the housing market normalizes or not, there is still demand for homes, and management is skillfully threading the needle between conditions and profits. Takeaways from the Q4 report include better-than-expected results, a widening margin, and an improved outlook that affirms growth will resume in 2024. The net result is a double-digit increase in shareholder equity in the last twelve months, and another one is expected this year.

Toll Brothers turns a corner, business outlook accelerates

Toll Brothers turned a corner in Q1, with results returning to growth after a tepid showing last year and the 18% contraction in Q4. The company reported $1.95 billion, a gain of 9.6% over last year. Revenue outperformed the Marketbeat.com consensus by 370 basis points, and the internal metrics are favorable. The company’s delivery volume increased by 6% and was compounded by a higher average realized price.

Margin news is favorable. The company increased gross and operating margins to leverage the bottom line result. The gross and adjusted margin improved by more than 100 basis points while SG&A expense fell by 20 bps as a percentage of revenue. The net result is a 25% increase in net income and a 32% improvement in GAAP earnings, with margin strength expected to be sustained in 2024. The GAAP $2.25 is $0.47 better than expected, suggesting the guidance is cautious.

The company raised its guidance for 2024 revenue and earnings. It now expects deliveries near 10,250, up 150 basis points, aligning with the market expectations. Margin is expected to hold near 28% and produce better-than-forecast earnings. The new earnings guidance ranges from $13.25 to $13.75 compared to the $12.31 analysts expect.

The new contract and backlog data align with the idea of cautious guidance. The net new contract value, a leading indicator, is up 42% YOY and rose sequentially, giving evidence of market momentum. Market momentum is also seen in the backlog, down YOY but up sequentially.

Toll Brothers builds shareholder value

Toll Brothers' business is driving ample cash flow, which is being used well. The cash balance is down YOY, but land purchases and capital returns offset the loss. The primary takeaways are that shareholder equity is up 3.2% sequentially and about 12% YOY, with additional gains expected in 2024. Book value is also up, advancing 2.7% in the quarter.

Value is also given through dividend payments and share repurchases, which reduced the share count by nearly 5.5% YOY. The dividend yield isn’t large but reliable, and the distribution is growing. The payout ratio is very low, below 10%, and recent increases are running in the low teens on a percentage basis.

Analysts are leading Toll Brothers stock price higher

Analysts have yet to issue revisions, but they are on the way. The Q1 results align with the analyst's trends, suggesting the revisions will be positive. As it is, the fourteen analysts tracked by Marketbeat raised the consensus sentiment to Moderate Buy from Hold and the price target by 70% in the last twelve months. The consensus target lags the price action but is supportive; the high-end range assumes another 15% to 20% upside is possible.

The price action is favorable to shareholders. The market is up following the release and at a new all-time high. If these levels can be sustained, the market will likely rally to new highs before mid-year, possibly reaching the $120 region.

Before you consider Toll Brothers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toll Brothers wasn't on the list.

While Toll Brothers currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report