Key Points

- The Lovesac Company outperformed again and gave solid guidance.

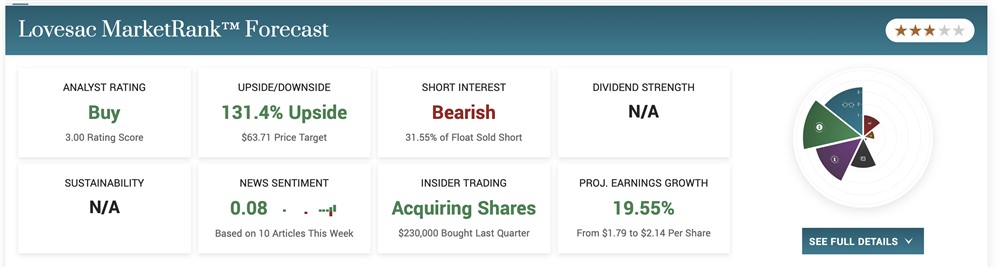

- The analysts see a triple-digit upside for this stock.

- Short-sellers think it could move lower.

- 5 stocks we like better than La-Z-Boy

Shares of The Lovesac Company NASDAQ: LOVE are up more than 15% following a solid report and may go even higher. This company benefits from sustained strength in the furniture industry, but there is more to the story. The Lovesac Company is a unique offering in a rarely-disrupted space, and it is one with value and appeal for consumers. It is growing at a pace above the broader industry and could more than double in size over the next few years.

The closest competitor, La-Z-Boy NYSE: LZB, does about twice the business compared to the recent quarter, and its offerings aren’t twice as good. If anything, these brands offer contrasting takes on the same approach to furniture, and La-Z-Boy is the one that stands to lose market share.

The Lovesac Company Has Robust Quarter, Reaffirms Guidance

The Lovesac Company had a robust quarter, posting revenue growth of 21% compared to low-single-digit growth or no growth for competitors like Ethan Allen NYSE: ETD, Haverty Furniture Company NYSE: HVT and La-z-Boy. The revenue was driven by a 16.2% comp, new store additions and strength in the digital channels. Digital sales increased by 26.4%, a testament to the company’s model. The “sactional” sofas are interchangeable, so add-on purchases are quickly done from remote locations. The overlapping manufacturing footprint means orders can be fulfilled from multiple locations, cutting lead times and costs.

The margin was solid as well. The company improved gross and operating margins to drive bottom-line growth and outperformance—however, the company’s $1.74 in GAAP EPS is down YOY due to tax provisions last year and this year. The company reaffirmed its guidance, which is better than the analysts expected.

A Short-Covering Rally For The Lovesac Company?

The short sellers have been hard at work with The Lovesac Company. They’ve sold it down more than 50% to outpace the next most aggressive correction in the furniture industry by triple double digits. The short interest was a whopping 28% at the last report and may remain high even with the Q4 report and guidance. The short volume at the time was nearly 70% indicating a high level of conviction among traders. The takeaway is that short selling has this market set up for a sustained rally, if not a squeeze, and there is significant upside potential.

The analysts' activity in The Lovesac Company has been muted over the past few months, but the rating has remained steady at a Buy. The price target is down compared to last year but steady over the last quarter and still 135% above the price action. Even the low price target of $50 assumes nearly 100% of upside, and there could be more, given the growth outlook. The institutions also support this company; they’ve been buying it since the IPO and own about 88%, which is a telling figure.

The Technical Outlook: The Lovesac Company Is At Bottom

A short-covering rally or short-squeeze remains to be seen, but this market has hit bottom. The bottom was reached late last year and is shaping into a Head & Shoulders that may lead to a reversal. The next hurdle for the market is near $30; if it can get above that level, it may move up into the $50 range. Until then, investors should expect this stock to move sideways within the current range until another catalyst for change exists. The outlook for economic growth is still sketchy and will likely weigh on all stocks as the year progresses.

Before you consider La-Z-Boy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and La-Z-Boy wasn't on the list.

While La-Z-Boy currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report