Key Points

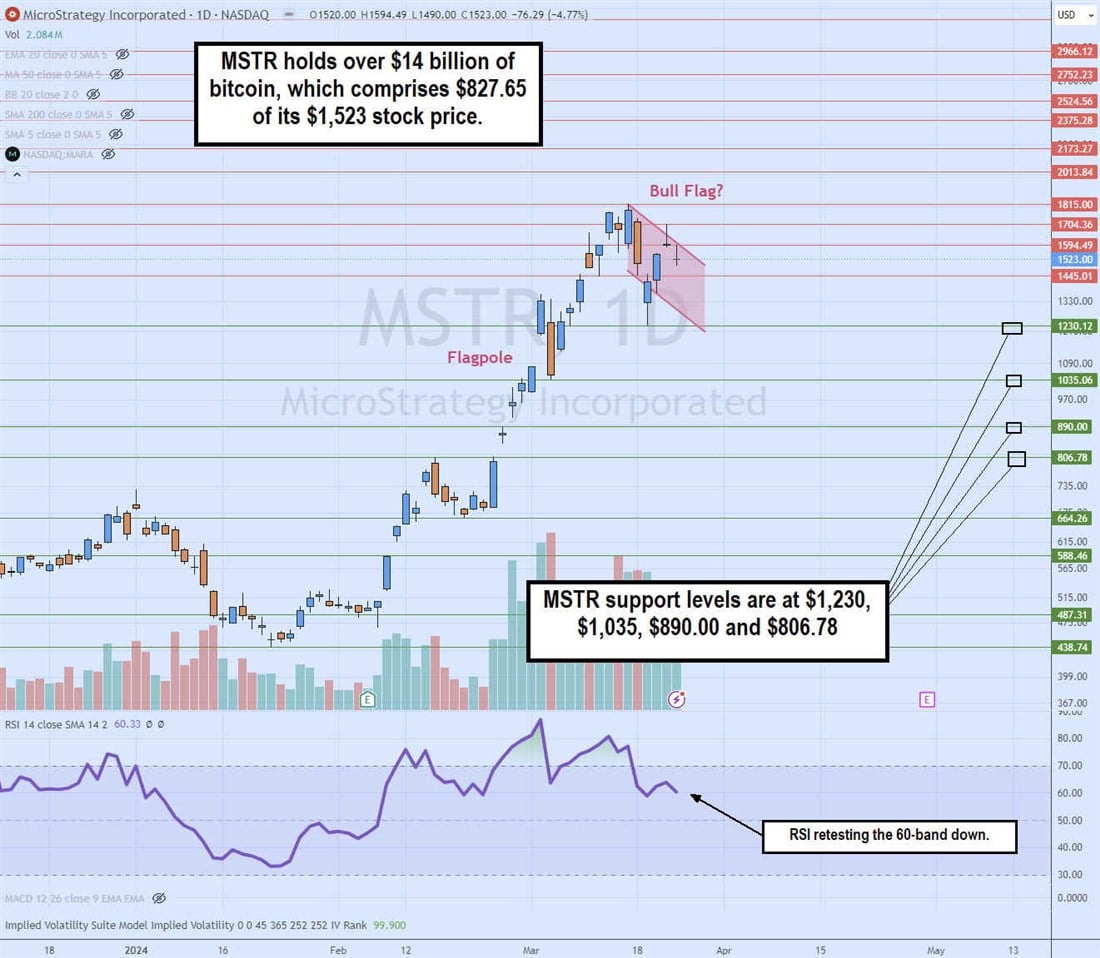

- MicroStrategy is a pioneer in business intelligence (BI) software, which comprises $695.34 of its $1,523 share price, leaving its bitcoin holdings at $827.65 per share.

- The company is widely known more so for its estimated $14 billion worth of bitcoin holdings, which it continues to keep acquiring more through debt financing.

- MicroStrategy acquired 9,245 more Bitcoin for $623 million between March 11, 2024, and March 18, 2024, for an estimated total of 214,246 Bitcoin or just over 1% of the total supply.

- 5 stocks we like better than MicroStrategy

MicroStrategy Inc. NASDAQ: MSTR stock has been synonymous with, and correlated to, spot bitcoin prices. MSTR stock has garnered the spotlight, making headlines not for its core business in the computer and technology sector as an operator and developer of business intelligence (BI) software solutions but instead as a bitcoin holder using the cryptocurrency as a Treasury reserve asset.

Its enigmatic Executive Chairman is a staunch proponent of Bitcoin and continues to acquire more of it. In fact, MicroStrategy has become the largest corporate holder of bitcoin with 214,246 bitcoin as of March 19, 2024, at an average price of $33,706, now worth an estimated $14.07 billion. Investors have to wonder if MicroStrategy has overleveraged its future with Bitcoin.

Who Are the Largest Holders of Bitcoin?

The largest holder of Bitcoin is the Grayscale Bitcoin Trust NYSEARCA: GBTC, holding 355,759 bitcoins valued at $23.3 billion and 1.694% of the total supply. The iShares Bitcoin Trust NASDAQ: IBIT owns 239,253 bitcoins valued at $15.7 billion, holding 1.139% of the total supply. MicroStrategy is the third largest holder of bitcoins, with 214,246 bitcoins worth $14.07 billion and 1.02% of total supply.

Marathon Digital Holdings Inc. NASDAQ: MARA is the largest bitcoin miner holder, with 16,930 bitcoins worth $1.11 billion and 0.081% of the total supply. The second largest miner is Hut 8 Co. NASDAQ: HUT, with 9,110 bitcoins worth $597.8 million and 0.043% of the total supply.

MicroStrategy Isn't the Only Public Company That Loves Bitcoin

MicroStrategy is the public company with the largest ownership stake in bitcoin, but it's not alone. Tesla Inc. NASDAQ: TSLA owns 9,720 bitcoins worth $637.3 million and 0.046% of the total supply. Coinbase Global Inc. NASDAQ: COIN owns 9,000 bitcoins worth $590 million and 0.043% of the total supply. Block Inc. NASDAQ: SQ owns 8,027 bitcoins worth $526.3 million and 0.038% of the total supply.

And don't forget about the Bitcoin ETFs. These funds own the most bitcoins, with 1,000,564 valued at $65.66 billion and 4.765% of the total supply of 21 million bitcoins.

MicroStrategy's Latest Earnings Report

MicroStrategy reported Q4 2023 EPS of $5.62, beating consensus analyst estimates of a loss of 21 cents by $5.41. Revenues sank 6% YoY to $124.5 million, missing consensus estimates by $7.7 million. The company reported it acquired 31,755 bitcoin acquired since Q3 2023 for $39,411 per bitcoin as of February 5, 2024. Total bitcoin holdings as of February 5, 2024, were reported at 190,000 bitcoin.

CEO Insights

MicroStrategy's CEO Phong Le commented, "2023 was an extraordinary year for MicroStrategy as we strategically raised capital to significantly increase our bitcoin holdings and continued to innovate, including by developing and launching MicroStrategy AI, our first-to-market AI-based BI tool."

Le continued, "We achieved double-digit subscription services revenue growth for both the fourth quarter and full year, demonstrating our ongoing commitment to transition our business to the cloud. We believe that the combination of our operating structure, bitcoin strategy, and focus on technology innovation provides a unique opportunity for value creation for our shareholders."

What is the Business Worth?

MSTR has a market capitalization of $25.85 billion at a price of $1,523 per share. However, its bitcoin holdings have a market capitalization of $14.07 billion as of March 23, 2024. Since bitcoin prices trade 24 hours a day around the clock, that market cap will change by the minute. After backing out the market cap of Bitcoin, the business of MicroStrategy is valued at around $11.8 billion. With 16.97 million shares outstanding, that equates to MicroStrategy's business is approximately $695.34 of the $1,523 share price, and the remaining $827.65 is the value of its bitcoin holdings.

MicroStrategy analyst ratings and price targets are at MarketBeat. MicroStrategy peers and competitor stocks can be found with the MarketBeat stock screener.

Daily Bull Flag Pattern Set-Up

The daily candlestick chart on MSTR illustrates a potential bull flag breakout set-up pattern. The flagpole formed on its parabolic rise from $451.03 swing lows on January 23, 2024, peaking at $1815 on March 15, 2024. The bull flag comprised lower highs and lower lows in a parallel channel formed afterward, with a potential trigger breakout above $1,600. The daily relative strength index (RSI) is retesting the 60-band for a possible slip back down under. Pullback support levels are at $1,230, $1,035, $890.00 and $806.78.

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report