Far from boring, technology stocks provide a lot of excitement for hundreds of reasons. After all, they focus on an explosive field, a hub driven by revenue through technological growth and development. For technologically based companies, the sky's the limit (as far as human ingenuity goes, anyway).

However, It's easy to get caught up in the idea that you should only invest in Apple. But as any dot-com-bust-era investors will remember, tech stocks tumbled nearly 80% in March 2000. But is the environment eerily similar to the early predecessors of today's tech stocks? After all, the overall market is down 18%, and tech shares have suffered the most, at around 30%.

In this article, we'll take a look at technology stocks and analyze the environment for technology stocks during these inflationary times. We'll also explore why technology stocks may make a good investment for you and when they do well. We'll also help you analyze several types of technology stocks as well as look at some popular technology index funds you may want to consider adding to your list.

There's a lot to digest when it comes to technology stocks, so let's get right to it.

Technology Stocks and Inflation

Why inflation, why right now? As you've likely noticed, everything costs more right now. Eggs, butter, toiletries, etc. Inflation is a general increase in the prices of goods and services in an economy and a few main factors have currently been fueling much of the price growth: sharply rising labor costs, energy prices and rising interest prices. Inflation also comes from supply chain issues (you've heard about those chip shortages) and consumer demand for products.

In order to steer the rudder of inflation, many governments increase the interest rate which encourages people to spend less money.

However, what do higher interest rates do for tech companies? They hurt growing technology companies because of the fact that they must take on a higher interest rate to borrow. It also reduces the long-term estimates for company earnings and free cash flow and hurts investor sentiment. To put it succinctly, tech companies sometimes get by on investors' belief in their ability to be disruptive, such as in the case of GTE technology. Learn how to invest in GTE technology and other top-rated technology stocks, including ChatGPT stocks.

Learn more: Why Do Tech Stocks Go Down when Interest Rates Rise?

Are Technology Stocks a Good Investment?

What does all this doom and gloom mean for tech stocks? Are they still a good investment?

Yes, yes and yes — despite the fact that the VIPs Apple, Amazon, Microsoft, Meta and Google have lost trillions.

It's important to note that tech stocks are nowhere near in the same headspace as those in the Y2K era. Unlike in the dot-com era, many of the most valuable publicly traded tech companies today actually make a profit selling things that people actually need. There's no question that those swanky VIPs will bounce back.

However, there are still a few weeds in the garden. Just like in any other sector, you can still find tech companies that lack pricing power, have stinky profits and are overvalued for what they offer.

Look toward a financial-first approach. Stick with companies that have staying power amid the current environment — aka, those that have attractive valuation, noticeable profit margins and those that treat their shareholders well without the threat of overextending their dividends.

Should you funnel money out of the tech sector? (Your Bank of America stock might look more attractive right now.) It's true that financial companies, consumer staples and others may work to your advantage in a rising-inflation environment. However, it's important to understand that the right tech companies can take this pressure-cooker environment due to their stability and ability to manage headwinds. Focusing on company profit, cash flow and deployment of capital should benefit you most, as should dodging public companies that cannot produce adequate cash flow. When in doubt, check the fundamentals.

When Do Technology Stocks Do Well?

What are technology stocks' favorite breeding ground? One of the universal truths is that tech stocks do well when the economy isn't in freefall.

Tech stocks typically offer smoking returns despite higher premiums than most other stocks in all other categories. That's why investors scamper after them like they're fistfuls of golden-ticket laden Wonka bars. Tech stocks have definite battle scars from the first half of the year, and as the Fed shuttles an electric currency-like shutdown toward Americans (again) tech stocks (including new technology to invest in) could face even more challenges over the rest of the year.

The Nasdaq Composite has lost over a third of its value compared to its all-time peak last November 2021. Apple (AAPL) fell over 21% during the past six months and Alphabet (GOOG) ratcheted down the same amount.

Top Technology Stocks List

Let's take a look at three of the best technology stock examples prior to help you choose the right investments for your portfolio.

This company hardly needs an introduction. However, Apple Inc. designs and sells smartphones, computers and tablets and wearables and accessories with product brands like iPhone, Mac, iPad, AirPods Max, AirPods, Apple TV, Apple Watch, Beats products, HomePod and iPod touch.

The company also provides support services; cloud services and the App Store, the Apple Arcade, Apple Music and Apple News+ as well as the Apple Card and Apple Pay. It also operates through retail and online stores, direct sales force and third-party cellular network carriers, wholesalers, retailers and resellers.

Microsoft Corporation (NASDAQ:MSFT)

Microsoft Corporation develops and sells computers and cloud-based and on-premises business solutions, including services and brands such as SQL, Windows Servers, Visual Studio, System Center and as well as GitHub and Nuance. It offers other brands like Surface, PC accessories, PCs, tablets, gaming and entertainment consoles, Xbox hardware and Xbox content and a wide variety of other services.

Alphabet Inc. operates through Google Services, Google Cloud and other segments and supports Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search and YouTube. It also sells apps and in-app purchases and digital content in the Google Play store as well as Fitbit wearable devices, Google Nest home products, Pixel phones and supports Gmail, Docs, Drive, Calendar and Meet.

Learn more about deepening your investment by investing in quantum computing.

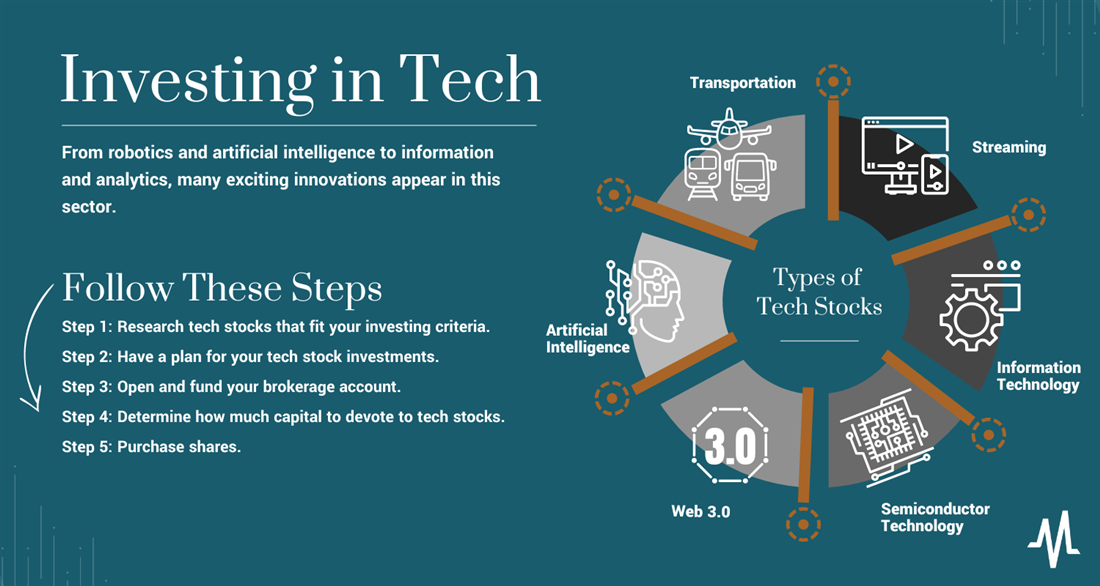

How to Invest in Technology Stocks

If you think you might want to invest in technology stocks, what is the correct approach? Let's take a look at how to evaluate companies, open a brokerage account and buy shares.

Step 1: Evaluate companies.

Analysis can help you decide whether technology makes sense for your specific needs. Evaluation can also help you identify any red flags as you consider certain companies. You may want to take a look at the following evaluation metrics: dividend yield, the dividend payout ratio, earnings per share and price-to-earnings ratio, for example. Let's take a brief look at each metric:

- Dividend yield: Many technology companies pay dividends, which means that a company pays back a certain amount to investors. How do you know whether a company offers a good dividend? The dividend yield lets you know the percentage of a share price a company will give shareholders. You can find the dividend share price by taking dividends per share divided by the current share price. In other words, let's say a company offers $1 in dividends per year and the stock costs $30 per share. In this case, the dividend yield is 3%. Higher-yield dividends can be risky, so skip over companies that seem to offer a much higher dividend yield than their competitors.

- Dividend payout ratio: The dividend payout ratio is the percentage of a company's earnings paid out as dividends. The lower the payout ratio, the more sustainable the dividend will be. If a company offers a dividend, you'll want to make sure that you'll be able to keep bringing in the dividend, rather than a company's dividend drying up after a year or two. Let's say a company earns $1 million and issues $50,000 in dividends. The payout ratio would be $50,000 / $1 million = 5% in this case.

- Earnings per share (EPS): EPS simply shows how many outstanding shares of stock a company has. You can figure this out by taking a company's quarterly or annual net income and dividing by the number of outstanding shares of stock it owns.

- Price-to-earnings (P/E) ratio: The price-to-earnings (P/E) ratio helps show you whether a company is fairly valued. You can divide a company's share price by its earnings per share to find its P/E ratio.

There are other metrics you can use to figure out exactly what your needs are. Make sure you determine these ahead of time and evaluate which type of company makes sense for your risk tolerance and future goals.

Step 2: Open a brokerage account.

Do you have a brokerage account? If you don't already have a brokerage account, choose the right option for you and fund your account. Luckily, it's easy to find a great one through a robo-advisor, an AI-operated brokerage — good luck getting in touch with customer service, though!

You may also consider choosing a full-service stockbroker or a financial advisor who can meet with you in person and will help you choose your investments. You may also be able to buy stock directly from the company. Take a look at the fees involved, the platform that the robo-advisor uses (if you choose to go that route) and other things that you believe you need in order to successfully invest.

Step 3: Buy your shares and reinvest.

Once you take a few minutes to set up your brokerage account, choose the number of shares you want to purchase and buy. Again, make sure that you choose the right investments that meet your goals and timeline for investment. Also consider diversifying, which means that you spread around the type and number of investments you purchase. Consider reinvesting on a regular basis, such as on a monthly basis, in order to maximize your investment potential.

Technology Stock ETFs

Technology stocks have traditionally been one of the hottest perks of the stock market. Its track record will always be sizzling, so it's worth considering never giving up on this sector.

If you're one of the investors who wouldn't dream of veering away from tech investing, you're likely to believe in the power of ample research to make the right decisions. That's a healthy view, especially when you understand that a "top stocks list" from today won't necessarily be a magic orb in helping you invest for the future.

If you're looking for automatic diversification, you may want to consider an exchange-traded fund (ETF). An ETF works like a mutual fund (a pooled investment) but can be traded at any point during the trading day, like a stock. Take a look at the following tech stock ETFs:

- Technology Select Sector SPDR Fund (NYSEARCA: XLK)

- Vanguard Growth ETF (NYSEARCA: VUG)

- Vanguard Mega Cap Growth ETF (NYSEARCA: MGK)

- Vanguard Information Technology Index (NYSEARCA: VGT)

- ARK Innovation ETF (NYSEARCA: ARKK)

- Invesco QQQ ETF (NYSEARCA: QQQ)

- Direxion Daily Technology Bull 3x Shares (NYSEARCA: TECL)