I’m guessing you heard about the plunge in Tesla (TSLA) stock spurred by founder Elon Musk’s recent tweet asking if he should sell 10% of his shares.

(The tweet—a poll of Twitter users—garnered a positive response, by the way; Musk says he’ll abide by it.)

I know—another bizarre Musk tweet doesn’t seem to mean much to us income investors. But this one is different, because as hard as it may be to believe, it’s telling us one thing: buy municipal bonds—an asset class many investors dismiss as “sleepy.” That’s not true: there’s a reason why “munis” are favored among billionaires, starting with their huge tax-free dividends.

And what Musk’s tweet is telling us (even if Musk himself doesn’t realize it) is that if we buy munis today, through closed-end funds (CEFs) like the one we’ll discuss below, we’ll get in just before a rush of new investors. And we’ll be pocketing yields that could be worth more than 8% to us, too!

Muni Bonds: Musk’s New BFFs?

Let’s start with why Musk posted this poll: he was responding to recent talk in DC about taxing the unrealized stock-market gains of billionaires. Specifically, the prospective tax aims to curb their regularly used strategy of keeping their shares unsold and borrowing against them to fund their lifestyles, thereby skirting the capital gains taxes they’d have to pay on any sales.

But if unrealized gains were taxed, billionaires would likely sell more shares and, more importantly, find tax-advantaged alternatives. That’s where munis come in.

The Muni Hack to Tax-Free Income

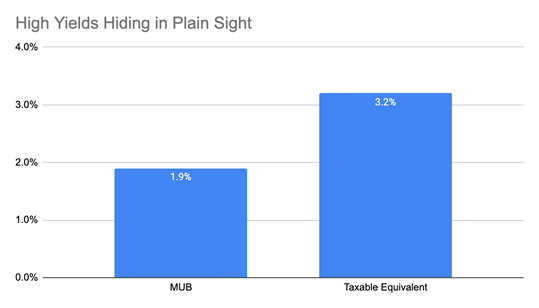

Many investors yawn when they hear about munis because the benchmark index fund for the asset class, the iShares National Muni Bond ETF (MUB), yields a paltry 1.9%. And a long-term return chart for MUB is pretty flat compared to the S&P 500.

Munis Look Like a Ho-Hum Option—on the Surface

But if you dig deeper, munis get a lot more interesting. Remember that MUB’s 1.9% income stream is 100% tax-free for qualifying investors (and most Americans qualify). That means, to get the equivalent of that 1.9% cash flow with dividend-paying stocks (or real estate investment trusts or junk bonds), you’d have to get a 3.2% yield if you’re in the highest tax bracket.

Source: CEF Insider

Of course, us CEF investors know that we can do a lot better than MUB by skipping the ETF option and going with a muni-bond CEF.

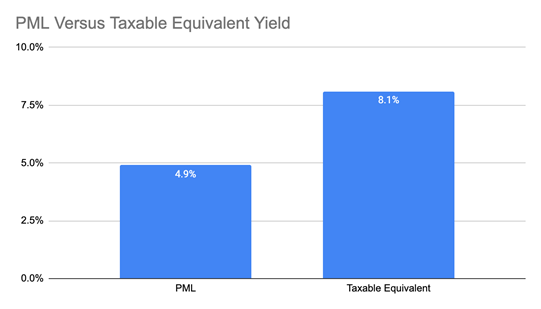

A Muni-Bond CEF Whose 4.9% Yield “Transforms” Into 8.1%

That brings me to the fund we’re spotlighting today, the PIMCO Municipal Income Fund II (PML), which yields 4.9% tax-free. That’s equal to an 8.1% taxable yield if you’re in the highest tax bracket.

Source: CEF Insider

What’s more, PML has easily beaten MUB in the last decade, with a solid 8.9% annualized total return. In other words, it’s done just what we CEF Insider members want it to: deliver strong and steady price gains while letting us enjoy our dividend in peace. (It’s worth noting, as well, that our default risk is low here: fewer than 0.001% of muni bonds default.)

Muni-Bond CEFs Give Us a “Heads You Win, Tails You Win” Setup

If an unrealized-gains tax is pushed through, or even if just a hike in billionaires’ taxes goes through, money will inevitably shift into the muni-bond market, moving prices higher.

And even if none of these tax plans materialize, anxiety about higher taxes on the rich won’t go away—a billionaire tax has been a talking point for over a decade now. And while that’s in the ether, investors will see value in top-performing muni-bond funds like PML, due to their lower volatility and tax-free income streams.

4 MORE “Billionaires’ Favorite” CEFs Yielding 7.3%+

It isn’t just municipal-bond CEFs that are attracting the billionaire class—America’s ultra-rich have been investing in them for decades, including business titans like Bill Gates, Bill Ackman, Jeffrey Gundlach and Boaz Weinstein, who made a killing betting against the ridiculous trades of JPMorgan’s so-called “London Whale.”

Now you can join this esteemed group with the 4-CEF “instant portfolio” I’ll share with you right here.

Inside you’ll discover 4 CEFs from across the market, with funds holding the best infrastructure plays to tap President Biden’s new spending plans; top high-yield bonds for the rising-rate environment we’re facing today; convertible bonds, which can transform from bonds to stocks to grab the biggest upside; and the industrial stocks best positioned to ride the recovery.

All told, these unsung funds yield 7.3%, on average. And their discounts are so deep I’m calling for 20% price upside in the next 12 months!

Now is the time to buy them. Click here and I’ll share my complete research on each of these 4 stout income plays, including their names, tickers, current yields, discounts and all the other “need to know” stats.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report