I recently accomplished something that had been on my “to do” list for no fewer than three months.

I figured out how to log into my 401(K)!

You would think a simple “password reset” would not be that difficult, especially for a guy who has started a software company or three in his day. Well, I’m not embarrassed, just glad that my long personal investing nightmare is over.

What is it about 401(K) access? It’s a circus when we try to log into my wife’s retirement plan, too. (Any task that starts with “logging into her company’s VPN” is off to a rough start.)

Most people I know don’t even bother checking these accounts. Which is probably good (and perhaps a big unintentional benefit of this user unfriendliness!). It is tough to beat the “set it and forget it” rhythm of regular retirement contributions, where dollar cost averaging works in our favor.

That’s what I’ve done with my own 401(K) since we launched the program on April 6, 2016. Others at my firm, unfortunately, were too scared to invest in stocks after the violent selloff in early ’16, so they stuck their allocations in cash—and, sadly, never reinvested!

The dividend growth fund I have plowed 100% of my allocations into, Vanguard Dividend Growth (VDIGX), has meanwhile delivered total returns of 103% since our retirement plan’s inception. That’s quite a bit ahead of the near zero my cash-focused colleagues have generated.

Now, I did underperform the S&P 500 in the VDIGX, so my choice was not perfect. But I’m using this real-life example to illustrate two key points.

First, when in doubt, invest in equities—not cash! The stock market goes up two-thirds of the time. The deck is skewed in our favor. Plus, the dealer (the Federal Reserve) really wants us to win.

My second point is that most mutual funds are flawed. VDIGX is a well-run fund and so popular that it closes itself to new money from time to time. But you and I can do better, simply by cherry picking the current holdings of VDIGX.

Heck, we can even buy the stocks that manager Donald Gilbride should be buying!

I agree with Don on his top holding, UnitedHealth (UNH). The largest health carrier in the US is one of the most consistent profit growers out there. It’s boosted EPS (earnings per share) at a 10% annualized rate over the last decade, enjoying its lucrative business niche of health care insurance.

Now, its perennial growth isn’t simply due to good fortune. The firm had the foresight in 2011 to start Optum, its own technology driven unit. Optum provides pharmacy benefits, runs clinics and supplies data analytics and other cutting-edge tech to streamline healthcare.

When we bought UNH in January 2020 in my Hidden Yields dividend growth service, Optum’s business had boomed so much that it accounted for nearly half of the company’s overall profits! We reasoned that with Optum’s earnings rising faster than the firm’s legacy business, it was a sweet inflection point for us to purchase shares.

Likewise, health care organizations are adopting the Optum platform to help sort through huge mounds of data to make better decisions. For example, there are reams of clinical patient data that could help establish industry best practices around treatments and techniques.

Problem is, until recently, much of it has still been on paper! As this information becomes digitized, Optum is able to model the data and provide answers to questions that health care providers may or may not have thought to ask, such as:

- Which pediatric asthma patients are most likely to visit the ER?

- Which heart failure patients are at highest risk of hospitalization in the next 6 months?

(Source: Optum)

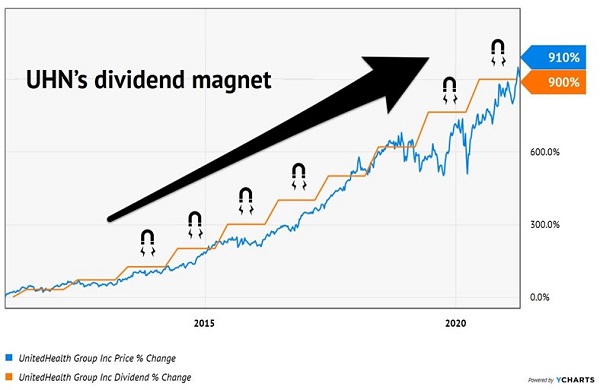

Granted, we don’t need Optum or a supercomputer to model UNH’s share price. The stock simply follows its dividend higher over time. Since January 2011, the stock is up 910% thanks to its dividend, which gained 900% over the same time period:

No Optum Needed to Model This Payout-Price Path

(Please note, the total return for UNH—which includes dividends received—clocked in even higher at 1,080%.)

Any stock that climbs with this payout is one we want to own. UNH has doubled its dividend over the past five years, and management just announced its latest 16% hike.

So…would I add new money to UnitedHealth today?

Ask me this Friday, when we deliver our full Hidden Yields best buy list to subscribers’ inboxes.

I wish VDIGX manager Don would buy some of these names—perhaps you can tip him off.

If you’re reading this, you are not a current Hidden Yields subscriber. But I have good news for you—it’s not necessary to wait until Friday to get my seven best buys! Click here to read my seven favorite recession-proof dividend growth buys, including stock names, tickers and target prices.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report