Consider this; the S&P 500 hadn’t even reached the lows of its Q1 selloff in mid-March when Walmart’s (NYSE: WMT) stock was being upgraded by analysts. Equity markets were in turmoil as the coronavirus pandemic drove

widespread shutdowns across both industries and national borders but that didn’t stop the likes of Credit Suisse or Oppenheimer coming out strong on one of the world’s biggest employers. With more people than ever before confined to their houses and with social distancing measures becoming the norm, the analysts saw a major structural shift happening and pinpointed Walmart as one of the main benefactors.

With smaller chains and individual stores feeling the effect of tightening margins and struggling to stay afloat, the likes of Walmart and Amazon (NASDAQ: AMZN), with their multi-channel retailers and multi-category offerings, were able to embrace the new environment. Online shopping and home delivery became almost mandatory overnight and investors haven’t been slow about seeing how well-positioned Walmart is to capture the shift.

Strong Bid

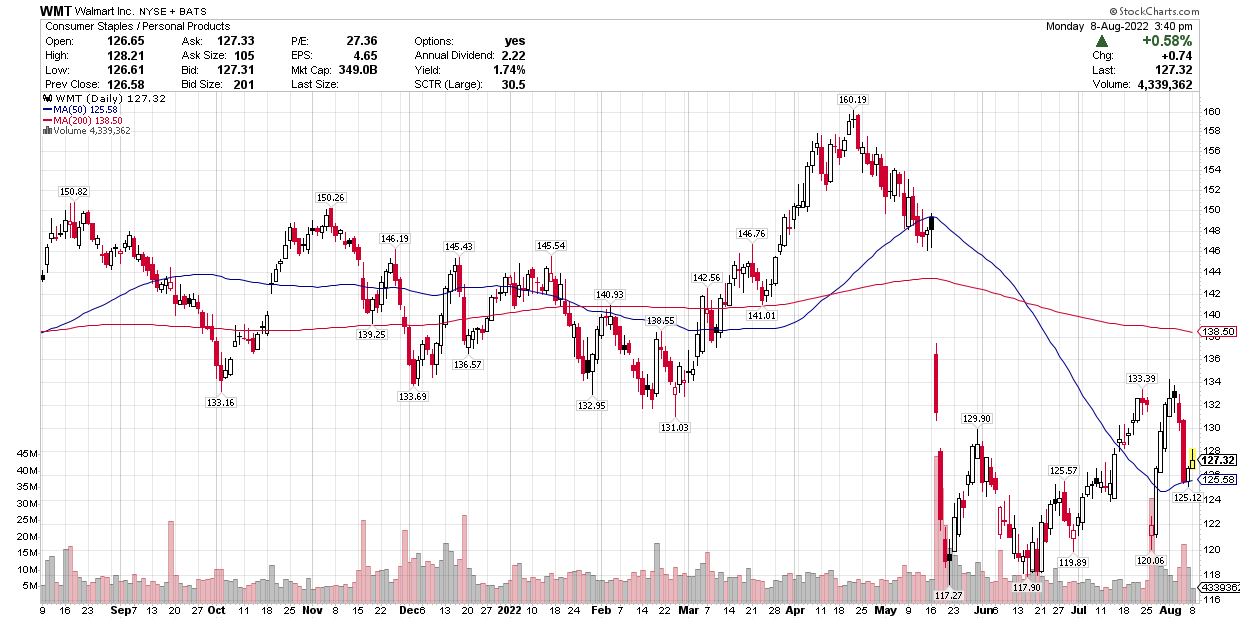

While Walmart’s shares saw selling towards the end of February and through the first half of March, it was light compared to what was happening elsewhere. At their low point, they were down around 12% from January levels but were already catching a bid by 16 March. In contrast, the S&P 500 fell more than 30% and didn’t catch a bid until a week later. The benchmark index has staged an impressive rally since then but it’s still off its pre-crash levels by about 15% while Walmart is currently up 7% based on Tuesday’s close. Towards the end of April the stock was even higher and actually printed fresh all-time highs as investors flooded in. There’s only a handful of names out there who can claim to have hit their highest prices ever in the midst of one of the biggest market crashes ever.

In a report published last week, independent research firm Gordon Haskett published results of a consumer survey that listed Amazon as the number one retailer of choice but with a falling score compared to previous results while Walmart was in second place and gaining traction. These kinds of insights have not been missed. Wall Street has baked plenty of expectations into Walmart’s performance during the second half of Q1 and all eyes will be watching the company’s upcoming earnings release (19 May) to see if they justify it.

Analyst Expectations

The street is expecting Q1 US comparable sales to be up 9.3% versus the prior forecast of 5.5% and the consensus analyst estimate of 3.5%. Analyst Seth Sigman from Credit Suisse reiterated the company’s Outperform rating on the stock in a note earlier this month and said "we raise our comps estimates for 1H, although we lower EPS to reflect incremental margin pressures/ cost headwinds/ FX. Based on our work, we are more confident in sales outlook past Q1 while we also believe that WMT will be better positioned to navigate what could be very choppy consumer waters ahead, and benefit med/long-term from significant share gains from the structural changes in shopping behavior we are seeing."

In terms of appearances, it looks like the optimism of analysts and investors will be justified. On Tuesday this week, Walmart announced another round of cash bonuses to its full time and part-time employees, as a gesture of appreciation for all their hard work. This round of bonuses will cost $390 million and comes on top of $545 million worth of bonuses already distributed earlier this year. That’s almost $1 billion in bonuses and you could look at this as a kind of internal dividend. This is not something that would (or should) be happening if management felt current prices and projections were not justified.

For investors considering getting involved, it’s worth noting that a lot of optimism and forecasted figures from an unprecedented period of economic volatility have been baked into the current share price. Walmart has done well out of the uncertainty so far, but if results are way off expectations, expect volatility in the shares as Wall Street adjusts the stock price to reality.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report