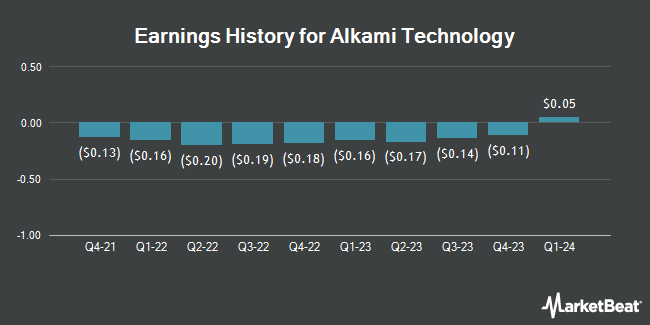

Alkami Technology (NASDAQ:ALKT - Get Free Report) announced its earnings results on Wednesday. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.02 by $0.03, Briefing.com reports. The business had revenue of $76.10 million during the quarter, compared to the consensus estimate of $75.57 million. Alkami Technology had a negative net margin of 20.42% and a negative return on equity of 15.31%. Alkami Technology's quarterly revenue was up 26.8% on a year-over-year basis. During the same quarter last year, the firm earned ($0.16) earnings per share. Alkami Technology updated its FY 2024 guidance to EPS and its Q2 2024 guidance to EPS.

Alkami Technology (NASDAQ:ALKT - Get Free Report) announced its earnings results on Wednesday. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.02 by $0.03, Briefing.com reports. The business had revenue of $76.10 million during the quarter, compared to the consensus estimate of $75.57 million. Alkami Technology had a negative net margin of 20.42% and a negative return on equity of 15.31%. Alkami Technology's quarterly revenue was up 26.8% on a year-over-year basis. During the same quarter last year, the firm earned ($0.16) earnings per share. Alkami Technology updated its FY 2024 guidance to EPS and its Q2 2024 guidance to EPS.

Alkami Technology Stock Performance

Shares of NASDAQ:ALKT traded up $0.64 during mid-day trading on Friday, reaching $27.33. 622,085 shares of the company traded hands, compared to its average volume of 321,106. The firm has a market cap of $2.66 billion, a PE ratio of -45.10 and a beta of 0.40. Alkami Technology has a 52 week low of $11.23 and a 52 week high of $27.87. The company's 50 day moving average price is $24.12 and its 200-day moving average price is $23.35. The company has a debt-to-equity ratio of 0.06, a current ratio of 3.77 and a quick ratio of 3.77.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on ALKT shares. JMP Securities restated a "market outperform" rating and issued a $30.00 target price on shares of Alkami Technology in a report on Monday, April 15th. The Goldman Sachs Group lowered shares of Alkami Technology from a "buy" rating to a "neutral" rating and upped their target price for the stock from $23.00 to $27.00 in a report on Tuesday, January 23rd. Craig Hallum raised their price objective on shares of Alkami Technology from $30.00 to $31.00 and gave the company a "buy" rating in a research report on Thursday. TheStreet raised shares of Alkami Technology from a "d" rating to a "c-" rating in a research note on Thursday, February 29th. Finally, William Blair restated an "outperform" rating on shares of Alkami Technology in a report on Thursday, February 29th. Three research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, Alkami Technology presently has an average rating of "Moderate Buy" and an average target price of $26.90.

Read Our Latest Research Report on Alkami Technology

Insider Transactions at Alkami Technology

In related news, insider Stephen Bohanon sold 29,052 shares of Alkami Technology stock in a transaction on Monday, March 18th. The shares were sold at an average price of $23.02, for a total transaction of $668,777.04. Following the transaction, the insider now owns 434,823 shares in the company, valued at approximately $10,009,625.46. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In other Alkami Technology news, insider Stephen Bohanon sold 29,052 shares of the stock in a transaction that occurred on Monday, March 18th. The shares were sold at an average price of $23.02, for a total transaction of $668,777.04. Following the completion of the sale, the insider now directly owns 434,823 shares of the company's stock, valued at approximately $10,009,625.46. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO W Bryan Hill sold 50,089 shares of the business's stock in a transaction on Friday, March 8th. The stock was sold at an average price of $23.91, for a total transaction of $1,197,627.99. Following the completion of the sale, the chief financial officer now owns 508,501 shares in the company, valued at approximately $12,158,258.91. The disclosure for this sale can be found here. Insiders sold a total of 112,734 shares of company stock valued at $2,658,864 over the last three months. Corporate insiders own 38.00% of the company's stock.

About Alkami Technology

(

Get Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report