TimesSquare Capital Management LLC increased its position in AtriCure, Inc. (NASDAQ:ATRC - Free Report) by 7.9% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 976,110 shares of the medical device company's stock after purchasing an additional 71,275 shares during the quarter. TimesSquare Capital Management LLC owned approximately 2.06% of AtriCure worth $34,837,000 as of its most recent filing with the Securities & Exchange Commission.

TimesSquare Capital Management LLC increased its position in AtriCure, Inc. (NASDAQ:ATRC - Free Report) by 7.9% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 976,110 shares of the medical device company's stock after purchasing an additional 71,275 shares during the quarter. TimesSquare Capital Management LLC owned approximately 2.06% of AtriCure worth $34,837,000 as of its most recent filing with the Securities & Exchange Commission.

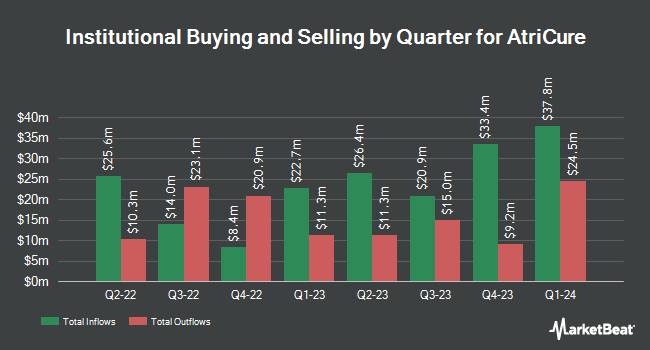

Several other hedge funds also recently made changes to their positions in the company. RiverPark Advisors LLC purchased a new position in shares of AtriCure during the third quarter valued at approximately $27,000. Allspring Global Investments Holdings LLC boosted its holdings in AtriCure by 31.5% in the third quarter. Allspring Global Investments Holdings LLC now owns 2,074 shares of the medical device company's stock worth $91,000 after acquiring an additional 497 shares in the last quarter. Victory Capital Management Inc. grew its stake in shares of AtriCure by 22.9% in the fourth quarter. Victory Capital Management Inc. now owns 6,202 shares of the medical device company's stock worth $221,000 after acquiring an additional 1,155 shares during the last quarter. HighMark Wealth Management LLC increased its holdings in shares of AtriCure by 223.0% during the fourth quarter. HighMark Wealth Management LLC now owns 9,125 shares of the medical device company's stock valued at $326,000 after acquiring an additional 6,300 shares in the last quarter. Finally, Vanguard Personalized Indexing Management LLC raised its position in shares of AtriCure by 38.2% in the 3rd quarter. Vanguard Personalized Indexing Management LLC now owns 8,715 shares of the medical device company's stock worth $382,000 after purchasing an additional 2,408 shares during the last quarter. 99.11% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the company. Oppenheimer upgraded AtriCure from a "market perform" rating to an "outperform" rating and set a $32.00 price target for the company in a research note on Tuesday, April 23rd. Canaccord Genuity Group dropped their price target on AtriCure from $57.00 to $49.00 and set a "buy" rating on the stock in a research note on Thursday, May 2nd. StockNews.com cut AtriCure from a "hold" rating to a "sell" rating in a research report on Wednesday, March 27th. Stifel Nicolaus dropped their target price on AtriCure from $50.00 to $42.00 and set a "buy" rating on the stock in a research report on Friday, February 16th. Finally, UBS Group upped their price target on shares of AtriCure from $57.00 to $58.00 and gave the company a "buy" rating in a research report on Friday, February 16th. One equities research analyst has rated the stock with a sell rating and seven have given a buy rating to the company. According to MarketBeat.com, AtriCure currently has an average rating of "Moderate Buy" and an average price target of $49.78.

View Our Latest Report on AtriCure

Insider Activity at AtriCure

In other AtriCure news, insider Karl S. Dahlquist sold 8,231 shares of the company's stock in a transaction that occurred on Tuesday, March 5th. The stock was sold at an average price of $37.36, for a total value of $307,510.16. Following the completion of the transaction, the insider now directly owns 52,839 shares in the company, valued at approximately $1,974,065.04. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other AtriCure news, insider Karl S. Dahlquist sold 8,231 shares of the business's stock in a transaction on Tuesday, March 5th. The shares were sold at an average price of $37.36, for a total value of $307,510.16. Following the sale, the insider now owns 52,839 shares in the company, valued at approximately $1,974,065.04. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, insider Justin J. Noznesky sold 1,500 shares of the firm's stock in a transaction dated Tuesday, March 12th. The shares were sold at an average price of $36.72, for a total value of $55,080.00. Following the transaction, the insider now owns 74,284 shares of the company's stock, valued at approximately $2,727,708.48. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 14,616 shares of company stock valued at $504,932. 3.20% of the stock is owned by company insiders.

AtriCure Stock Performance

NASDAQ ATRC traded down $1.18 on Wednesday, reaching $20.69. 555,111 shares of the stock were exchanged, compared to its average volume of 714,474. The firm has a market capitalization of $984.60 million, a PE ratio of -25.86 and a beta of 1.41. AtriCure, Inc. has a one year low of $20.19 and a one year high of $59.61. The company's 50-day simple moving average is $28.08 and its two-hundred day simple moving average is $32.82. The company has a current ratio of 4.00, a quick ratio of 2.83 and a debt-to-equity ratio of 0.16.

AtriCure (NASDAQ:ATRC - Get Free Report) last released its earnings results on Wednesday, May 1st. The medical device company reported ($0.25) earnings per share for the quarter, missing analysts' consensus estimates of ($0.23) by ($0.02). The firm had revenue of $108.90 million for the quarter, compared to analysts' expectations of $106.86 million. AtriCure had a negative net margin of 8.98% and a negative return on equity of 7.85%. The firm's quarterly revenue was up 16.5% compared to the same quarter last year. During the same quarter last year, the firm posted ($0.23) EPS. Analysts expect that AtriCure, Inc. will post -0.75 EPS for the current fiscal year.

About AtriCure

(

Free Report)

AtriCure, Inc develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, Europe, the Asia-Pacific, and internationally. The company offers Isolator Synergy Clamps, single-use disposable radio frequency products; multifunctional pens and linear ablation devices, such as the MAX Pen device that enables surgeons to evaluate cardiac arrhythmias, perform temporary cardiac pacing, sensing, and stimulation, and ablate cardiac tissue with the same device; and the Coolrail device, which enables users to make longer linear lines of ablation.

See Also

Want to see what other hedge funds are holding ATRC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AtriCure, Inc. (NASDAQ:ATRC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AtriCure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AtriCure wasn't on the list.

While AtriCure currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report