Steele Capital Management Inc. acquired a new stake in The First Bancshares, Inc. (NASDAQ:FBMS - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 60,973 shares of the bank's stock, valued at approximately $1,788,000. Steele Capital Management Inc. owned 0.20% of First Bancshares as of its most recent SEC filing.

Steele Capital Management Inc. acquired a new stake in The First Bancshares, Inc. (NASDAQ:FBMS - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 60,973 shares of the bank's stock, valued at approximately $1,788,000. Steele Capital Management Inc. owned 0.20% of First Bancshares as of its most recent SEC filing.

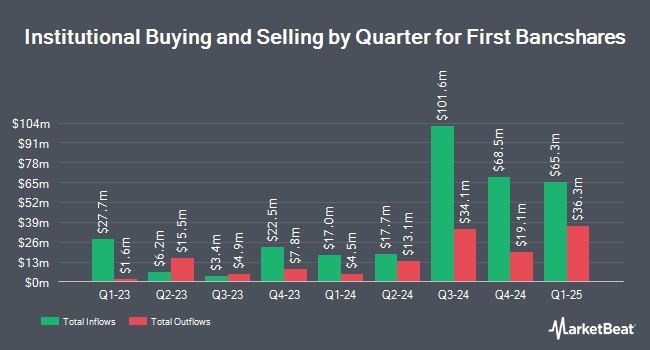

A number of other hedge funds have also recently modified their holdings of FBMS. Vanguard Group Inc. raised its position in First Bancshares by 0.8% during the third quarter. Vanguard Group Inc. now owns 1,530,263 shares of the bank's stock worth $41,271,000 after acquiring an additional 12,212 shares during the period. North Reef Capital Management LP raised its position in shares of First Bancshares by 0.8% during the 3rd quarter. North Reef Capital Management LP now owns 1,106,781 shares of the bank's stock worth $29,850,000 after purchasing an additional 8,945 shares during the last quarter. Kennedy Capital Management LLC raised its position in shares of First Bancshares by 1.8% during the 3rd quarter. Kennedy Capital Management LLC now owns 340,112 shares of the bank's stock worth $9,173,000 after purchasing an additional 6,011 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of First Bancshares by 4.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 224,195 shares of the bank's stock worth $6,047,000 after purchasing an additional 8,642 shares during the last quarter. Finally, Bank of New York Mellon Corp raised its position in shares of First Bancshares by 0.7% during the 3rd quarter. Bank of New York Mellon Corp now owns 134,660 shares of the bank's stock worth $3,632,000 after purchasing an additional 904 shares during the last quarter. Hedge funds and other institutional investors own 69.95% of the company's stock.

First Bancshares Stock Up 1.0 %

Shares of First Bancshares stock traded up $0.23 during trading hours on Monday, hitting $24.13. The company had a trading volume of 146,598 shares, compared to its average volume of 161,213. The company's 50-day moving average is $24.68 and its two-hundred day moving average is $25.95. The First Bancshares, Inc. has a twelve month low of $22.82 and a twelve month high of $32.06. The company has a debt-to-equity ratio of 0.54, a current ratio of 0.85 and a quick ratio of 0.85. The company has a market cap of $753.34 million, a P/E ratio of 9.58 and a beta of 0.88.

First Bancshares Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, May 23rd. Stockholders of record on Tuesday, May 7th will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 4.14%. The ex-dividend date is Monday, May 6th. First Bancshares's dividend payout ratio (DPR) is currently 39.68%.

Analyst Ratings Changes

Several research analysts recently weighed in on the stock. StockNews.com downgraded shares of First Bancshares from a "hold" rating to a "sell" rating in a research report on Saturday, April 13th. TheStreet lowered shares of First Bancshares from a "b-" rating to a "c+" rating in a research note on Wednesday, February 28th. Keefe, Bruyette & Woods restated a "market perform" rating and issued a $28.00 price target on shares of First Bancshares in a research report on Friday, January 26th. Finally, Stephens reiterated an "overweight" rating and set a $34.00 price objective on shares of First Bancshares in a research report on Wednesday, January 17th. One investment analyst has rated the stock with a sell rating, one has given a hold rating and two have given a buy rating to the company. According to MarketBeat.com, First Bancshares presently has a consensus rating of "Hold" and a consensus target price of $32.00.

Get Our Latest Analysis on FBMS

About First Bancshares

(

Free Report)

The First Bancshares, Inc operates as the bank holding company for The First Bank that provides general commercial and retail banking services. The company operates through three segments: Commercial/Retail Bank, Mortgage Banking Division, and Holding Company. It offers deposit services, including checking, NOW, and savings accounts; other time deposits, such as daily money market accounts and longer-term certificates of deposit; and individual retirement and health savings accounts.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider First Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Bancshares wasn't on the list.

While First Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report