Readystate Asset Management LP bought a new position in shares of GLOBALFOUNDRIES Inc. (NASDAQ:GFS - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 58,098 shares of the company's stock, valued at approximately $3,521,000.

Readystate Asset Management LP bought a new position in shares of GLOBALFOUNDRIES Inc. (NASDAQ:GFS - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 58,098 shares of the company's stock, valued at approximately $3,521,000.

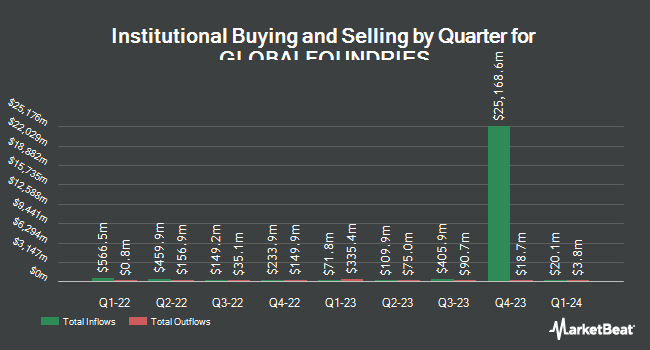

Several other hedge funds have also made changes to their positions in GFS. Treasurer of the State of North Carolina raised its holdings in GLOBALFOUNDRIES by 0.5% during the third quarter. Treasurer of the State of North Carolina now owns 34,449 shares of the company's stock worth $2,005,000 after purchasing an additional 180 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank raised its holdings in GLOBALFOUNDRIES by 50.4% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 558 shares of the company's stock worth $34,000 after purchasing an additional 187 shares in the last quarter. Vanguard Personalized Indexing Management LLC raised its holdings in GLOBALFOUNDRIES by 6.2% during the third quarter. Vanguard Personalized Indexing Management LLC now owns 5,389 shares of the company's stock worth $314,000 after purchasing an additional 316 shares in the last quarter. Principal Financial Group Inc. raised its holdings in GLOBALFOUNDRIES by 5.5% during the third quarter. Principal Financial Group Inc. now owns 6,160 shares of the company's stock worth $358,000 after purchasing an additional 321 shares in the last quarter. Finally, Balentine LLC raised its holdings in GLOBALFOUNDRIES by 7.8% during the second quarter. Balentine LLC now owns 4,525 shares of the company's stock worth $292,000 after purchasing an additional 326 shares in the last quarter.

Wall Street Analysts Forecast Growth

GFS has been the subject of a number of research analyst reports. Citigroup cut shares of GLOBALFOUNDRIES from a "buy" rating to a "neutral" rating and dropped their target price for the company from $70.00 to $56.00 in a report on Wednesday, February 14th. Robert W. Baird dropped their target price on shares of GLOBALFOUNDRIES from $70.00 to $63.00 and set an "outperform" rating for the company in a report on Wednesday, February 14th. Susquehanna reissued a "neutral" rating and set a $48.00 price objective (down from $65.00) on shares of GLOBALFOUNDRIES in a research note on Tuesday, March 5th. Cantor Fitzgerald reissued a "neutral" rating and set a $55.00 price objective (down from $70.00) on shares of GLOBALFOUNDRIES in a research note on Monday, April 8th. Finally, JPMorgan Chase & Co. dropped their price objective on shares of GLOBALFOUNDRIES from $56.00 to $55.00 and set a "neutral" rating for the company in a research note on Wednesday, February 14th. Five analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $63.08.

Check Out Our Latest Research Report on GFS

GLOBALFOUNDRIES Stock Down 0.9 %

Shares of NASDAQ:GFS traded down $0.44 during midday trading on Wednesday, hitting $47.36. 1,242,871 shares of the company's stock traded hands, compared to its average volume of 1,560,085. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.56 and a current ratio of 2.04. The company has a market cap of $25.94 billion, a PE ratio of 25.74, a P/E/G ratio of 3.99 and a beta of 1.61. The firm's fifty day moving average price is $52.47 and its two-hundred day moving average price is $54.70. GLOBALFOUNDRIES Inc. has a twelve month low of $46.73 and a twelve month high of $68.57.

GLOBALFOUNDRIES (NASDAQ:GFS - Get Free Report) last released its quarterly earnings results on Tuesday, February 13th. The company reported $0.64 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.59 by $0.05. GLOBALFOUNDRIES had a net margin of 13.80% and a return on equity of 10.16%. The firm had revenue of $1.85 billion for the quarter, compared to the consensus estimate of $1.85 billion. During the same quarter in the previous year, the firm posted $1.37 EPS. The firm's quarterly revenue was down 11.8% on a year-over-year basis. On average, equities research analysts anticipate that GLOBALFOUNDRIES Inc. will post 1 EPS for the current fiscal year.

GLOBALFOUNDRIES Profile

(

Free Report)

GLOBALFOUNDRIES Inc operates as a semiconductor foundry worldwide. The company manufactures a range of semiconductor devices, including microprocessors, mobile application processors, baseband processors, network processors, radio frequency modems, microcontrollers, and power management units; and offers mainstream wafer fabrication services and technologies.

See Also

Want to see what other hedge funds are holding GFS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for GLOBALFOUNDRIES Inc. (NASDAQ:GFS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GLOBALFOUNDRIES, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GLOBALFOUNDRIES wasn't on the list.

While GLOBALFOUNDRIES currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report