State of New Jersey Common Pension Fund D lowered its position in H World Group Limited (NASDAQ:HTHT - Free Report) by 11.6% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 383,507 shares of the company's stock after selling 50,556 shares during the period. State of New Jersey Common Pension Fund D owned about 0.12% of H World Group worth $12,824,000 at the end of the most recent reporting period.

State of New Jersey Common Pension Fund D lowered its position in H World Group Limited (NASDAQ:HTHT - Free Report) by 11.6% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 383,507 shares of the company's stock after selling 50,556 shares during the period. State of New Jersey Common Pension Fund D owned about 0.12% of H World Group worth $12,824,000 at the end of the most recent reporting period.

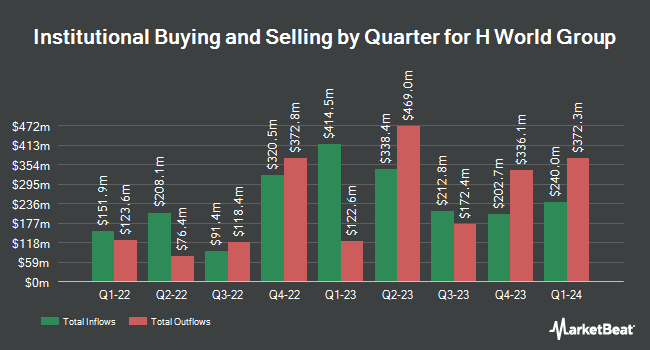

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Nordea Investment Management AB grew its position in H World Group by 344.7% during the fourth quarter. Nordea Investment Management AB now owns 367,343 shares of the company's stock valued at $12,324,000 after buying an additional 284,742 shares during the period. American Century Companies Inc. grew its position in H World Group by 6.0% during the third quarter. American Century Companies Inc. now owns 2,057,059 shares of the company's stock valued at $81,110,000 after buying an additional 116,641 shares during the period. Trexquant Investment LP grew its position in H World Group by 10.6% during the third quarter. Trexquant Investment LP now owns 178,932 shares of the company's stock valued at $7,055,000 after buying an additional 17,153 shares during the period. AIA Group Ltd grew its position in H World Group by 5.8% during the fourth quarter. AIA Group Ltd now owns 285,062 shares of the company's stock valued at $9,532,000 after buying an additional 15,502 shares during the period. Finally, Vanguard Group Inc. grew its position in H World Group by 0.7% during the third quarter. Vanguard Group Inc. now owns 8,404,958 shares of the company's stock valued at $331,407,000 after buying an additional 58,687 shares during the period. Hedge funds and other institutional investors own 46.41% of the company's stock.

H World Group Price Performance

Shares of HTHT stock traded up $0.58 during trading hours on Thursday, reaching $39.74. The stock had a trading volume of 688,725 shares, compared to its average volume of 1,855,413. The stock's fifty day simple moving average is $37.93 and its 200 day simple moving average is $35.68. The company has a current ratio of 0.69, a quick ratio of 0.69 and a debt-to-equity ratio of 0.32. H World Group Limited has a 12 month low of $30.20 and a 12 month high of $48.84. The firm has a market capitalization of $12.98 billion, a PE ratio of 22.52, a PEG ratio of 1.29 and a beta of 0.92.

H World Group (NASDAQ:HTHT - Get Free Report) last released its quarterly earnings data on Wednesday, March 20th. The company reported $0.33 EPS for the quarter, beating analysts' consensus estimates of $0.31 by $0.02. H World Group had a net margin of 18.62% and a return on equity of 31.50%. The company had revenue of $786.00 million during the quarter, compared to analyst estimates of $759.99 million. On average, equities research analysts predict that H World Group Limited will post 1.94 EPS for the current year.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on the stock. Benchmark restated a "buy" rating and set a $64.00 price target on shares of H World Group in a research report on Friday, March 22nd. Macquarie started coverage on shares of H World Group in a research report on Friday, April 19th. They set an "outperform" rating and a $48.00 target price for the company. Bank of America cut their target price on shares of H World Group from $51.00 to $43.00 and set a "buy" rating for the company in a research report on Wednesday, March 13th. Finally, JPMorgan Chase & Co. increased their target price on shares of H World Group from $40.00 to $45.00 and gave the stock an "overweight" rating in a research report on Friday, March 22nd. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, H World Group presently has a consensus rating of "Moderate Buy" and a consensus target price of $50.00.

Check Out Our Latest Analysis on HTHT

H World Group Profile

(

Free Report)

H World Group Limited, together with its subsidiaries, develops leased and owned, manachised, and franchised hotels primarily in the People's Republic of China. The company operates hotels under its own brands, such as HanTing Hotel, Ni Hao Hotel, Hi Inn, Elan Hotel, Zleep Hotels, Ibis Hotel, JI Hotel, Orange Hotel, Starway Hotel, Ibis Styles Hotel, CitiGO Hotel, Crystal Orange Hotel, IntercityHotel, Manxin Hotel, Mercure Hotel, Madison Hotel, Novotel Hotel, Joya Hotel, Blossom House, Steigenberger Hotels & Resorts, MAXX by Steigenberger, Jaz in the City, Grand Mercure, Steigenberger Icon, and Song Hotels.

Featured Stories

Want to see what other hedge funds are holding HTHT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for H World Group Limited (NASDAQ:HTHT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider H World Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H World Group wasn't on the list.

While H World Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report