Insmed (NASDAQ:INSM - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "hold" rating to a "sell" rating in a research note issued on Monday.

Insmed (NASDAQ:INSM - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "hold" rating to a "sell" rating in a research note issued on Monday.

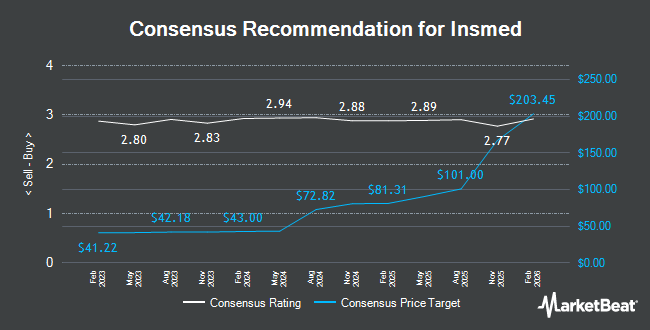

A number of other analysts also recently issued reports on INSM. Guggenheim raised their price target on shares of Insmed from $52.00 to $54.00 and gave the stock a "buy" rating in a report on Tuesday, February 27th. Wolfe Research initiated coverage on shares of Insmed in a report on Thursday, February 15th. They set an "outperform" rating and a $42.00 price target for the company. UBS Group initiated coverage on shares of Insmed in a report on Tuesday, February 27th. They set a "buy" rating and a $46.00 price target for the company. Barclays increased their price objective on shares of Insmed from $37.00 to $40.00 and gave the stock an "overweight" rating in a research report on Thursday, April 11th. Finally, Truist Financial initiated coverage on shares of Insmed in a research report on Tuesday, April 23rd. They set a "buy" rating and a $48.00 price objective for the company. One equities research analyst has rated the stock with a sell rating and twelve have issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $44.92.

View Our Latest Stock Report on INSM

Insmed Trading Up 1.6 %

INSM stock traded up $0.40 during mid-day trading on Monday, reaching $25.95. The company's stock had a trading volume of 1,394,855 shares, compared to its average volume of 1,747,257. The stock has a market cap of $3.85 billion, a PE ratio of -4.86 and a beta of 0.93. Insmed has a fifty-two week low of $18.08 and a fifty-two week high of $32.00. The company's 50 day moving average is $26.72 and its two-hundred day moving average is $27.07.

Insmed (NASDAQ:INSM - Get Free Report) last announced its quarterly earnings results on Thursday, February 22nd. The biopharmaceutical company reported ($1.28) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.13) by ($0.15). The firm had revenue of $83.70 million for the quarter, compared to analyst estimates of $82.15 million. Insmed's revenue was up 41.1% on a year-over-year basis. During the same period in the prior year, the company earned ($1.20) EPS. On average, analysts forecast that Insmed will post -4.65 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Insmed

Several institutional investors have recently modified their holdings of the company. Essex Investment Management Co. LLC lifted its position in shares of Insmed by 0.6% during the 1st quarter. Essex Investment Management Co. LLC now owns 108,629 shares of the biopharmaceutical company's stock worth $2,947,000 after purchasing an additional 622 shares during the last quarter. Fidelis Capital Partners LLC purchased a new stake in shares of Insmed during the 1st quarter worth $34,000. Principal Financial Group Inc. lifted its position in shares of Insmed by 5.9% during the 1st quarter. Principal Financial Group Inc. now owns 1,439,280 shares of the biopharmaceutical company's stock worth $39,048,000 after purchasing an additional 79,717 shares during the last quarter. China Universal Asset Management Co. Ltd. lifted its position in shares of Insmed by 72.6% during the 1st quarter. China Universal Asset Management Co. Ltd. now owns 28,569 shares of the biopharmaceutical company's stock worth $775,000 after purchasing an additional 12,018 shares during the last quarter. Finally, WCM Investment Management LLC raised its stake in Insmed by 8.4% during the 1st quarter. WCM Investment Management LLC now owns 320,001 shares of the biopharmaceutical company's stock worth $8,682,000 after acquiring an additional 24,673 shares in the last quarter.

About Insmed

(

Get Free Report)

Insmed Incorporated is a global biopharmaceutical company on a mission to transform the lives of patients with serious and rare diseases. Insmed's first commercial product is ARIKAYCE® (amikacin liposome inhalation suspension), which is approved in the United States for the treatment of Mycobacterium avium complex (MAC) lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Insmed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Insmed wasn't on the list.

While Insmed currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report