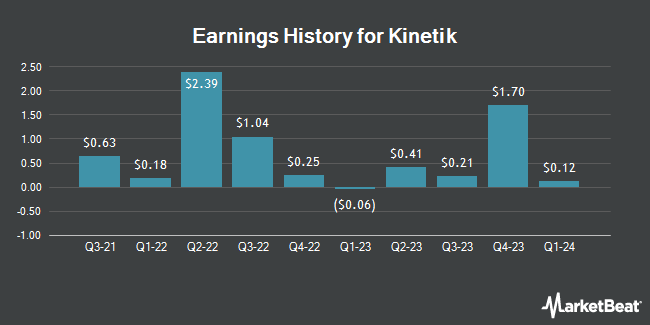

Kinetik (NASDAQ:KNTK - Get Free Report) issued its quarterly earnings results on Wednesday. The company reported $0.12 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.44 by ($0.32), Briefing.com reports. Kinetik had a negative return on equity of 49.32% and a net margin of 28.57%. The business had revenue of $341.39 million during the quarter, compared to analysts' expectations of $277.52 million. During the same quarter in the previous year, the company posted ($0.06) EPS. The company's quarterly revenue was up 21.5% on a year-over-year basis.

Kinetik (NASDAQ:KNTK - Get Free Report) issued its quarterly earnings results on Wednesday. The company reported $0.12 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.44 by ($0.32), Briefing.com reports. Kinetik had a negative return on equity of 49.32% and a net margin of 28.57%. The business had revenue of $341.39 million during the quarter, compared to analysts' expectations of $277.52 million. During the same quarter in the previous year, the company posted ($0.06) EPS. The company's quarterly revenue was up 21.5% on a year-over-year basis.

Kinetik Stock Down 1.0 %

Shares of Kinetik stock traded down $0.41 during mid-day trading on Thursday, hitting $38.96. The stock had a trading volume of 495,627 shares, compared to its average volume of 556,850. The firm has a 50-day moving average of $38.02 and a two-hundred day moving average of $35.49. The firm has a market cap of $5.99 billion, a P/E ratio of 17.38, a price-to-earnings-growth ratio of 2.00 and a beta of 2.81. Kinetik has a 12-month low of $28.82 and a 12-month high of $40.42.

Kinetik Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, May 9th. Shareholders of record on Monday, April 29th will be paid a dividend of $0.75 per share. This represents a $3.00 dividend on an annualized basis and a yield of 7.70%. The ex-dividend date is Friday, April 26th. Kinetik's dividend payout ratio (DPR) is presently 132.74%.

Wall Street Analysts Forecast Growth

KNTK has been the topic of a number of research analyst reports. Barclays began coverage on Kinetik in a report on Monday, April 22nd. They issued an "equal weight" rating and a $40.00 price target on the stock. JPMorgan Chase & Co. boosted their price target on shares of Kinetik from $40.00 to $43.00 and gave the stock an "overweight" rating in a research note on Wednesday, April 17th. Mizuho raised their price objective on Kinetik from $39.00 to $42.00 and gave the company a "buy" rating in a research report on Tuesday, April 23rd. Finally, Royal Bank of Canada began coverage on Kinetik in a research note on Monday, March 25th. They set an "outperform" rating and a $40.00 price target for the company. Six investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat, Kinetik presently has a consensus rating of "Moderate Buy" and a consensus price target of $40.00.

View Our Latest Stock Analysis on KNTK

Insider Transactions at Kinetik

In related news, insider Anne Psencik sold 3,182 shares of the company's stock in a transaction that occurred on Monday, March 11th. The stock was sold at an average price of $35.57, for a total value of $113,183.74. Following the transaction, the insider now directly owns 247,128 shares in the company, valued at $8,790,342.96. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In other Kinetik news, insider Trevor Howard sold 7,000 shares of Kinetik stock in a transaction dated Friday, March 22nd. The shares were sold at an average price of $37.62, for a total transaction of $263,340.00. Following the completion of the sale, the insider now directly owns 198,411 shares in the company, valued at $7,464,221.82. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider Anne Psencik sold 3,182 shares of the company's stock in a transaction that occurred on Monday, March 11th. The stock was sold at an average price of $35.57, for a total transaction of $113,183.74. Following the completion of the transaction, the insider now owns 247,128 shares in the company, valued at $8,790,342.96. The disclosure for this sale can be found here. Insiders sold 13,095,803 shares of company stock worth $442,051,135 in the last 90 days. Insiders own 3.71% of the company's stock.

Kinetik Company Profile

(

Get Free Report)

Kinetik Holdings Inc operates as a midstream company in the Texas Delaware Basin. The company operates through two segments, Midstream Logistics and Pipeline Transportation. It provides gathering, transportation, compression, processing, stabilization, treating, storage, and transportation services for companies that produce natural gas, natural gas liquids, and crude oil; and water gathering and disposal services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kinetik, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinetik wasn't on the list.

While Kinetik currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report