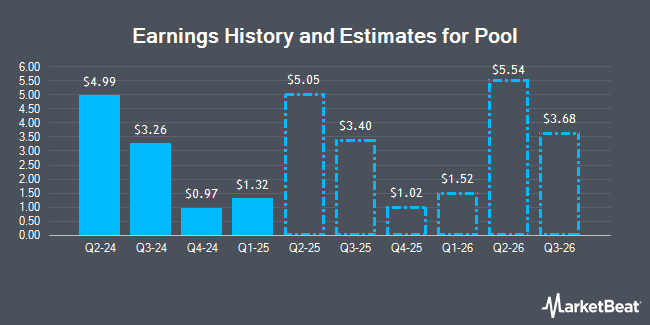

Pool Co. (NASDAQ:POOL - Free Report) - Research analysts at Zacks Research boosted their Q3 2025 earnings per share (EPS) estimates for Pool in a research report issued to clients and investors on Tuesday, May 14th. Zacks Research analyst R. Department now anticipates that the specialty retailer will earn $4.22 per share for the quarter, up from their prior forecast of $4.13. The consensus estimate for Pool's current full-year earnings is $13.02 per share.

Other research analysts have also recently issued reports about the company. Stifel Nicolaus lowered their target price on Pool from $370.00 to $360.00 and set a "hold" rating on the stock in a report on Monday, April 29th. TheStreet lowered Pool from a "b" rating to a "c+" rating in a research note on Thursday, February 22nd. Finally, Oppenheimer cut their target price on Pool from $436.00 to $416.00 and set an "outperform" rating for the company in a research note on Monday, April 29th. Five equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. According to MarketBeat, Pool currently has an average rating of "Hold" and an average target price of $391.80.

View Our Latest Report on Pool

Pool Price Performance

NASDAQ POOL traded down $13.84 during trading hours on Thursday, hitting $369.23. 336,095 shares of the company's stock traded hands, compared to its average volume of 330,993. The company has a market capitalization of $14.15 billion, a PE ratio of 28.89, a PEG ratio of 3.89 and a beta of 1.01. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.88 and a quick ratio of 0.56. Pool has a 52-week low of $307.77 and a 52-week high of $422.73. The firm's 50-day moving average is $385.66 and its 200-day moving average is $377.30.

Pool (NASDAQ:POOL - Get Free Report) last announced its quarterly earnings data on Thursday, April 25th. The specialty retailer reported $1.85 earnings per share for the quarter, missing analysts' consensus estimates of $1.87 by ($0.02). Pool had a net margin of 9.17% and a return on equity of 35.49%. The firm had revenue of $1.12 billion during the quarter, compared to analysts' expectations of $1.13 billion. During the same quarter in the previous year, the business posted $2.46 EPS. The company's revenue for the quarter was down 7.1% on a year-over-year basis.

Hedge Funds Weigh In On Pool

Several hedge funds have recently bought and sold shares of the company. Assetmark Inc. grew its stake in shares of Pool by 12.2% in the third quarter. Assetmark Inc. now owns 321 shares of the specialty retailer's stock worth $114,000 after acquiring an additional 35 shares in the last quarter. Fifth Third Bancorp grew its stake in Pool by 18.9% during the 3rd quarter. Fifth Third Bancorp now owns 1,169 shares of the specialty retailer's stock worth $416,000 after purchasing an additional 186 shares in the last quarter. Allworth Financial LP increased its holdings in Pool by 48.2% during the 3rd quarter. Allworth Financial LP now owns 123 shares of the specialty retailer's stock worth $44,000 after purchasing an additional 40 shares during the period. Teacher Retirement System of Texas raised its position in Pool by 2.4% in the 3rd quarter. Teacher Retirement System of Texas now owns 3,024 shares of the specialty retailer's stock valued at $1,077,000 after purchasing an additional 70 shares in the last quarter. Finally, Wealthfront Advisers LLC raised its position in Pool by 29.7% in the 3rd quarter. Wealthfront Advisers LLC now owns 10,247 shares of the specialty retailer's stock valued at $3,649,000 after purchasing an additional 2,346 shares in the last quarter. Institutional investors and hedge funds own 98.99% of the company's stock.

Insider Transactions at Pool

In other news, General Counsel Jennifer M. Neil sold 1,100 shares of the business's stock in a transaction that occurred on Friday, March 1st. The shares were sold at an average price of $401.00, for a total value of $441,100.00. Following the sale, the general counsel now directly owns 8,622 shares of the company's stock, valued at approximately $3,457,422. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Company insiders own 3.00% of the company's stock.

Pool Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, May 30th. Stockholders of record on Thursday, May 16th will be paid a $1.20 dividend. This represents a $4.80 annualized dividend and a dividend yield of 1.30%. The ex-dividend date is Wednesday, May 15th. This is a positive change from Pool's previous quarterly dividend of $1.10. Pool's dividend payout ratio is 34.43%.

Pool Company Profile

(

Get Free Report)

Pool Corporation distributes swimming pool supplies, equipment, and related leisure products in the United States and internationally. The company offers maintenance products, including chemicals, supplies, and pool accessories; repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps, and lights; and building materials, such as concrete, plumbing and electrical components, functional and decorative pool surfaces, decking materials, tiles, hardscapes, and natural stones for pool installations and remodeling.

Recommended Stories

Before you consider Pool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pool wasn't on the list.

While Pool currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report