Seagate Technology Holdings plc (NASDAQ:STX - Get Free Report) announced a quarterly dividend on Tuesday, April 23rd, RTT News reports. Investors of record on Thursday, June 20th will be given a dividend of 0.70 per share by the data storage provider on Friday, July 5th. This represents a $2.80 dividend on an annualized basis and a yield of 3.24%.

Seagate Technology Holdings plc (NASDAQ:STX - Get Free Report) announced a quarterly dividend on Tuesday, April 23rd, RTT News reports. Investors of record on Thursday, June 20th will be given a dividend of 0.70 per share by the data storage provider on Friday, July 5th. This represents a $2.80 dividend on an annualized basis and a yield of 3.24%.

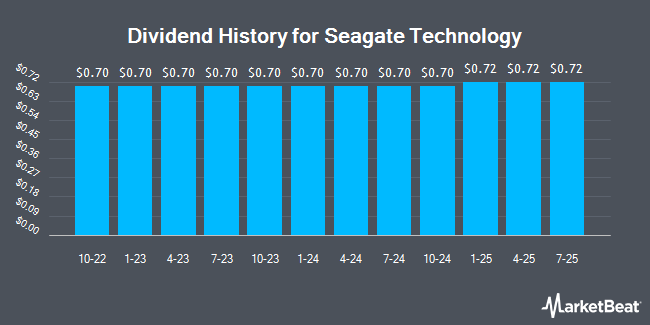

Seagate Technology has raised its dividend payment by an average of 2.2% per year over the last three years. Seagate Technology has a dividend payout ratio of 55.4% meaning its dividend is sufficiently covered by earnings. Analysts expect Seagate Technology to earn $4.23 per share next year, which means the company should continue to be able to cover its $2.80 annual dividend with an expected future payout ratio of 66.2%.

Seagate Technology Stock Up 1.6 %

Shares of STX stock traded up $1.35 during mid-day trading on Tuesday, reaching $86.53. The stock had a trading volume of 5,955,695 shares, compared to its average volume of 2,798,576. The firm has a market cap of $18.13 billion, a PE ratio of -24.34, a P/E/G ratio of 681.49 and a beta of 1.04. Seagate Technology has a one year low of $54.47 and a one year high of $101.26. The firm's 50 day simple moving average is $89.31 and its 200 day simple moving average is $82.47.

Seagate Technology (NASDAQ:STX - Get Free Report) last issued its earnings results on Wednesday, January 24th. The data storage provider reported ($0.02) earnings per share for the quarter, beating the consensus estimate of ($0.21) by $0.19. The business had revenue of $1.56 billion for the quarter, compared to analyst estimates of $1.56 billion. Sell-side analysts forecast that Seagate Technology will post 0.1 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on STX. Barclays cut their target price on shares of Seagate Technology from $85.00 to $80.00 and set an "equal weight" rating for the company in a research note on Monday. The Goldman Sachs Group increased their target price on Seagate Technology from $65.00 to $84.00 and gave the stock a "neutral" rating in a report on Friday, January 26th. Wedbush reissued a "neutral" rating and set a $100.00 price objective on shares of Seagate Technology in a report on Thursday, January 25th. BNP Paribas downgraded shares of Seagate Technology from a "neutral" rating to an "underperform" rating and set a $65.00 target price for the company. in a research note on Thursday, January 11th. Finally, Cantor Fitzgerald reaffirmed a "neutral" rating and set a $95.00 price objective on shares of Seagate Technology in a report on Monday, March 4th. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $91.73.

Check Out Our Latest Stock Analysis on STX

About Seagate Technology

(

Get Free Report)

Seagate Technology Holdings plc provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It provides mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Seagate Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seagate Technology wasn't on the list.

While Seagate Technology currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report