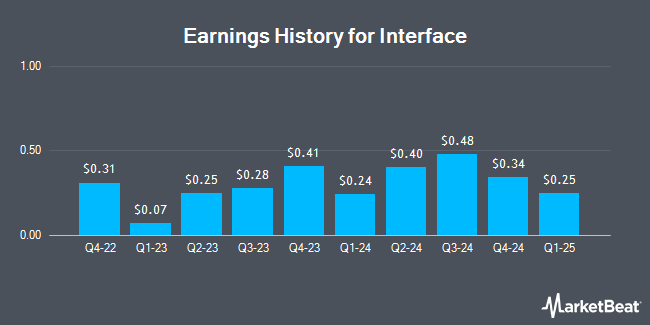

Interface (NASDAQ:TILE - Get Free Report) posted its quarterly earnings results on Friday. The textile maker reported $0.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.12 by $0.12, RTT News reports. The business had revenue of $289.70 million for the quarter, compared to analyst estimates of $284.76 million. Interface had a return on equity of 14.95% and a net margin of 3.53%. The business's revenue was down 2.1% compared to the same quarter last year. During the same period in the prior year, the company posted $0.07 EPS. Interface updated its FY 2024 guidance to EPS and its Q2 2024 guidance to EPS.

Interface (NASDAQ:TILE - Get Free Report) posted its quarterly earnings results on Friday. The textile maker reported $0.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.12 by $0.12, RTT News reports. The business had revenue of $289.70 million for the quarter, compared to analyst estimates of $284.76 million. Interface had a return on equity of 14.95% and a net margin of 3.53%. The business's revenue was down 2.1% compared to the same quarter last year. During the same period in the prior year, the company posted $0.07 EPS. Interface updated its FY 2024 guidance to EPS and its Q2 2024 guidance to EPS.

Interface Price Performance

Shares of TILE stock traded up $1.53 during midday trading on Friday, reaching $17.39. 794,394 shares of the company were exchanged, compared to its average volume of 385,721. Interface has a 12 month low of $6.51 and a 12 month high of $18.47. The company has a market cap of $1.01 billion, a P/E ratio of 22.88, a PEG ratio of 0.97 and a beta of 1.99. The company's 50 day moving average price is $15.85 and its two-hundred day moving average price is $12.91. The company has a debt-to-equity ratio of 0.96, a quick ratio of 1.42 and a current ratio of 2.72.

Interface Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, April 12th. Investors of record on Friday, March 29th were given a $0.01 dividend. The ex-dividend date was Wednesday, March 27th. This represents a $0.04 dividend on an annualized basis and a yield of 0.23%. Interface's dividend payout ratio is presently 5.26%.

Analyst Ratings Changes

A number of research analysts have recently issued reports on TILE shares. Truist Financial raised their price target on shares of Interface from $10.00 to $14.00 and gave the stock a "hold" rating in a research report on Wednesday, February 28th. Barrington Research lifted their target price on Interface from $20.00 to $22.00 and gave the company an "outperform" rating in a research note on Friday. Finally, TheStreet raised Interface from a "c" rating to a "b-" rating in a report on Tuesday, February 27th.

Get Our Latest Analysis on TILE

About Interface

(

Get Free Report)

Interface, Inc designs, produces, and sells modular carpet products primarily worldwide. The company operates in two segments, Americas (AMS), and Europe, Africa, Asia and Australia (EAAA). The company offers modular carpets under the Interface and FLOR brand names; luxury vinyl tiles; carpet tiles under the CQuestGB name for use in commercial interiors, include offices, healthcare facilities, airports, educational and other institutions, hospitality spaces, and retail facilities, as well as residential interiors; and modular resilient flooring products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Interface, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interface wasn't on the list.

While Interface currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report