Texas Roadhouse (NASDAQ:TXRH - Get Free Report) had its target price lifted by equities researchers at Morgan Stanley from $135.00 to $145.00 in a report released on Friday, Benzinga reports. The brokerage presently has an "equal weight" rating on the restaurant operator's stock. Morgan Stanley's target price would suggest a potential downside of 2.44% from the company's previous close.

Texas Roadhouse (NASDAQ:TXRH - Get Free Report) had its target price lifted by equities researchers at Morgan Stanley from $135.00 to $145.00 in a report released on Friday, Benzinga reports. The brokerage presently has an "equal weight" rating on the restaurant operator's stock. Morgan Stanley's target price would suggest a potential downside of 2.44% from the company's previous close.

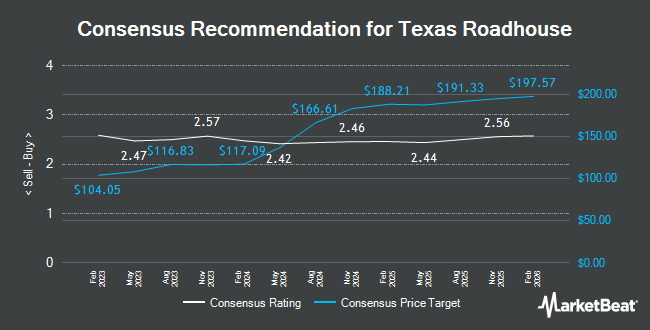

TXRH has been the subject of a number of other research reports. BMO Capital Markets upped their price objective on Texas Roadhouse from $110.00 to $130.00 and gave the company a "market perform" rating in a research note on Friday, February 16th. Wells Fargo & Company increased their price target on Texas Roadhouse from $125.00 to $140.00 and gave the stock an "equal weight" rating in a research note on Friday, February 16th. JPMorgan Chase & Co. increased their price target on Texas Roadhouse from $142.00 to $145.00 and gave the stock a "neutral" rating in a research note on Tuesday, March 19th. Stephens began coverage on Texas Roadhouse in a research note on Friday. They set an "equal weight" rating and a $150.00 price target for the company. Finally, Wedbush increased their price target on Texas Roadhouse from $160.00 to $170.00 and gave the stock an "outperform" rating in a research note on Friday, April 5th. Eleven research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat, Texas Roadhouse currently has an average rating of "Hold" and an average price target of $136.05.

Read Our Latest Report on TXRH

Texas Roadhouse Stock Performance

NASDAQ:TXRH traded down $0.34 during trading on Friday, reaching $148.63. The company's stock had a trading volume of 641,497 shares, compared to its average volume of 792,276. The firm has a market cap of $9.93 billion, a price-to-earnings ratio of 32.81, a price-to-earnings-growth ratio of 1.65 and a beta of 0.99. The firm has a 50 day moving average of $147.14 and a 200-day moving average of $122.90. Texas Roadhouse has a 12 month low of $91.06 and a 12 month high of $157.12.

Texas Roadhouse (NASDAQ:TXRH - Get Free Report) last announced its quarterly earnings data on Thursday, February 15th. The restaurant operator reported $1.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.07 by $0.01. The firm had revenue of $1.16 billion during the quarter, compared to the consensus estimate of $1.16 billion. Texas Roadhouse had a return on equity of 27.43% and a net margin of 6.58%. The business's revenue for the quarter was up 15.3% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.89 EPS. Equities research analysts forecast that Texas Roadhouse will post 5.71 earnings per share for the current fiscal year.

Insider Buying and Selling at Texas Roadhouse

In other Texas Roadhouse news, President Regina A. Tobin sold 3,064 shares of the firm's stock in a transaction dated Tuesday, March 5th. The stock was sold at an average price of $150.07, for a total value of $459,814.48. Following the sale, the president now owns 15,261 shares of the company's stock, valued at approximately $2,290,218.27. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In other Texas Roadhouse news, President Regina A. Tobin sold 3,064 shares of the firm's stock in a transaction dated Tuesday, March 5th. The stock was sold at an average price of $150.07, for a total value of $459,814.48. Following the sale, the president now owns 15,261 shares of the company's stock, valued at approximately $2,290,218.27. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, insider Christopher C. Colson sold 405 shares of the firm's stock in a transaction dated Friday, February 23rd. The shares were sold at an average price of $149.05, for a total value of $60,365.25. Following the transaction, the insider now directly owns 8,500 shares in the company, valued at $1,266,925. The disclosure for this sale can be found here. Insiders have sold a total of 12,382 shares of company stock valued at $1,843,145 in the last 90 days. Corporate insiders own 0.50% of the company's stock.

Hedge Funds Weigh In On Texas Roadhouse

A number of large investors have recently modified their holdings of the company. Red Spruce Capital LLC raised its holdings in shares of Texas Roadhouse by 0.5% during the 4th quarter. Red Spruce Capital LLC now owns 22,359 shares of the restaurant operator's stock valued at $2,733,000 after buying an additional 110 shares in the last quarter. Avior Wealth Management LLC grew its position in Texas Roadhouse by 3.2% during the 4th quarter. Avior Wealth Management LLC now owns 3,579 shares of the restaurant operator's stock worth $437,000 after acquiring an additional 111 shares during the last quarter. Metropolitan Life Insurance Co NY grew its position in Texas Roadhouse by 3.1% during the 4th quarter. Metropolitan Life Insurance Co NY now owns 4,121 shares of the restaurant operator's stock worth $375,000 after acquiring an additional 124 shares during the last quarter. First Republic Investment Management Inc. grew its position in Texas Roadhouse by 0.8% during the 1st quarter. First Republic Investment Management Inc. now owns 16,561 shares of the restaurant operator's stock worth $1,790,000 after acquiring an additional 124 shares during the last quarter. Finally, Fifth Third Bancorp grew its position in Texas Roadhouse by 35.8% during the 3rd quarter. Fifth Third Bancorp now owns 474 shares of the restaurant operator's stock worth $46,000 after acquiring an additional 125 shares during the last quarter. 94.82% of the stock is owned by hedge funds and other institutional investors.

About Texas Roadhouse

(

Get Free Report)

Texas Roadhouse, Inc, together with its subsidiaries, operates casual dining restaurants in the United States and internationally. It also operates and franchises restaurants under the Texas Roadhouse, Bubba's 33, and Jaggers names in 49 states and ten internationally. Texas Roadhouse, Inc was founded in 1993 and is based in Louisville, Kentucky.

Featured Articles

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report