Yunqi Capital Ltd bought a new position in shares of KE Holdings Inc. (NYSE:BEKE - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 510,100 shares of the company's stock, valued at approximately $8,269,000. KE accounts for about 5.8% of Yunqi Capital Ltd's portfolio, making the stock its 6th biggest holding.

Yunqi Capital Ltd bought a new position in shares of KE Holdings Inc. (NYSE:BEKE - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 510,100 shares of the company's stock, valued at approximately $8,269,000. KE accounts for about 5.8% of Yunqi Capital Ltd's portfolio, making the stock its 6th biggest holding.

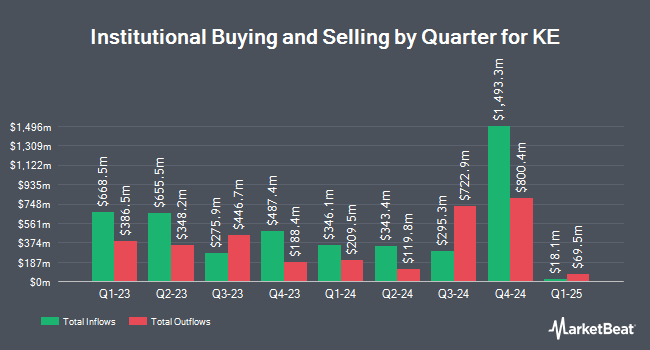

A number of other institutional investors have also recently bought and sold shares of the business. Jennison Associates LLC boosted its stake in KE by 12.9% during the fourth quarter. Jennison Associates LLC now owns 1,573,927 shares of the company's stock worth $25,513,000 after buying an additional 180,150 shares in the last quarter. Handelsbanken Fonder AB boosted its stake in KE by 64.0% during the fourth quarter. Handelsbanken Fonder AB now owns 332,412 shares of the company's stock worth $5,388,000 after buying an additional 129,776 shares in the last quarter. OVERSEA CHINESE BANKING Corp Ltd boosted its stake in KE by 17.9% during the fourth quarter. OVERSEA CHINESE BANKING Corp Ltd now owns 986,173 shares of the company's stock worth $15,976,000 after buying an additional 149,570 shares in the last quarter. abrdn plc boosted its stake in KE by 3.8% during the fourth quarter. abrdn plc now owns 447,798 shares of the company's stock worth $7,259,000 after buying an additional 16,216 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in KE by 50.2% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 269,907 shares of the company's stock worth $4,375,000 after buying an additional 90,258 shares in the last quarter. Institutional investors and hedge funds own 39.34% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently commented on the stock. HSBC reduced their target price on shares of KE from $23.90 to $21.80 and set a "buy" rating on the stock in a research note on Friday, March 15th. Citigroup reissued a "buy" rating and set a $21.10 price objective on shares of KE in a report on Tuesday, March 19th.

Read Our Latest Report on BEKE

KE Trading Up 4.1 %

Shares of BEKE stock traded up $0.54 on Tuesday, reaching $13.61. The company had a trading volume of 11,144,507 shares, compared to its average volume of 7,746,825. The stock has a market cap of $16.78 billion, a PE ratio of 19.72, a PEG ratio of 0.34 and a beta of -0.73. The company has a 50-day moving average of $13.71 and a 200-day moving average of $14.59. KE Holdings Inc. has a 12 month low of $12.44 and a 12 month high of $19.95.

KE (NYSE:BEKE - Get Free Report) last issued its quarterly earnings data on Thursday, March 14th. The company reported $0.11 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.08 by $0.03. KE had a return on equity of 9.19% and a net margin of 7.62%. The business had revenue of $2.85 billion during the quarter, compared to analyst estimates of $2.66 billion. Sell-side analysts anticipate that KE Holdings Inc. will post 0.77 earnings per share for the current year.

KE Announces Dividend

The company also recently declared an annual dividend, which will be paid on Wednesday, April 24th. Shareholders of record on Friday, April 5th will be given a dividend of $0.351 per share. This represents a yield of 2.2%. The ex-dividend date is Thursday, April 4th. KE's dividend payout ratio (DPR) is currently 44.93%.

KE Company Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report