TimesSquare Capital Management LLC increased its stake in shares of BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 10.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,650,167 shares of the company's stock after acquiring an additional 152,870 shares during the period. BJ's Wholesale Club comprises 1.6% of TimesSquare Capital Management LLC's holdings, making the stock its 6th largest position. TimesSquare Capital Management LLC owned approximately 1.24% of BJ's Wholesale Club worth $110,000,000 as of its most recent filing with the Securities & Exchange Commission.

TimesSquare Capital Management LLC increased its stake in shares of BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 10.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,650,167 shares of the company's stock after acquiring an additional 152,870 shares during the period. BJ's Wholesale Club comprises 1.6% of TimesSquare Capital Management LLC's holdings, making the stock its 6th largest position. TimesSquare Capital Management LLC owned approximately 1.24% of BJ's Wholesale Club worth $110,000,000 as of its most recent filing with the Securities & Exchange Commission.

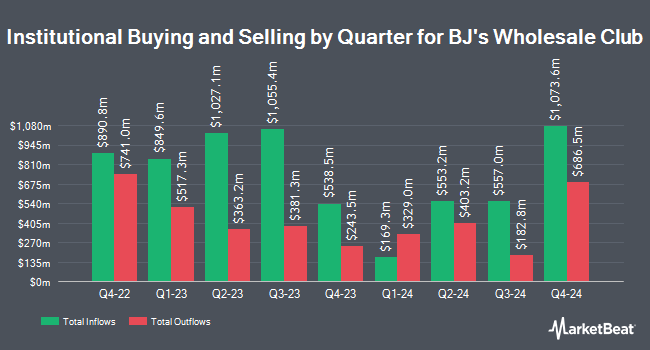

Other hedge funds have also recently added to or reduced their stakes in the company. International Assets Investment Management LLC purchased a new stake in BJ's Wholesale Club in the fourth quarter valued at $5,745,000. Boston Trust Walden Corp increased its holdings in BJ's Wholesale Club by 2.0% in the fourth quarter. Boston Trust Walden Corp now owns 1,073,646 shares of the company's stock valued at $71,569,000 after buying an additional 20,703 shares during the last quarter. Jump Financial LLC acquired a new stake in BJ's Wholesale Club in the third quarter valued at $685,000. Envestnet Asset Management Inc. lifted its holdings in BJ's Wholesale Club by 46.2% during the 3rd quarter. Envestnet Asset Management Inc. now owns 558,667 shares of the company's stock worth $39,872,000 after buying an additional 176,494 shares during the last quarter. Finally, Lazard Asset Management LLC boosted its position in shares of BJ's Wholesale Club by 342.0% during the 3rd quarter. Lazard Asset Management LLC now owns 233,147 shares of the company's stock worth $16,639,000 after acquiring an additional 180,397 shares in the last quarter. 98.60% of the stock is owned by hedge funds and other institutional investors.

BJ's Wholesale Club Stock Up 2.1 %

NYSE BJ traded up $1.58 during trading hours on Thursday, reaching $77.74. 966,200 shares of the company traded hands, compared to its average volume of 1,461,022. The company has a 50 day moving average of $75.41 and a two-hundred day moving average of $69.93. BJ's Wholesale Club Holdings, Inc. has a 12 month low of $60.33 and a 12 month high of $80.42. The stock has a market capitalization of $10.34 billion, a PE ratio of 20.01, a PEG ratio of 3.20 and a beta of 0.27. The company has a current ratio of 0.73, a quick ratio of 0.14 and a debt-to-equity ratio of 0.27.

BJ's Wholesale Club (NYSE:BJ - Get Free Report) last issued its quarterly earnings data on Thursday, March 7th. The company reported $1.11 earnings per share for the quarter, beating the consensus estimate of $1.06 by $0.05. The firm had revenue of $5.36 billion for the quarter, compared to the consensus estimate of $5.38 billion. BJ's Wholesale Club had a net margin of 2.64% and a return on equity of 40.84%. BJ's Wholesale Club's quarterly revenue was up 8.7% compared to the same quarter last year. During the same period last year, the firm posted $1.00 EPS. As a group, equities analysts expect that BJ's Wholesale Club Holdings, Inc. will post 3.91 earnings per share for the current year.

Insiders Place Their Bets

In other news, SVP Joseph Mcgrail sold 1,000 shares of the stock in a transaction that occurred on Monday, April 15th. The stock was sold at an average price of $77.37, for a total value of $77,370.00. Following the completion of the sale, the senior vice president now directly owns 12,905 shares of the company's stock, valued at $998,459.85. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other BJ's Wholesale Club news, SVP Joseph Mcgrail sold 1,000 shares of BJ's Wholesale Club stock in a transaction on Monday, April 15th. The shares were sold at an average price of $77.37, for a total transaction of $77,370.00. Following the sale, the senior vice president now owns 12,905 shares in the company, valued at $998,459.85. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Christopher J. Baldwin sold 73,062 shares of the stock in a transaction on Monday, March 11th. The shares were sold at an average price of $73.95, for a total transaction of $5,402,934.90. Following the completion of the transaction, the director now owns 173,294 shares of the company's stock, valued at approximately $12,815,091.30. The disclosure for this sale can be found here. Insiders sold 98,840 shares of company stock valued at $7,408,605 over the last ninety days. Corporate insiders own 2.20% of the company's stock.

Wall Street Analysts Forecast Growth

BJ has been the subject of several recent analyst reports. Evercore ISI decreased their target price on BJ's Wholesale Club from $79.00 to $78.00 and set an "in-line" rating for the company in a research note on Tuesday, April 16th. JPMorgan Chase & Co. upped their target price on shares of BJ's Wholesale Club from $58.00 to $62.00 and gave the company an "underweight" rating in a report on Friday, March 1st. The Goldman Sachs Group upgraded shares of BJ's Wholesale Club from a "neutral" rating to a "buy" rating and lifted their price target for the stock from $81.00 to $87.00 in a research note on Monday, April 8th. Loop Capital reaffirmed a "hold" rating and set a $80.00 price objective (down previously from $85.00) on shares of BJ's Wholesale Club in a report on Thursday, April 18th. Finally, Gordon Haskett cut BJ's Wholesale Club from a "buy" rating to a "hold" rating and set a $70.00 target price on the stock. in a research report on Wednesday, February 7th. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, BJ's Wholesale Club currently has a consensus rating of "Hold" and a consensus price target of $74.40.

Get Our Latest Analysis on BJ's Wholesale Club

BJ's Wholesale Club Company Profile

(

Free Report)

BJ's Wholesale Club Holdings, Inc, together with its subsidiaries, operates warehouse clubs on the eastern half of the United States. It provides groceries, general merchandise, gasoline and other ancillary services, coupon books, and promotions. The company sells its products through the websites BJs.com, BerkleyJensen.com, and Wellsleyfarms.com, as well as the mobile app.

Further Reading

Want to see what other hedge funds are holding BJ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report