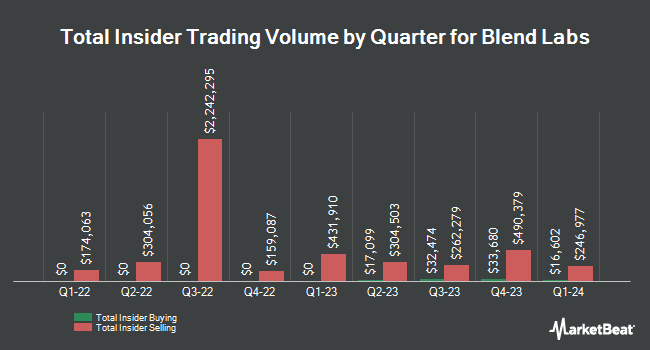

Blend Labs, Inc. (NYSE:BLND - Get Free Report) insider Amir Jafari bought 6,265 shares of the firm's stock in a transaction dated Friday, April 12th. The shares were acquired at an average price of $2.65 per share, with a total value of $16,602.25. Following the purchase, the insider now directly owns 402,716 shares of the company's stock, valued at approximately $1,067,197.40. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link.

Blend Labs, Inc. (NYSE:BLND - Get Free Report) insider Amir Jafari bought 6,265 shares of the firm's stock in a transaction dated Friday, April 12th. The shares were acquired at an average price of $2.65 per share, with a total value of $16,602.25. Following the purchase, the insider now directly owns 402,716 shares of the company's stock, valued at approximately $1,067,197.40. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link.

Amir Jafari also recently made the following trade(s):

- On Wednesday, March 13th, Amir Jafari bought 5,555 shares of Blend Labs stock. The shares were acquired at an average price of $3.00 per share, with a total value of $16,665.00.

Blend Labs Stock Performance

NYSE:BLND traded down $0.11 during mid-day trading on Monday, reaching $2.42. The stock had a trading volume of 2,070,445 shares, compared to its average volume of 1,759,351. The company has a debt-to-equity ratio of 34.81, a quick ratio of 5.38 and a current ratio of 5.38. The firm has a market capitalization of $609.96 million, a price-to-earnings ratio of -3.10 and a beta of 1.00. Blend Labs, Inc. has a twelve month low of $0.53 and a twelve month high of $3.40. The business has a 50 day simple moving average of $2.84 and a 200 day simple moving average of $2.16.

Blend Labs (NYSE:BLND - Get Free Report) last announced its quarterly earnings data on Friday, March 15th. The company reported ($0.10) EPS for the quarter, meeting analysts' consensus estimates of ($0.10). The firm had revenue of $36.10 million during the quarter, compared to the consensus estimate of $37.52 million. Blend Labs had a negative net margin of 118.15% and a negative return on equity of 595.99%. On average, analysts expect that Blend Labs, Inc. will post -0.47 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Blend Labs

A number of hedge funds and other institutional investors have recently modified their holdings of BLND. Formation8 GP LLC acquired a new stake in shares of Blend Labs during the 4th quarter valued at approximately $41,362,000. Vanguard Group Inc. increased its stake in shares of Blend Labs by 1,862.4% during the 1st quarter. Vanguard Group Inc. now owns 11,117,426 shares of the company's stock worth $63,369,000 after purchasing an additional 10,550,895 shares in the last quarter. MFN Partners Management LP purchased a new position in shares of Blend Labs during the 1st quarter worth approximately $28,500,000. State Street Corp increased its stake in shares of Blend Labs by 664.2% during the 2nd quarter. State Street Corp now owns 2,870,893 shares of the company's stock worth $6,775,000 after purchasing an additional 2,495,209 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its stake in shares of Blend Labs by 111.1% during the 3rd quarter. Bank of New York Mellon Corp now owns 3,740,619 shares of the company's stock worth $8,267,000 after purchasing an additional 1,968,921 shares in the last quarter. 52.56% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on BLND. The Goldman Sachs Group increased their target price on shares of Blend Labs from $1.60 to $3.10 and gave the stock a "buy" rating in a research note on Friday, March 15th. Canaccord Genuity Group increased their target price on shares of Blend Labs from $2.00 to $3.00 and gave the stock a "hold" rating in a research note on Monday, March 18th. Wells Fargo & Company upgraded shares of Blend Labs from an "equal weight" rating to an "overweight" rating and increased their target price for the stock from $1.50 to $3.50 in a research note on Wednesday, December 20th. Finally, Keefe, Bruyette & Woods raised their price objective on shares of Blend Labs from $1.85 to $2.65 and gave the company a "market perform" rating in a research report on Monday, March 18th. Three equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $3.06.

View Our Latest Stock Analysis on Blend Labs

Blend Labs Company Profile

(

Get Free Report)

Blend Labs, Inc engages in the provision of cloud-based software platform solutions for financial services firms in the United States. It operates in two segments, Blend Platform and Title365. The company's Blend Builder Platform offers a suite of products that powers digital-first consumer journeys for mortgages, home equity loans and lines of credit, vehicle loans, personal loans, credit cards, and deposit accounts; and offers mortgage products to facilitate the homeownership journey for consumers comprising close, income verification for mortgage, homeowners' insurance, and realty.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Blend Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blend Labs wasn't on the list.

While Blend Labs currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report