Cardinal Health (NYSE:CAH - Get Free Report) was downgraded by equities researchers at StockNews.com from a "strong-buy" rating to a "buy" rating in a report released on Wednesday.

Cardinal Health (NYSE:CAH - Get Free Report) was downgraded by equities researchers at StockNews.com from a "strong-buy" rating to a "buy" rating in a report released on Wednesday.

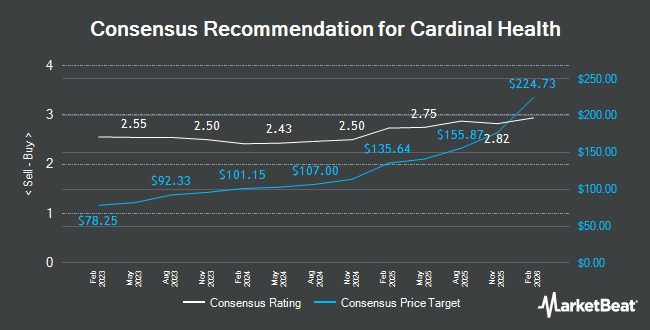

CAH has been the subject of several other reports. Barclays assumed coverage on shares of Cardinal Health in a research note on Wednesday, January 3rd. They issued an "overweight" rating and a $117.00 target price for the company. SVB Leerink initiated coverage on Cardinal Health in a report on Monday, February 26th. They set an "outperform" rating and a $125.00 price target for the company. Leerink Partnrs reaffirmed an "outperform" rating on shares of Cardinal Health in a report on Monday, February 26th. Argus raised Cardinal Health from a "hold" rating to a "buy" rating in a report on Friday, February 9th. Finally, UBS Group raised their price target on Cardinal Health from $122.00 to $125.00 and gave the company a "buy" rating in a report on Monday, February 5th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat, Cardinal Health currently has a consensus rating of "Moderate Buy" and an average target price of $103.07.

Get Our Latest Research Report on Cardinal Health

Cardinal Health Stock Performance

CAH stock traded up $0.16 during mid-day trading on Wednesday, hitting $103.54. 2,057,471 shares of the company were exchanged, compared to its average volume of 2,274,126. The firm has a market cap of $25.18 billion, a P/E ratio of 40.76, a P/E/G ratio of 0.99 and a beta of 0.68. The firm's 50 day simple moving average is $109.56 and its 200 day simple moving average is $104.59. Cardinal Health has a 1-year low of $77.56 and a 1-year high of $116.04.

Cardinal Health (NYSE:CAH - Get Free Report) last issued its quarterly earnings results on Thursday, February 1st. The company reported $1.82 earnings per share for the quarter, topping the consensus estimate of $1.56 by $0.26. The company had revenue of $57.45 billion during the quarter, compared to analysts' expectations of $57.02 billion. Cardinal Health had a net margin of 0.30% and a negative return on equity of 57.44%. The business's quarterly revenue was up 11.6% on a year-over-year basis. During the same period last year, the business earned $1.32 EPS. On average, equities research analysts predict that Cardinal Health will post 7.28 EPS for the current fiscal year.

Institutional Trading of Cardinal Health

Hedge funds and other institutional investors have recently made changes to their positions in the company. Cornerstone Wealth Management LLC bought a new stake in shares of Cardinal Health during the fourth quarter worth about $209,000. Nordea Investment Management AB boosted its holdings in Cardinal Health by 50.5% in the fourth quarter. Nordea Investment Management AB now owns 184,537 shares of the company's stock valued at $18,649,000 after acquiring an additional 61,933 shares during the last quarter. Vest Financial LLC increased its position in Cardinal Health by 15.9% during the 4th quarter. Vest Financial LLC now owns 282,440 shares of the company's stock valued at $28,470,000 after purchasing an additional 38,769 shares during the period. Bellwether Advisors LLC acquired a new stake in Cardinal Health during the 4th quarter valued at approximately $6,290,000. Finally, DekaBank Deutsche Girozentrale increased its position in Cardinal Health by 30.1% during the 4th quarter. DekaBank Deutsche Girozentrale now owns 547,525 shares of the company's stock valued at $54,618,000 after purchasing an additional 126,668 shares during the period. 87.17% of the stock is currently owned by institutional investors.

About Cardinal Health

(

Get Free Report)

Cardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report