Swiss National Bank decreased its position in Enbridge Inc. (NYSE:ENB - Free Report) TSE: ENB by 3.0% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 6,911,331 shares of the pipeline company's stock after selling 215,800 shares during the period. Swiss National Bank owned 0.33% of Enbridge worth $249,259,000 at the end of the most recent quarter.

Swiss National Bank decreased its position in Enbridge Inc. (NYSE:ENB - Free Report) TSE: ENB by 3.0% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 6,911,331 shares of the pipeline company's stock after selling 215,800 shares during the period. Swiss National Bank owned 0.33% of Enbridge worth $249,259,000 at the end of the most recent quarter.

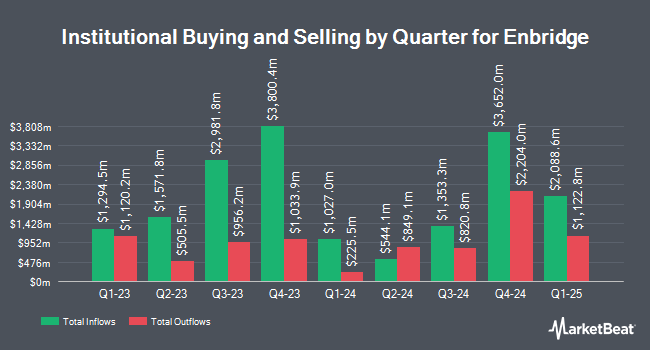

Several other hedge funds and other institutional investors also recently bought and sold shares of the company. Mechanics Financial Corp boosted its position in Enbridge by 13.1% during the 4th quarter. Mechanics Financial Corp now owns 5,788 shares of the pipeline company's stock valued at $208,000 after acquiring an additional 670 shares in the last quarter. Fisher Asset Management LLC raised its stake in shares of Enbridge by 39.9% in the fourth quarter. Fisher Asset Management LLC now owns 11,833 shares of the pipeline company's stock worth $426,000 after purchasing an additional 3,373 shares during the last quarter. LGT Group Foundation boosted its position in Enbridge by 23.1% in the fourth quarter. LGT Group Foundation now owns 435,658 shares of the pipeline company's stock valued at $15,687,000 after buying an additional 81,859 shares during the last quarter. Hexagon Capital Partners LLC boosted its holdings in shares of Enbridge by 52.9% in the 4th quarter. Hexagon Capital Partners LLC now owns 3,989 shares of the pipeline company's stock valued at $144,000 after acquiring an additional 1,380 shares during the last quarter. Finally, Savant Capital LLC raised its holdings in shares of Enbridge by 23.1% during the fourth quarter. Savant Capital LLC now owns 21,547 shares of the pipeline company's stock worth $776,000 after purchasing an additional 4,049 shares during the last quarter. Institutional investors own 54.60% of the company's stock.

Enbridge Stock Down 0.2 %

ENB traded down $0.08 on Friday, reaching $36.34. The company's stock had a trading volume of 4,207,722 shares, compared to its average volume of 5,835,232. The company has a quick ratio of 0.74, a current ratio of 0.83 and a debt-to-equity ratio of 1.30. Enbridge Inc. has a fifty-two week low of $31.03 and a fifty-two week high of $40.30. The stock has a 50 day moving average of $35.29 and a two-hundred day moving average of $34.89. The company has a market capitalization of $77.26 billion, a price-to-earnings ratio of 17.30, a P/E/G ratio of 3.36 and a beta of 0.83.

Enbridge (NYSE:ENB - Get Free Report) TSE: ENB last released its quarterly earnings data on Friday, February 9th. The pipeline company reported $0.47 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.50 by ($0.03). The company had revenue of $8.37 billion during the quarter, compared to analyst estimates of $9.62 billion. Enbridge had a net margin of 13.97% and a return on equity of 10.23%. As a group, analysts forecast that Enbridge Inc. will post 2.12 EPS for the current fiscal year.

Enbridge Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Saturday, June 1st. Stockholders of record on Wednesday, May 15th will be paid a dividend of $0.677 per share. This represents a $2.71 dividend on an annualized basis and a dividend yield of 7.45%. This is a positive change from Enbridge's previous quarterly dividend of $0.66. The ex-dividend date of this dividend is Tuesday, May 14th. Enbridge's payout ratio is 127.14%.

Analysts Set New Price Targets

ENB has been the subject of a number of analyst reports. Jefferies Financial Group initiated coverage on shares of Enbridge in a research report on Tuesday, February 27th. They issued a "buy" rating for the company. Stifel Nicolaus started coverage on shares of Enbridge in a research report on Thursday, January 18th. They set a "hold" rating for the company. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and three have issued a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $55.20.

Check Out Our Latest Report on Enbridge

Enbridge Company Profile

(

Free Report)

Enbridge Inc, together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment operates pipelines and related terminals to transport various grades of crude oil and other liquid hydrocarbons in Canada and the United States.

Further Reading

Want to see what other hedge funds are holding ENB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Enbridge Inc. (NYSE:ENB - Free Report) TSE: ENB.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Enbridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enbridge wasn't on the list.

While Enbridge currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report