Fresenius Medical Care (NYSE:FMS - Get Free Report) was upgraded by analysts at StockNews.com from a "buy" rating to a "strong-buy" rating in a research note issued to investors on Tuesday.

Fresenius Medical Care (NYSE:FMS - Get Free Report) was upgraded by analysts at StockNews.com from a "buy" rating to a "strong-buy" rating in a research note issued to investors on Tuesday.

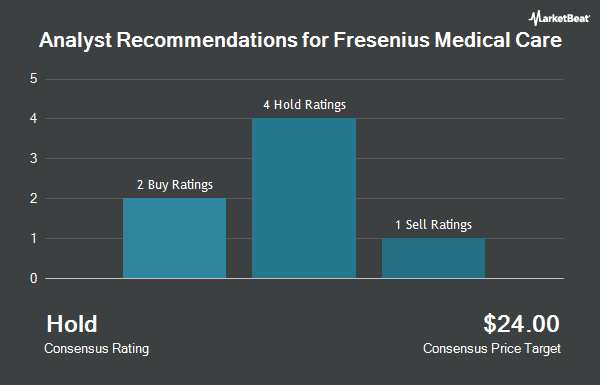

Separately, Morgan Stanley downgraded Fresenius Medical Care from an "equal weight" rating to an "underweight" rating in a research note on Monday, January 8th. One research analyst has rated the stock with a sell rating, five have given a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $32.25.

Read Our Latest Stock Analysis on Fresenius Medical Care

Fresenius Medical Care Stock Performance

Shares of NYSE FMS traded down $0.18 during midday trading on Tuesday, hitting $18.59. 347,436 shares of the company's stock were exchanged, compared to its average volume of 430,443. The company has a quick ratio of 1.07, a current ratio of 1.42 and a debt-to-equity ratio of 0.47. Fresenius Medical Care has a 12 month low of $16.37 and a 12 month high of $27.72. The company's 50 day moving average price is $19.54 and its 200 day moving average price is $19.48. The firm has a market capitalization of $10.91 billion, a PE ratio of 20.20, a price-to-earnings-growth ratio of 0.89 and a beta of 1.00.

Fresenius Medical Care (NYSE:FMS - Get Free Report) last issued its earnings results on Tuesday, February 20th. The company reported $0.47 EPS for the quarter, topping the consensus estimate of $0.36 by $0.11. Fresenius Medical Care had a return on equity of 4.99% and a net margin of 2.56%. The company had revenue of $5.37 billion during the quarter, compared to the consensus estimate of $5.32 billion. As a group, analysts predict that Fresenius Medical Care will post 1.53 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Fresenius Medical Care

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Arrowstreet Capital Limited Partnership raised its holdings in Fresenius Medical Care by 77.1% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 1,570,817 shares of the company's stock valued at $25,667,000 after acquiring an additional 683,851 shares in the last quarter. Morgan Stanley raised its holdings in Fresenius Medical Care by 3.7% in the 3rd quarter. Morgan Stanley now owns 1,041,447 shares of the company's stock valued at $22,433,000 after acquiring an additional 36,820 shares in the last quarter. Balyasny Asset Management L.P. raised its holdings in Fresenius Medical Care by 69.5% in the 1st quarter. Balyasny Asset Management L.P. now owns 750,610 shares of the company's stock valued at $15,958,000 after acquiring an additional 307,801 shares in the last quarter. Goldman Sachs Group Inc. raised its holdings in Fresenius Medical Care by 58.8% in the 2nd quarter. Goldman Sachs Group Inc. now owns 736,847 shares of the company's stock valued at $17,633,000 after acquiring an additional 272,886 shares in the last quarter. Finally, Millennium Management LLC acquired a new position in Fresenius Medical Care in the 2nd quarter valued at $16,738,000. 8.25% of the stock is owned by institutional investors and hedge funds.

About Fresenius Medical Care

(

Get Free Report)

Fresenius Medical Care AG provides dialysis and related services for individuals with renal diseases in Germany, North America, and internationally. The company offers dialysis treatment and related laboratory and diagnostic services through a network of outpatient dialysis clinics; materials, training, and patient support services comprising clinical monitoring, follow-up assistance, and arranging for delivery of the supplies to the patient's residence; and dialysis services under contract to hospitals in the United States for the hospitalized end-stage renal disease (ESRD) patients and for patients suffering from acute kidney failure.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fresenius Medical Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fresenius Medical Care wasn't on the list.

While Fresenius Medical Care currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report