Global Payments (NYSE:GPN - Get Free Report) was upgraded by equities researchers at StockNews.com from a "hold" rating to a "buy" rating in a report issued on Wednesday.

Global Payments (NYSE:GPN - Get Free Report) was upgraded by equities researchers at StockNews.com from a "hold" rating to a "buy" rating in a report issued on Wednesday.

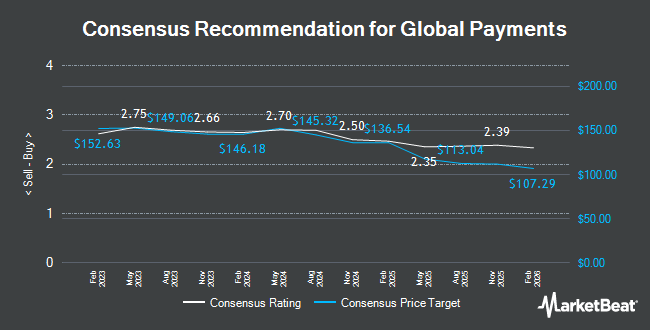

A number of other analysts have also weighed in on the company. Wedbush increased their price objective on Global Payments from $130.00 to $160.00 and gave the company an "outperform" rating in a research note on Wednesday, January 10th. Royal Bank of Canada increased their price objective on Global Payments from $154.00 to $172.00 and gave the company an "outperform" rating in a research note on Thursday, February 15th. Robert W. Baird increased their price objective on Global Payments from $172.00 to $182.00 and gave the company an "outperform" rating in a research note on Monday, April 8th. Susquehanna increased their price objective on Global Payments from $150.00 to $160.00 and gave the company a "positive" rating in a research note on Thursday, February 15th. Finally, B. Riley raised their price target on Global Payments from $180.00 to $186.00 and gave the stock a "buy" rating in a research note on Monday, February 5th. One investment analyst has rated the stock with a sell rating, five have given a hold rating and twenty-one have issued a buy rating to the company. Based on data from MarketBeat, Global Payments presently has a consensus rating of "Moderate Buy" and an average price target of $151.92.

Check Out Our Latest Report on GPN

Global Payments Price Performance

NYSE GPN traded up $0.60 on Wednesday, reaching $127.47. 1,395,189 shares of the company's stock traded hands, compared to its average volume of 2,168,980. Global Payments has a 12 month low of $95.12 and a 12 month high of $141.77. The company has a debt-to-equity ratio of 0.67, a current ratio of 0.99 and a quick ratio of 0.99. The stock has a 50-day simple moving average of $129.64 and a 200 day simple moving average of $124.58. The stock has a market cap of $32.52 billion, a PE ratio of 33.72, a P/E/G ratio of 0.80 and a beta of 0.96.

Global Payments (NYSE:GPN - Get Free Report) last released its quarterly earnings data on Wednesday, February 14th. The business services provider reported $2.65 earnings per share for the quarter, beating analysts' consensus estimates of $2.64 by $0.01. The firm had revenue of $2.43 billion during the quarter, compared to analyst estimates of $2.18 billion. Global Payments had a return on equity of 11.44% and a net margin of 10.22%. The business's quarterly revenue was up 7.9% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.30 earnings per share. As a group, research analysts predict that Global Payments will post 10.94 earnings per share for the current year.

Hedge Funds Weigh In On Global Payments

Several institutional investors and hedge funds have recently modified their holdings of the stock. Global Retirement Partners LLC increased its holdings in shares of Global Payments by 18.8% during the first quarter. Global Retirement Partners LLC now owns 524 shares of the business services provider's stock valued at $70,000 after acquiring an additional 83 shares in the last quarter. Assenagon Asset Management S.A. increased its holdings in Global Payments by 1.9% in the 1st quarter. Assenagon Asset Management S.A. now owns 4,752 shares of the business services provider's stock worth $635,000 after buying an additional 90 shares in the last quarter. Coldstream Capital Management Inc. increased its holdings in Global Payments by 3.8% in the 3rd quarter. Coldstream Capital Management Inc. now owns 2,485 shares of the business services provider's stock worth $287,000 after buying an additional 91 shares in the last quarter. Fulton Bank N.A. increased its holdings in Global Payments by 1.7% in the 4th quarter. Fulton Bank N.A. now owns 5,409 shares of the business services provider's stock worth $687,000 after buying an additional 93 shares in the last quarter. Finally, Stratos Wealth Partners LTD. increased its holdings in Global Payments by 2.0% in the 3rd quarter. Stratos Wealth Partners LTD. now owns 4,707 shares of the business services provider's stock worth $543,000 after buying an additional 94 shares in the last quarter. 89.76% of the stock is currently owned by institutional investors.

About Global Payments

(

Get Free Report)

Global Payments Inc provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Global Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Payments wasn't on the list.

While Global Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report