Motley Fool Asset Management LLC cut its holdings in Howard Hughes Holdings Inc. (NYSE:HHH - Free Report) by 73.7% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 8,507 shares of the company's stock after selling 23,828 shares during the period. Motley Fool Asset Management LLC's holdings in Howard Hughes were worth $728,000 at the end of the most recent reporting period.

Motley Fool Asset Management LLC cut its holdings in Howard Hughes Holdings Inc. (NYSE:HHH - Free Report) by 73.7% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 8,507 shares of the company's stock after selling 23,828 shares during the period. Motley Fool Asset Management LLC's holdings in Howard Hughes were worth $728,000 at the end of the most recent reporting period.

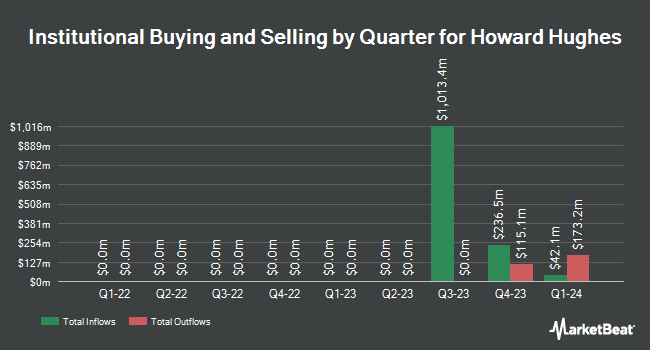

Other hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. purchased a new position in shares of Howard Hughes in the third quarter valued at about $359,181,000. Baillie Gifford & Co. purchased a new position in shares of Howard Hughes during the third quarter valued at about $188,891,000. Principal Financial Group Inc. purchased a new position in shares of Howard Hughes during the third quarter valued at about $156,887,000. New South Capital Management Inc. purchased a new position in shares of Howard Hughes during the third quarter valued at about $47,706,000. Finally, Brandywine Global Investment Management LLC purchased a new position in shares of Howard Hughes during the third quarter valued at about $44,577,000. 93.83% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, JPMorgan Chase & Co. cut their price objective on shares of Howard Hughes from $90.00 to $84.00 and set an "overweight" rating on the stock in a report on Tuesday, April 16th.

Get Our Latest Research Report on HHH

Insider Transactions at Howard Hughes

In other news, insider Heath Melton sold 1,926 shares of the company's stock in a transaction that occurred on Friday, March 15th. The shares were sold at an average price of $72.95, for a total value of $140,501.70. Following the transaction, the insider now owns 9,274 shares in the company, valued at $676,538.30. The sale was disclosed in a legal filing with the SEC, which is available at this link. Insiders own 33.00% of the company's stock.

Howard Hughes Stock Up 1.0 %

Shares of NYSE HHH traded up $0.62 during midday trading on Friday, hitting $64.37. The stock had a trading volume of 278,144 shares, compared to its average volume of 308,404. The business's 50 day moving average is $70.84 and its 200-day moving average is $74.57. The company has a market cap of $3.23 billion, a P/E ratio of -5.73 and a beta of 1.48. Howard Hughes Holdings Inc. has a 52 week low of $59.00 and a 52 week high of $86.72. The company has a quick ratio of 1.60, a current ratio of 1.60 and a debt-to-equity ratio of 1.73.

Howard Hughes (NYSE:HHH - Get Free Report) last issued its earnings results on Tuesday, February 27th. The company reported $0.69 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.44 by $0.25. The firm had revenue of $335.84 million for the quarter, compared to the consensus estimate of $318.32 million. Howard Hughes had a negative net margin of 53.88% and a negative return on equity of 0.62%. As a group, analysts predict that Howard Hughes Holdings Inc. will post 2.69 EPS for the current year.

Howard Hughes Company Profile

(

Free Report)

Howard Hughes Holdings Inc, together with its subsidiaries, operates as a real estate development company in the United States. It operates in four segments: Operating Assets; Master Planned Communities (MPCs); Seaport; and Strategic Developments. The Operating Assets segment consists of developed or acquired retail, office, and multi-family properties along with other retail investments.

Further Reading

Want to see what other hedge funds are holding HHH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Howard Hughes Holdings Inc. (NYSE:HHH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Howard Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howard Hughes wasn't on the list.

While Howard Hughes currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report