Bank Julius Baer & Co. Ltd Zurich lessened its stake in Illinois Tool Works Inc. (NYSE:ITW - Free Report) by 5.8% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 68,603 shares of the industrial products company's stock after selling 4,208 shares during the quarter. Bank Julius Baer & Co. Ltd Zurich's holdings in Illinois Tool Works were worth $17,970,000 at the end of the most recent quarter.

Bank Julius Baer & Co. Ltd Zurich lessened its stake in Illinois Tool Works Inc. (NYSE:ITW - Free Report) by 5.8% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 68,603 shares of the industrial products company's stock after selling 4,208 shares during the quarter. Bank Julius Baer & Co. Ltd Zurich's holdings in Illinois Tool Works were worth $17,970,000 at the end of the most recent quarter.

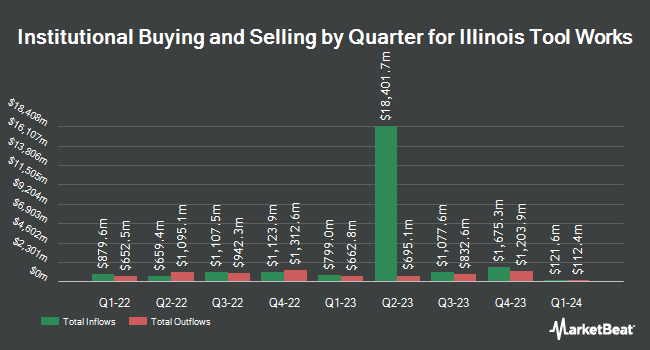

Other hedge funds have also bought and sold shares of the company. Tokio Marine Asset Management Co. Ltd. grew its stake in Illinois Tool Works by 1.4% in the 4th quarter. Tokio Marine Asset Management Co. Ltd. now owns 6,071 shares of the industrial products company's stock valued at $1,590,000 after buying an additional 84 shares in the last quarter. Rockline Wealth Management LLC purchased a new position in Illinois Tool Works in the fourth quarter worth $4,180,000. Wesbanco Bank Inc. grew its position in Illinois Tool Works by 23.4% in the third quarter. Wesbanco Bank Inc. now owns 6,085 shares of the industrial products company's stock worth $1,401,000 after acquiring an additional 1,152 shares in the last quarter. Ziegler Capital Management LLC bought a new stake in Illinois Tool Works in the fourth quarter worth $224,000. Finally, Tyche Wealth Partners LLC bought a new stake in Illinois Tool Works in the fourth quarter worth $2,972,000. 79.77% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on ITW. Truist Financial began coverage on shares of Illinois Tool Works in a research note on Thursday, March 14th. They issued a "buy" rating and a $301.00 price target for the company. Stifel Nicolaus boosted their price target on shares of Illinois Tool Works from $258.00 to $259.00 and gave the stock a "hold" rating in a research note on Wednesday, April 17th. Barclays upped their price objective on shares of Illinois Tool Works from $224.00 to $230.00 and gave the company an "underweight" rating in a research note on Tuesday, April 2nd. Citigroup upped their price objective on shares of Illinois Tool Works from $258.00 to $269.00 and gave the company a "neutral" rating in a research note on Monday, April 8th. Finally, Bank of America downgraded shares of Illinois Tool Works from a "neutral" rating to an "underperform" rating and decreased their price target for the stock from $260.00 to $235.00 in a research note on Wednesday, January 10th. Four investment analysts have rated the stock with a sell rating, three have assigned a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $257.00.

View Our Latest Research Report on Illinois Tool Works

Insider Activity

In related news, EVP Sharon Szafranski sold 801 shares of the stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $256.42, for a total transaction of $205,392.42. Following the transaction, the executive vice president now owns 5,870 shares in the company, valued at $1,505,185.40. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other Illinois Tool Works news, EVP Sharon Szafranski sold 801 shares of the stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $256.42, for a total value of $205,392.42. Following the transaction, the executive vice president now directly owns 5,870 shares in the company, valued at $1,505,185.40. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Michael M. Larsen sold 37,167 shares of the stock in a transaction that occurred on Thursday, March 14th. The stock was sold at an average price of $265.06, for a total transaction of $9,851,485.02. Following the completion of the transaction, the chief financial officer now owns 46,404 shares in the company, valued at $12,299,844.24. The disclosure for this sale can be found here. Insiders have sold a total of 189,471 shares of company stock worth $48,712,316 over the last 90 days. 0.88% of the stock is currently owned by insiders.

Illinois Tool Works Stock Up 0.0 %

ITW traded up $0.07 during midday trading on Friday, reaching $248.23. The company's stock had a trading volume of 947,179 shares, compared to its average volume of 1,241,645. The firm has a market capitalization of $74.16 billion, a price-to-earnings ratio of 25.55, a PEG ratio of 3.70 and a beta of 1.13. The company has a current ratio of 1.33, a quick ratio of 0.97 and a debt-to-equity ratio of 2.10. Illinois Tool Works Inc. has a 1 year low of $217.06 and a 1 year high of $271.15. The stock's 50-day moving average is $260.16 and its 200-day moving average is $251.28.

Illinois Tool Works (NYSE:ITW - Get Free Report) last posted its quarterly earnings results on Thursday, February 1st. The industrial products company reported $2.42 EPS for the quarter, beating analysts' consensus estimates of $2.41 by $0.01. Illinois Tool Works had a net margin of 18.36% and a return on equity of 96.60%. The firm had revenue of $3.98 billion for the quarter, compared to analysts' expectations of $4.01 billion. During the same quarter in the prior year, the company posted $2.34 earnings per share. The business's revenue for the quarter was up .3% on a year-over-year basis. As a group, research analysts expect that Illinois Tool Works Inc. will post 10.13 EPS for the current year.

Illinois Tool Works Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, April 11th. Stockholders of record on Friday, March 29th were issued a dividend of $1.40 per share. This represents a $5.60 dividend on an annualized basis and a dividend yield of 2.26%. The ex-dividend date of this dividend was Wednesday, March 27th. Illinois Tool Works's payout ratio is 57.49%.

About Illinois Tool Works

(

Free Report)

Illinois Tool Works Inc manufactures and sells industrial products and equipment in the United States and internationally. It operates through seven segments: Automotive OEM; Food Equipment; Test & Measurement and Electronics; Welding; Polymers & Fluids; Construction Products; and Specialty Products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Illinois Tool Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illinois Tool Works wasn't on the list.

While Illinois Tool Works currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report