Private Management Group Inc. reduced its position in JBG SMITH Properties (NYSE:JBGS - Free Report) by 4.6% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,579,343 shares of the company's stock after selling 76,534 shares during the quarter. Private Management Group Inc. owned 1.65% of JBG SMITH Properties worth $26,865,000 at the end of the most recent quarter.

Private Management Group Inc. reduced its position in JBG SMITH Properties (NYSE:JBGS - Free Report) by 4.6% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,579,343 shares of the company's stock after selling 76,534 shares during the quarter. Private Management Group Inc. owned 1.65% of JBG SMITH Properties worth $26,865,000 at the end of the most recent quarter.

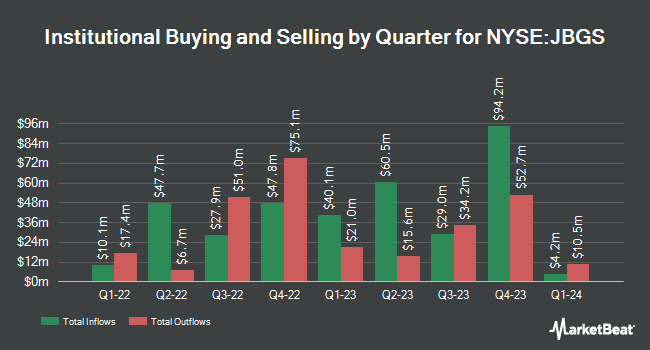

Several other institutional investors have also recently modified their holdings of the company. Wellington Management Group LLP bought a new stake in JBG SMITH Properties in the third quarter worth $16,385,000. UBS Group AG lifted its stake in shares of JBG SMITH Properties by 57.3% in the 3rd quarter. UBS Group AG now owns 1,029,631 shares of the company's stock valued at $14,888,000 after acquiring an additional 375,197 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in JBG SMITH Properties by 4.8% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,924,235 shares of the company's stock valued at $27,824,000 after acquiring an additional 87,645 shares during the period. Illinois Municipal Retirement Fund bought a new position in JBG SMITH Properties during the 3rd quarter worth approximately $786,000. Finally, Louisiana State Employees Retirement System purchased a new position in JBG SMITH Properties in the 4th quarter worth approximately $742,000. 98.46% of the stock is currently owned by institutional investors.

JBG SMITH Properties Trading Up 1.7 %

JBG SMITH Properties stock traded up $0.25 during trading hours on Tuesday, reaching $15.15. The stock had a trading volume of 480,767 shares, compared to its average volume of 1,036,156. The stock has a market cap of $1.39 billion, a PE ratio of -18.04 and a beta of 1.07. The company has a fifty day simple moving average of $16.14 and a 200-day simple moving average of $15.64. The company has a debt-to-equity ratio of 1.14, a current ratio of 3.33 and a quick ratio of 3.33. JBG SMITH Properties has a 52 week low of $12.63 and a 52 week high of $18.17.

JBG SMITH Properties Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, March 15th. Investors of record on Friday, March 1st were issued a dividend of $0.175 per share. The ex-dividend date was Thursday, February 29th. This represents a $0.70 dividend on an annualized basis and a yield of 4.62%. JBG SMITH Properties's dividend payout ratio is presently -83.33%.

Analysts Set New Price Targets

Separately, Evercore ISI dropped their price objective on JBG SMITH Properties from $16.00 to $14.50 and set an "underperform" rating for the company in a research note on Wednesday, April 10th.

View Our Latest Analysis on JBG SMITH Properties

JBG SMITH Properties Company Profile

(

Free Report)

JBG SMITH owns, operates, invests in, and develops mixed-use properties in high growth and high barrier-to-entry submarkets in and around Washington, DC, most notably National Landing. Through an intense focus on placemaking, JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods throughout the Washington, DC metropolitan area.

Featured Articles

Want to see what other hedge funds are holding JBGS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for JBG SMITH Properties (NYSE:JBGS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider JBG SMITH Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JBG SMITH Properties wasn't on the list.

While JBG SMITH Properties currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report