Teacher Retirement System of Texas cut its holdings in shares of Mid-America Apartment Communities, Inc. (NYSE:MAA - Free Report) by 41.8% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 33,532 shares of the real estate investment trust's stock after selling 24,085 shares during the quarter. Teacher Retirement System of Texas' holdings in Mid-America Apartment Communities were worth $4,509,000 at the end of the most recent reporting period.

Teacher Retirement System of Texas cut its holdings in shares of Mid-America Apartment Communities, Inc. (NYSE:MAA - Free Report) by 41.8% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 33,532 shares of the real estate investment trust's stock after selling 24,085 shares during the quarter. Teacher Retirement System of Texas' holdings in Mid-America Apartment Communities were worth $4,509,000 at the end of the most recent reporting period.

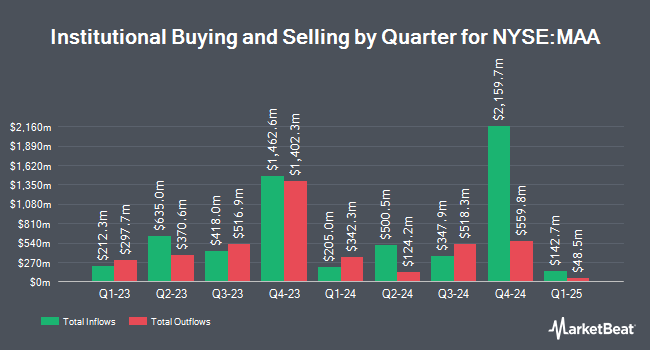

Several other large investors have also recently made changes to their positions in the business. Raymond James & Associates boosted its stake in Mid-America Apartment Communities by 16.5% in the 3rd quarter. Raymond James & Associates now owns 51,453 shares of the real estate investment trust's stock worth $6,619,000 after purchasing an additional 7,284 shares during the period. Panagora Asset Management Inc. grew its stake in Mid-America Apartment Communities by 4.2% during the third quarter. Panagora Asset Management Inc. now owns 436,274 shares of the real estate investment trust's stock valued at $56,127,000 after acquiring an additional 17,417 shares in the last quarter. Oakworth Capital Inc. grew its stake in Mid-America Apartment Communities by 106.8% during the third quarter. Oakworth Capital Inc. now owns 15,114 shares of the real estate investment trust's stock valued at $1,944,000 after acquiring an additional 7,806 shares in the last quarter. New Mexico Educational Retirement Board increased its holdings in Mid-America Apartment Communities by 8.9% during the 3rd quarter. New Mexico Educational Retirement Board now owns 6,100 shares of the real estate investment trust's stock worth $785,000 after acquiring an additional 500 shares during the period. Finally, AIA Group Ltd purchased a new stake in Mid-America Apartment Communities in the 3rd quarter worth approximately $612,000. 93.60% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, CEO H Eric Bolton, Jr. sold 2,642 shares of the company's stock in a transaction dated Friday, April 5th. The shares were sold at an average price of $126.07, for a total transaction of $333,076.94. Following the transaction, the chief executive officer now directly owns 317,737 shares in the company, valued at approximately $40,057,103.59. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders have sold a total of 2,807 shares of company stock worth $353,955 in the last 90 days. 1.30% of the stock is currently owned by corporate insiders.

Mid-America Apartment Communities Price Performance

Shares of MAA traded up $0.75 during trading hours on Tuesday, reaching $136.82. 439,383 shares of the stock traded hands, compared to its average volume of 866,890. The company has a current ratio of 0.12, a quick ratio of 0.12 and a debt-to-equity ratio of 0.74. Mid-America Apartment Communities, Inc. has a 52-week low of $115.56 and a 52-week high of $158.46. The company's 50-day moving average price is $130.60 and its two-hundred day moving average price is $128.82. The company has a market cap of $15.98 billion, a P/E ratio of 28.68, a price-to-earnings-growth ratio of 3.55 and a beta of 0.80.

Mid-America Apartment Communities (NYSE:MAA - Get Free Report) last released its earnings results on Thursday, May 2nd. The real estate investment trust reported $1.22 earnings per share for the quarter, missing analysts' consensus estimates of $2.23 by ($1.01). The firm had revenue of $543.60 million for the quarter, compared to analysts' expectations of $541.44 million. Mid-America Apartment Communities had a net margin of 25.92% and a return on equity of 8.90%. The firm's quarterly revenue was up 2.8% compared to the same quarter last year. During the same quarter last year, the firm posted $2.28 EPS. On average, analysts anticipate that Mid-America Apartment Communities, Inc. will post 8.89 earnings per share for the current year.

Mid-America Apartment Communities Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, April 30th. Shareholders of record on Monday, April 15th were paid a $1.47 dividend. This represents a $5.88 annualized dividend and a yield of 4.30%. The ex-dividend date of this dividend was Friday, April 12th. Mid-America Apartment Communities's payout ratio is currently 123.27%.

Wall Street Analyst Weigh In

A number of research firms have recently commented on MAA. Piper Sandler restated a "neutral" rating and set a $140.00 price target on shares of Mid-America Apartment Communities in a research report on Tuesday, March 26th. Royal Bank of Canada restated a "sector perform" rating and issued a $136.00 target price on shares of Mid-America Apartment Communities in a research note on Friday, February 9th. Wedbush upgraded Mid-America Apartment Communities from a "neutral" rating to an "outperform" rating and lifted their price target for the company from $135.00 to $154.00 in a research report on Monday, May 6th. Mizuho dropped their price target on Mid-America Apartment Communities from $132.00 to $126.00 and set a "neutral" rating for the company in a research note on Wednesday, February 28th. Finally, The Goldman Sachs Group restated a "buy" rating and issued a $149.00 price objective on shares of Mid-America Apartment Communities in a research report on Thursday, February 22nd. Three analysts have rated the stock with a sell rating, ten have issued a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $143.28.

Get Our Latest Analysis on MAA

About Mid-America Apartment Communities

(

Free Report)

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Featured Articles

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report